/Lilly(Eli)%20%26%20Co%20logo%20on%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $775.6 billion, Eli Lilly and Company (LLY) is a global biopharmaceutical leader with leading products in diabetes (Trulicity, Mounjaro), oncology (Verzenio, Erbitux) and immunology (Taltz, Olumiant). Through strategic acquisitions such as ImClone Systems, ICOS Corporation, and Loxo Oncology and partnerships with Incyte, Boehringer Ingelheim and Innovent, Lilly sustains a robust pipeline despite patent cliffs and pricing pressures.

The Indianapolis, Indiana-based company is expected to release its fiscal Q1 2025 earnings results before the market opens on Thursday, May 1. Ahead of this event, analysts expect LLY to report an adjusted EPS of $4.44, up 72.1% from $2.58 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion. In Q4 2024, Eli Lilly exceeded the consensus adjusted EPS estimate by 5.8%.

For fiscal 2025, analysts forecast the drugmaker to post an adjusted EPS of $23.21, reflecting a 78.7% increase from $12.99 in fiscal 2024.

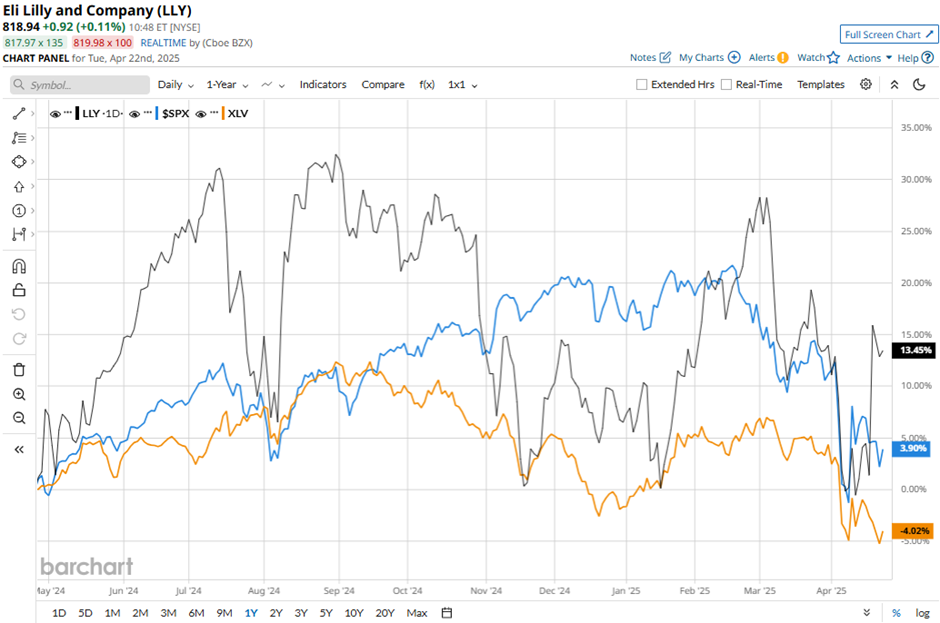

LLY has outperformed the broader markets over the past 52 weeks, with shares up 13.4%, compared to the S&P 500 Index's ($SPX) 4.5% gain and the Health Care Select Sector SPDR Fund's (XLV) 3.8% dip over the same period.

Lilly’s shares jumped 3.4% on Feb. 6 after the company reported Q4 2024 adjusted EPS of $5.32 and revenue of $13.5 billion, topping the forecasts. Exceptional demand for its GLP‑1 drugs Mounjaro and Zepbound drove a 45% year‑over‑year sales surge, while its non‑incretin portfolio still grew a healthy 20%. Management also raised 2025 guidance, projecting up to $61 billion in sales and GAAP EPS up to $23.55, well above analyst consensus.

Analysts' consensus rating on LLY stock is bullish, with a "Strong Buy" rating overall. Out of 24 analysts covering the stock, opinions include 20 "Strong Buys,” one "Moderate Buy," and three "Holds.” The average analyst price target for LLY is $1,021.04, suggesting a potential upside of 24.7% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.