Puerto Rico’s power company appears destined for an even longer bankruptcy than expected after several creditors rejected a new debt restructuring plan filed late Friday following years of failed negotiations.

A federal control board that oversees the island’s finances filed a plan that proposes to cut by nearly half the more than $10 billion of debt held by Puerto Rico’s Electric Power Authority, the largest of any local government agency.

Board chairman David Skeel warned that residents and businesses in the U.S. territory will “shoulder the payments of this greatly reduced debt through their electricity bill."

“However, (the power company) needs to move on, and Puerto Rico needs reliable electricity,” he said.

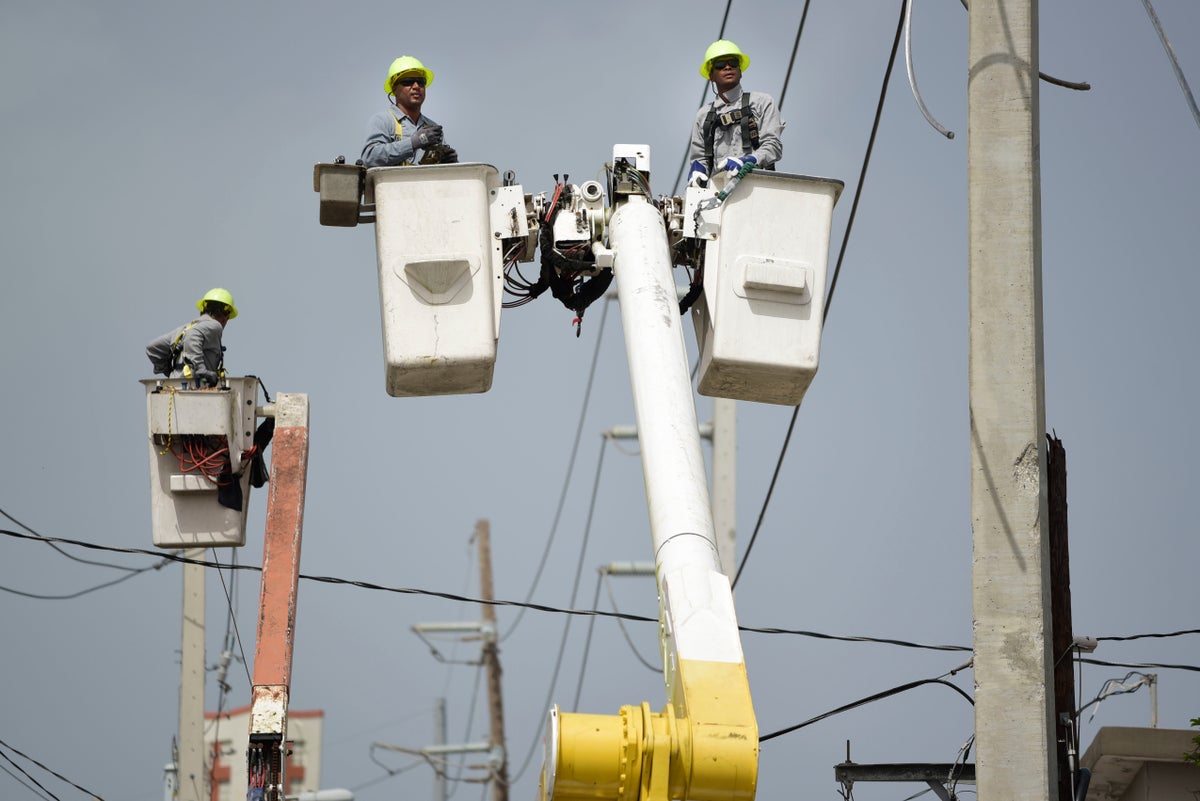

The announcement riled many Puerto Ricans already burdened by a deep economic crisis and recent power bill increases despite chronic outages blamed in part on crumbling infrastructure resulting from decades of neglect and mismanagement.

The board noted that two classes of creditors agreed to support the plan, surpassing a legal requirement that at least one has to support it for a federal judge to implement it across the board.

Skeel noted that no agreement was reached with the holders and guarantors of $7.6 billion worth of power company bonds, adding that the plan would allow them to join a settlement class as one option.

“Puerto Rico residents and businesses simply cannot pay what some creditors demand at this point,” he said, adding that the board is open to further negotiations. “We hope we will find a viable compromise.”

The Ad Hoc Group, which includes companies that hold or insure nearly half of the power company’s debt, rejected the plan, calling it “highly coercive” and warned it would only serve to extend the company’s nearly six-year-long bankruptcy.

“The biggest losers in this debacle are the island’s residents,” said Stephen Spencer of Houlihan Lokey, the group’s financial adviser.

The drawn-out bankruptcy already has cost more than $200 million in legal fees as litigation and mediation talks continue.

Spencer noted the power company has reneged on three debt restructuring deals since 2015, with Gov. Pedro Pierluisi announcing in March that he was rejecting the newest plan because it wasn’t feasible or in the island’s best interest.

A federal judge overseeing Puerto Rico’s bankruptcy case ordered a fresh round of mediation talks in September after the previous ones failed.

Puerto Rico has restructured nearly all its debt since announcing in 2015 that it was unable to pay its more than $70 billion public debt load and filed for the biggest U.S. municipal bankruptcy in history two years later.

The power company’s debt is the only one pending, and resolving it is considered key to help attract investors to the island and boost its economic development.