Sportsman's Warehouse (NASDAQ:SPWH) is preparing to release its quarterly earnings on Tuesday, 2024-12-10. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Sportsman's Warehouse to report an earnings per share (EPS) of $-0.02.

The announcement from Sportsman's Warehouse is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

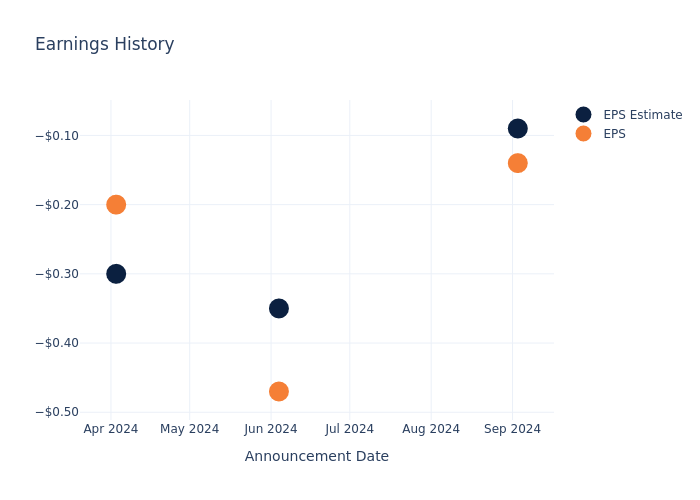

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.05, leading to a 6.7% increase in the share price on the subsequent day.

Here's a look at Sportsman's Warehouse's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.09 | -0.35 | -0.3 | -0.12 |

| EPS Actual | -0.14 | -0.47 | -0.2 | -0.01 |

| Price Change % | 7.000000000000001% | -13.0% | 21.0% | -22.0% |

Market Performance of Sportsman's Warehouse's Stock

Shares of Sportsman's Warehouse were trading at $2.12 as of December 06. Over the last 52-week period, shares are down 47.62%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Insights on Sportsman's Warehouse

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Sportsman's Warehouse.

Analysts have given Sportsman's Warehouse a total of 1 ratings, with the consensus rating being Buy. The average one-year price target is $3.5, indicating a potential 65.09% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Grove Collaborative Hldgs and Brilliant Earth Group, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for Grove Collaborative Hldgs, with an average 1-year price target of $2.0, indicating a potential 5.66% downside.

- The consensus among analysts is an Outperform trajectory for Brilliant Earth Group, with an average 1-year price target of $3.0, indicating a potential 41.51% upside.

Snapshot: Peer Analysis

The peer analysis summary presents essential metrics for Grove Collaborative Hldgs and Brilliant Earth Group, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sportsman's Warehouse | Buy | -6.71% | $90.02M | -2.41% |

| Grove Collaborative Hldgs | Outperform | -21.81% | $25.60M | -136.90% |

| Brilliant Earth Group | Outperform | -12.51% | $60.77M | -0.99% |

Key Takeaway:

Sportsman's Warehouse ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it is in the middle for Return on Equity.

Unveiling the Story Behind Sportsman's Warehouse

Sportsman's Warehouse Holdings Inc together with its subsidiaries operates as an outdoor sporting goods retailer. It provides a one-stop shopping experience that equips customers with the right quality, brand name hunting, shooting, fishing, and camping gear to maximize enjoyment of the outdoors. The company offers products in the categories of Camping, Apparel, Fishing, Footwear, Hunting and shooting, and Optics, Electronics, Accessories, and Other products. It provides products such as Backpacks, Jackets, Camp essentials, Hiking boots, GPS devices, ATV accessories and Fishing rods, among others.

Financial Milestones: Sportsman's Warehouse's Journey

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Sportsman's Warehouse faced challenges, resulting in a decline of approximately -6.71% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Sportsman's Warehouse's net margin is impressive, surpassing industry averages. With a net margin of -2.05%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Sportsman's Warehouse's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -2.41%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Sportsman's Warehouse's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.64% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Sportsman's Warehouse's debt-to-equity ratio is below the industry average at 2.15, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Sportsman's Warehouse visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.