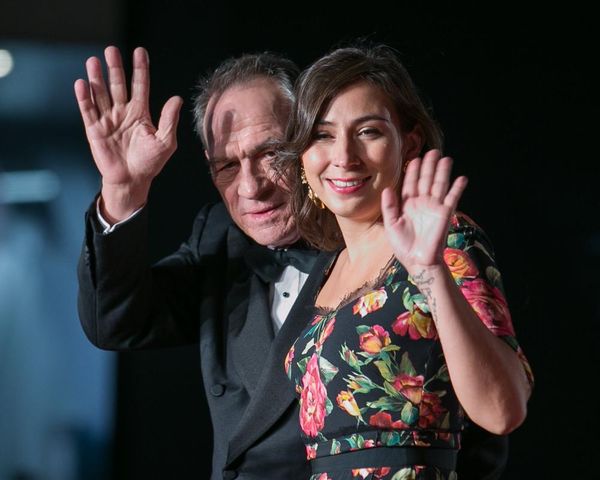

Pension fraudsters Rikki Nicholls, 57, and Mark Kelly, 51

(Picture: PA and Metropolitan Police)Two heartless financial advisers who plundered £22million from pensions wrecking clients’ lives have been jailed for six years.

Rikki Nicholls, 57, and Mark Kelly, 51, devised a complex plan to persuade hundreds of workers to transfer their life savings and then used the money for their own financial gain.

Victims lost anything between £10,000 to £200,000.

A court heard some had their entire pension pots stolen, while others must continue working to fund their retirement.

Nicholls voluntarily returned from his residence in Dubai and Kelly was arrested for fraud in May 2014.

Scotland Yard detectives traced over 250 victims from across the UK and seized 10,000 documents following a tip-off from the Financial Services Authority, now the Financial Conduct Authority.

Nicholls and Kelly set up a scheme named PCD Wealth & Pension Management in 2007 with the aim of transferring clients’ pensions to investment funds for growth.

Nicholls, an ex-Equitable Life employee, obtained details of existing customers who they then cold called and convinced them to move money into a Self-Invested Personal Pension controlled by their scheme.

In fact, the pair directed their victims’ pension money to investment funds which were lucrative to themselves, via high commission payments.

Nicholls, of Linthurst Newtown, Blackwell, Bromsgrove and Kelly, of Maplewood Road, Wilmslow, Cheshire were convicted of conspiracy to commit fraud and transferring criminal property following a five-month trial at Southwark Crown Court.

They were sentenced to a total of six years’ imprisonment.

One victim Denis Mountford, from Birmingham, said: “When I first discovered that my pension fund was rapidly diminishing and inaccessible, I was very cross with myself for trusting poor financial advisors who had taken a high percentage commission and also I was disgusted with them.

“I don’t know how one can tell if a financial advisor is totally trustworthy, except by recommendations from people you can trust and I hope that this case will be a warning to others.

“During this time, legal and investigating officers have been very helpful and considerate and have given me confidence in legal proceedings.”

Detective Superintendent John Roch, head of the Met’s Economic Crime team, said: “Both men put their own financial gain over the interest of over 250 victims, losing their money and leaving some in financial ruin, whilst earning lucrative sums themselves.

“I would ask anyone who is contacted by a cold caller about an investment to be vigilant.

“Please consider getting independent professional advice before making a significant financial decision.”

He added: “Many of the victims are vulnerable by age and financial position, and as a result of the actions of these men, they have been left in severe financial difficulties. Many must continue to work in order to fund their retirement, or retire with a lesser pension, or even without a pension. These man have caused so much distress and anxiety to them.

“I would like to applaud the victims for their help with this investigation and thank those who gave evidence in court.

“The detectives who worked on this case have distinct areas of expertise and it is with thanks to their years of hard work and dedication we have achieved. I would like to pay tribute to the tenacity, expertise and professionalism of my staff that has resulted in these convictions.”

A confiscation investigation will follow, police said.

Jane Mitchell, of the CPS, said: “The harm caused by these fraudsters is immense, involving raids on the victims’ pension pots which wrecked their future livelihood and post-retirement plans.

“Many victims were left with no pensions and will have to work well beyond their retirement date to provide for themselves and their families.”

If you suspect you have been a victim of fraud or if you believe someone is trying to access your pension, you should call Action Fraud – 0300 123 2040.