Dry January is, first and foremost, about the mental and physical health benefits of abstaining from alcohol for a month. But the popular practice also boasts a number of secondary benefits — including financial savings.

But just how much does the average person save by cutting out alcohol for a month? And if these savings were invested, how much could they be worth in a year? Five years?

Note: This article is for entertainment purposes only. Everyone’s relationship with alcohol is unique. If you have questions about alcohol dependence or reducing consumption, you can call SAMHSA’s National Helpline at 1-800-662-4357 or visit them online.

Related: What is the January Effect? Is it real?

What is Dry January?

While there’s never a bad time to try to start managing a bad habit or building a good one, the passage of one calendar year to the next serves as a convenient and symbolic starting gun for many hoping to institute a positive change. Eating healthier, dining out less, exercising more, and reducing or eliminating alcohol consumption are among the most common New Year's resolutions folks attempt to commit to each January.

It’s also become a common trope that few people carry these newfound changes further than a month or so into the new year. Reducing or eliminating alcohol — at least for a month — has become such a popular practice that it’s earned its moniker: Dry January.

Officially, Dry January is a registered trademark of British charity Alcohol Change UK. Formerly known as Alcohol Concern, the organization launched the first “official” Dry January campaign in 2013. The 2023 event was its 10th anniversary.

Of course, people have been taking breaks from alcohol to kick off the new year since long before Dry January became a hashtag, but during the decade since the official campaign’s inception, the phenomenon has exploded in popularity.

In 2023, it’s estimated that around 15% of adults in the U.S. are participating (down from 19% in 2022), according to the American Association for Cancer Research.

Abstaining from alcohol — even just for a month — can reportedly help improve energy levels, memory, sleep quality, and physical fitness, according to UC Davis Health, but he practice also comes with myriad secondary benefits, one of which is financial savings.

Dry January: How much can I save by quitting drinking?

Alcohol is expensive — especially when purchased on a drink-by-drink basis at restaurants, bars, and clubs instead of “in bulk” at grocery or liquor stores. Drink prices vary wildly depending on where one lives and what sort of establishments one frequents, but for the sake of simplicity, we’ll need a figure or two to experiment with.

According to a survey conducted by the Harris Poll and provided to “USA Today” in 2020, the average millennial drinker spends around $300 per month on alcohol between nights out and drinks purchased for home consumption.

Of course, plenty of people don’t spend nearly this much on alcohol. But on the other side of the coin, those who live in expensive urban centers like San Francisco or New York City and regularly dine out and visit bars or clubs might easily spend $300 on alcohol in a single weekend.

So, for the purposes of this thought experiment, let’s look at two hypothetical Dry January participants: a light-to-moderate drinker living in an area with a relatively low cost of living who only spends around $150 per month on alcohol and a heavier drinker living in a more expensive city who drops about $600 per month on inebriating libations.

How much could a month of alcohol savings be worth if invested for a year?

Let’s assume both of our hypothetical Dry January participants are hands-off, buy-and-hold style retail investors who use a fee-free trading app that offers fractional share investing — like Robinhood.

Neither person is a particularly attentive investor, and neither has the time to research individual stocks. But both know it’s better to put their money in the market than to let it languish in a low-interest savings account.

For these reasons, they both invest in a passively managed ETF that tracks the S&P 500, a capitalization-weighted stock index comprising the 500 largest public companies that trade on major exchanges in the U.S. One such ETF is the SoFi Select 500 ETF (SFY) -), which doesn’t charge an expense ratio or any other fees, making it one of the best ways to diversify a hands-off investment portfolio for free.

From 2012 through 2022, the S&P 500 produced an average annual return of 15.44%. And while past performance is never a guarantee of future returns, let’s assume for this experiment that the S&P returns its average of 15.44%. If this is the case, our light drinker’s $150 in alcohol savings would be worth $173.16 a year later. Our heavy drinker’s $600 would turn into $692.64.

If it was a particularly good year for the market, as it was in 2019 when the S&P returned 31.21%, our light drinker’s $150 would turn into $196.82, and our heavy drinker’s $600 investment would be worth $787.26.

How much could a year of alcohol savings be worth if invested for 5 years?

