/Discover%20Financial%20Services%20Credit%20Card-by%20Jarrett%20Homan%20via%20Shutterstock.jpg)

With a market cap of around $38 billion, Discover Financial Services (DFS) is a digital banking and payment services company operating through its Digital Banking and Payment Services segments. It offers Discover-branded credit cards, personal, student, and home loans, a range of direct-to-consumer deposit products, and operates the Discover Network, the PULSE network, and Diners Club International for global payment processing.

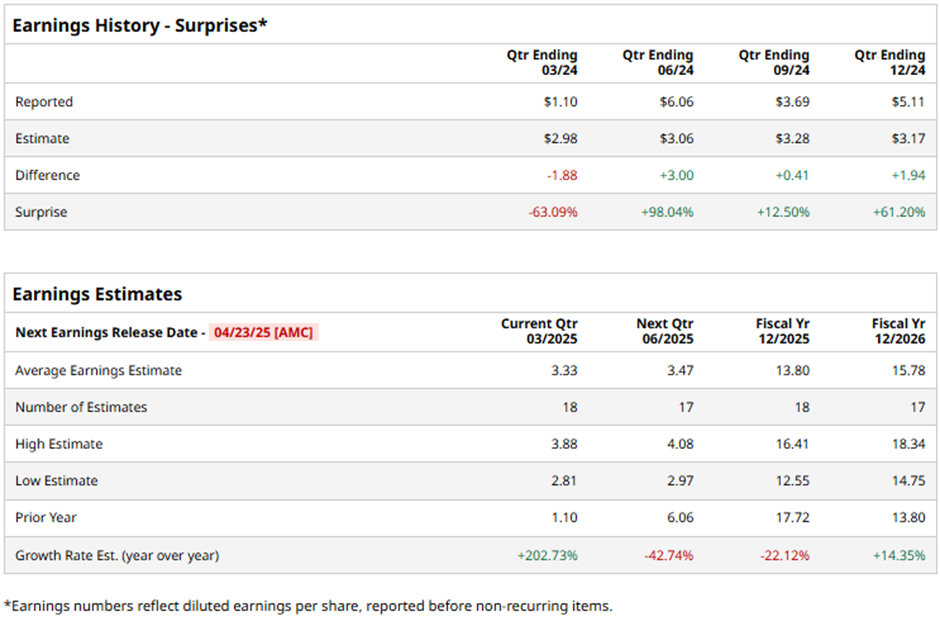

DFS is expected to announce its fiscal Q1 2025 earnings results after the market closes on Wednesday, Apr. 23. Ahead of this event, analysts expect the Riverwoods, Illinois-based company to report a profit of $3.33 per share, up significantly 202.7% from $1.10 per share in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion. In Q4 2024, DFS beat the consensus EPS estimate by 61.2%.

For fiscal 2025, analysts expect the credit card issuer and lender to report an EPS of $13.80, down 22.1% from $17.72 in fiscal 2024. However, EPS is anticipated to rebound and grow 14.4% year-over-year to $15.78 in fiscal 2026.

Shares of Discover Financial have increased 26.7% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) marginal decline and the Financial Select Sector SPDR Fund's (XLF) 10.2% return over the same period.

Shares of DFS rose 1.8% following its Q4 2024 earnings release on Jan. 22 due to a sharp jump in net income to $1.3 billion, more than tripling from the prior year. The company's net interest income rose 5% to $3.6 billion, driven by a 98 basis point increase in its net interest margin, helped by the sale of its student loan portfolio. Digital banking pretax income surged to $1.6 billion, supported by lower provisions for credit losses and higher revenue. Meanwhile, payment services pretax income grew 37% to $74 million, fueled by 4% growth in payment volume across Discover Network, PULSE, and Diners Club.

Analysts' consensus view on Discover Financial’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, six recommend "Strong Buy," one "Moderate Buy," and eight suggest "Hold." This configuration is slightly more bullish than three months ago, with five analysts suggesting a "Strong Buy."

As of writing, DFS is trading below the average analyst price target of $205.64.