El Salvador is close to finalizing a $1.3 billion loan agreement with the International Monetary Fund (IMF), expected within two to three weeks.

The deal is contingent on significant changes to the country's Bitcoin policy and measures to reduce its fiscal deficit, Financial Times reported, quoting sources.

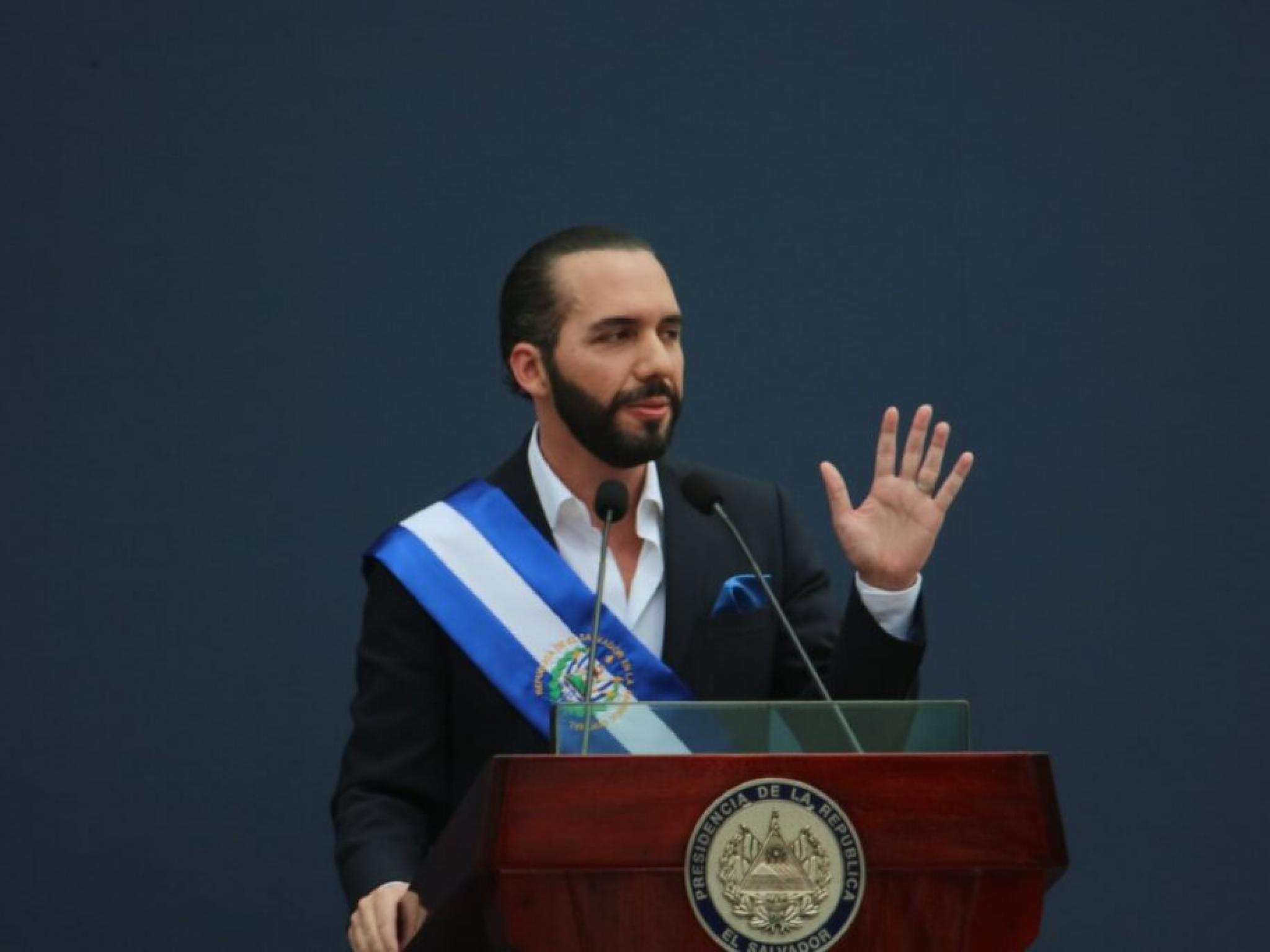

The IMF delegation, currently in San Salvador, is negotiating terms with President Nayib Bukele's administration.

The agreement, pending IMF board approval, is anticipated to unlock an additional $1 billion in lending from the World Bank and another $1 billion from the Inter-American Development Bank over the coming years.

The IMF has consistently expressed concerns over El Salvador’s pioneering adoption of Bitcoin as legal tender, citing risks to financial stability.

Under the proposed terms, businesses in El Salvador will no longer be required by law to accept Bitcoin as payment, although they may continue to do so voluntarily.

Additionally, the government has committed to reducing its budget deficit by 3.5 percentage points of GDP over three years through a mix of spending cuts and tax increases.

Other commitments include passing anti-corruption legislation and increasing national reserves from $11 billion to $15 billion.

President Bukele, who gained global attention for his dramatic crackdown on gang violence during his first term, is now focusing on economic revival in his second term.

His administration has sought to attract foreign investment, positioning El Salvador as a hub for surfing and cryptocurrency innovation.

Bukele’s Bitcoin initiatives, including the announcement of a “Bitcoin City” powered by geothermal energy, have drawn international attention.

Also Read: Bitcoin Saw ‘Historic Rally’ In November Thanks To Trump Win, Says JPMorgan

Despite these efforts, Bitcoin adoption among Salvadorans remains low, with the majority still relying on the US dollar as the country's primary currency.

El Salvador has also been accumulating Bitcoin reserves, with President Bukele purchasing Bitcoin during price dips.

Last month, Bukele revealed on social media that the country's Bitcoin reserves were valued at over $600 million, reflecting a 127% gain.

“You can call it our first #Bitcoin piggy bank,” he wrote. “It's not much, but it's honest work.”

While the Biden administration had previously criticized Bukele's governance and sanctioned officials for alleged corruption, relations have softened recently.

Meanwhile, Bukele has fostered strong ties with U.S. President-elect Donald Trump and Elon Musk, further amplifying his pro-Bitcoin stance.

El Salvador's economy is showing signs of recovery.

The country’s risk rating has significantly improved, with sovereign bonds now trading near face value after a substantial rally.

Bukele noted the twin rallies in Bitcoin prices and Salvadoran bonds, stating: "This is the first time in history that Bitcoin has driven sovereign bonds up in traditional markets."

Read Next:

Image: Shutterstock