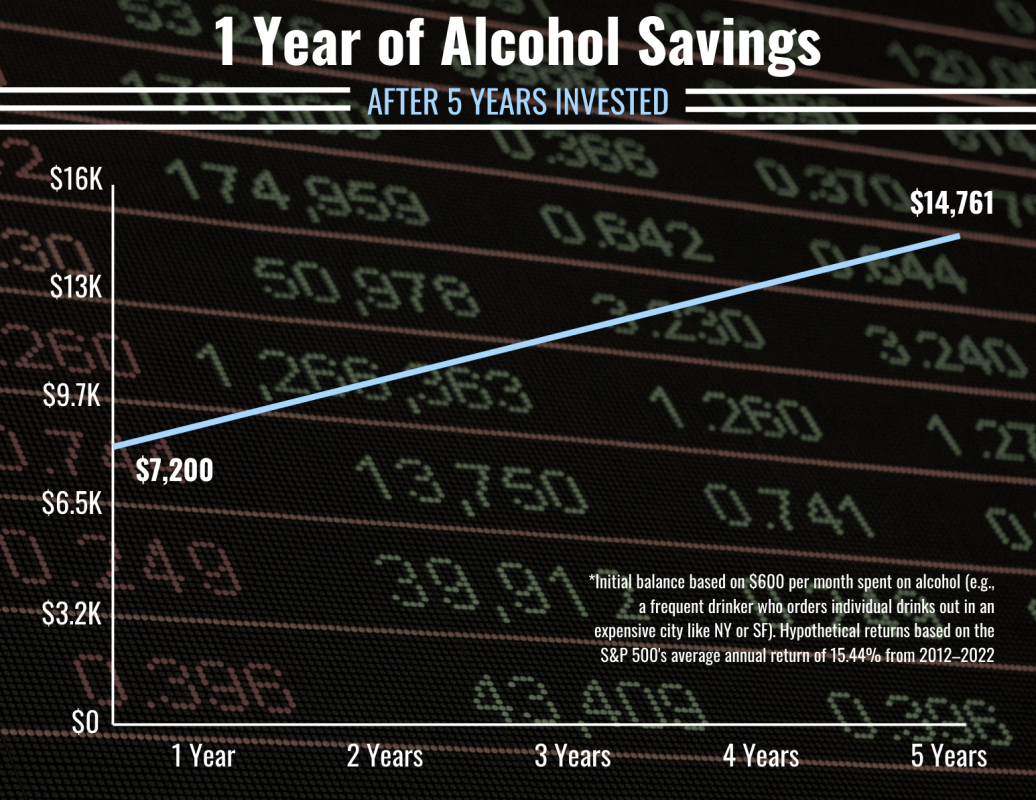

What if our Dry January participants were so pleased with their savings (and health) after a month that they both extended their resolutions? If they both swear off the sauce for the remainder of the year, our light drinker would have saved $1,800. Our heavy drinker would have saved $7,200.

If both parties invested the full sum of their alcohol savings at the end of the year — and left it invested for five years after that — how much would each of them come away with?

Assuming the S&P’s aforementioned ten-year average annual return of 15.44%, the light drinker would come away with $3,690 after five years, while the heavy drinker’s balance would rise to $14,761. In both cases, one year of alcohol savings left in the stock market for five years more than doubles their money.

Calculating how much you could save and invest this Dry January

The hypothetical experiments above make it clear that cutting out alcohol, even temporarily, can be an effective way to create passive investments that can grow over time. This is a great illustration of the opportunity cost associated with spending money instead of investing it.

Everyone’s circumstances, however, are different. For a more accurate picture of how much you could save — and how much your savings could be worth if invested — consider creating your own projection.

Rethinking Drinking, a division of the National Institute of health, offers a free alcohol spending calculator. Simply provide estimates of how much you drink and how much your drinks cost.

Next, you can take the figures this calculator spits out and enter them into NerdWallet’s compound interest calculator. How much could your invested savings be worth?

For “Estimated rate of return,” you can use the S&P’s ten-year average of 15.44%. You can also use the average annual return of your preferred fund or investment vehicle. Just be sure that “Compound frequency” is set to “Annually.”

For example, let's say I determine that I spend about $300 per month on alcohol. Say I want to quit for three months then invest my savings into the First Trust NASDAQ Cybersecurity ETF (CIBR) -) (which has an average annual return of 14.73%). If I plan to leave it there for three years, I would enter it like this:

| Initial deposit | Contribution amount | Years of growth | Estimated rate of return | Compound rate of return |

|---|---|---|---|---|

$900 |

$0 |

3 |

14.73% |

Annually |

The tool then shows that, over three years, my $900 investment could grow to $1,789. That's assuming average returns for my chosen ETF over that period.