Investors with a lot of money to spend have taken a bullish stance on Eaton Corp (NYSE:ETN).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ETN, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for Eaton Corp.

This isn't normal.

The overall sentiment of these big-money traders is split between 54% bullish and 36%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,780, and 10, calls, for a total amount of $449,756.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $270.0 to $390.0 for Eaton Corp over the recent three months.

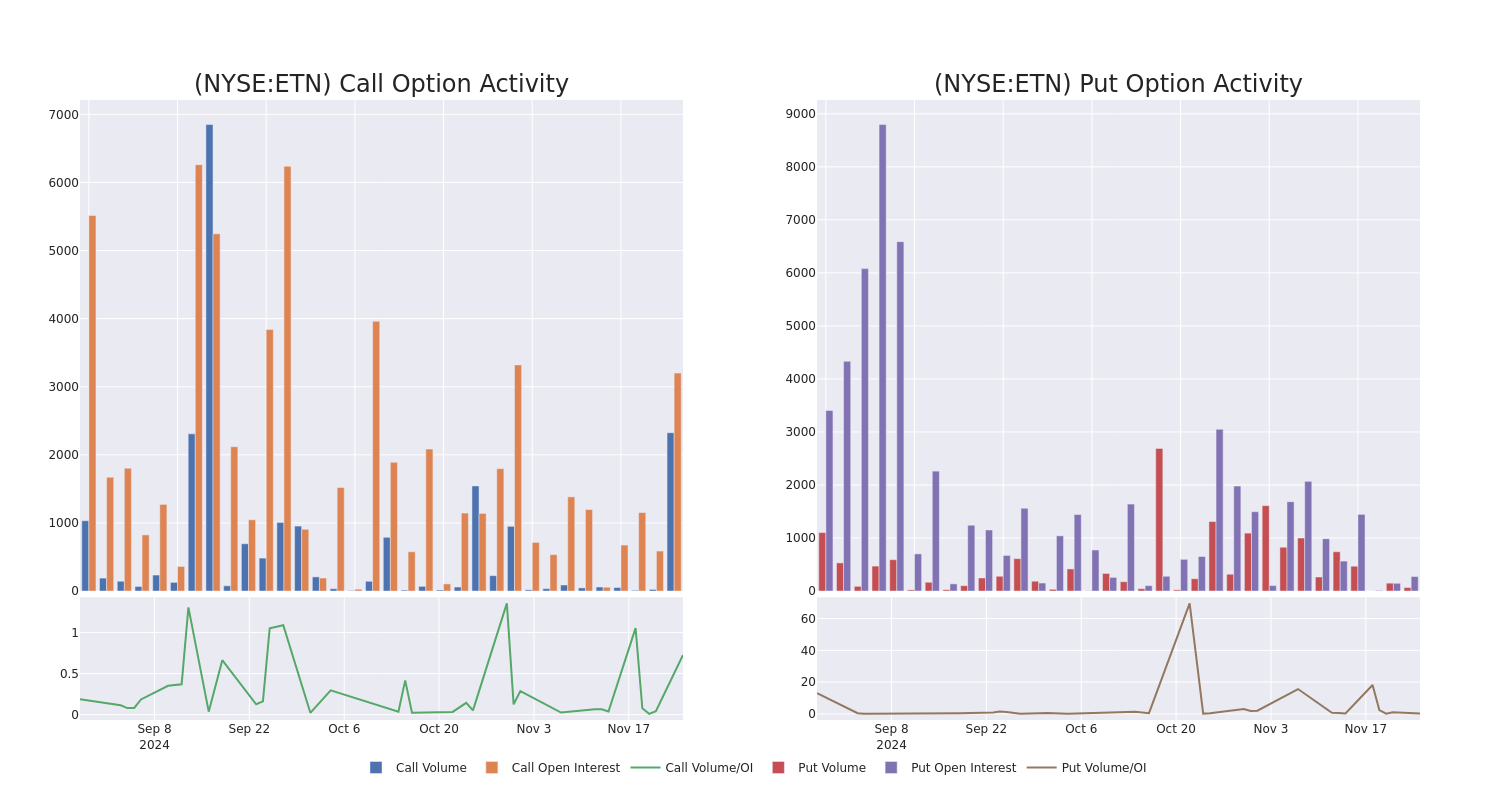

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eaton Corp's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Eaton Corp's significant trades, within a strike price range of $270.0 to $390.0, over the past month.

Eaton Corp Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | SWEEP | BULLISH | 12/20/24 | $15.0 | $14.0 | $14.92 | $370.00 | $80.4K | 1.3K | 56 |

| ETN | CALL | TRADE | BEARISH | 12/20/24 | $19.0 | $18.2 | $18.3 | $360.00 | $75.0K | 604 | 43 |

| ETN | CALL | SWEEP | BEARISH | 12/20/24 | $14.9 | $14.0 | $14.51 | $370.00 | $60.0K | 1.3K | 543 |

| ETN | CALL | SWEEP | BULLISH | 12/20/24 | $14.7 | $13.9 | $14.56 | $370.00 | $45.8K | 1.3K | 456 |

| ETN | CALL | TRADE | BEARISH | 01/17/25 | $112.2 | $108.9 | $109.94 | $270.00 | $43.9K | 564 | 4 |

About Eaton Corp

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton's portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

Eaton Corp's Current Market Status

- Trading volume stands at 732,546, with ETN's price down by -0.95%, positioned at $373.81.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 66 days.

Professional Analyst Ratings for Eaton Corp

In the last month, 5 experts released ratings on this stock with an average target price of $385.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for Eaton Corp, targeting a price of $385. * Reflecting concerns, an analyst from Bernstein lowers its rating to Outperform with a new price target of $382. * Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Eaton Corp with a target price of $320. * An analyst from UBS downgraded its action to Buy with a price target of $431. * An analyst from B of A Securities persists with their Buy rating on Eaton Corp, maintaining a target price of $410.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eaton Corp with Benzinga Pro for real-time alerts.