Last week, Taiwan experienced a severe Earthquake — and subsequent reports of memory makers refusing to publish contract DRAM prices two days ago raised concern over DRAM price hikes. These price hikes may still be happening, but, courtesy of a report from TrendForce, we now know that the quake's impact on DRAM was corrected for within the week— and the overall impact on Q2 DRAM production seems as low as 1%.

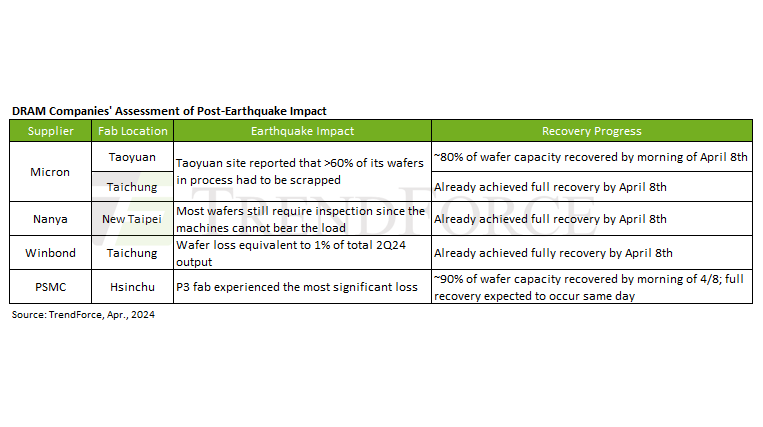

In total, five DRAM fabrication plants belonging to four suppliers impacted in the quake were evaluated by TrendForce. These included two of Micron's fab plants, and one each from Nanya, Winbond, and PSMC. Below, we have the original TrendForce graphic with this data explained in slightly more detail. Overall, things seem optimistic for this segment of the industry — at least, in terms of long-term production capacity.

In the face of confirmed upcoming price hikes to HDDs and NAND flash (at least from Western Digital), news that DRAM manufacturers have largely recovered from the quake without severe issue certainly seems to be a cause for optimism. With the estimation of a 1% impact on overall DRAM production made by TrendForce, then, is there anything to worry about?

Well, contract prices still have yet to be restarted by most manufacturers, except SK hynix and their mobile DRAM. The proposed price adjustments there seem "moderate," so TrendForce anticipates a Q2 mobile DRAM price increase of between 3% and 8%.

Price-hiking potential seems to be the highest in DDR3 RAM (age and thus scarcity), and in high-end server RAM. At the time, we don't have any numeric estimations of the impact to expect there, though most of Micron's damages were reportedly to their high-end facilities for that server RAM. Micron's HBM manufacturing is performed in Japan, which was fortunately not impacted by this quake — but their DRAM has a much larger market anyway.

Standard, consumer-targeted DDR4 and DDR5 may actually experience the lowest price hikes, because they the lowest demand. Most people who need DDR4 or DDR5 at this point simply already have it, and the impact on production and inventory was such that TrendForce expects "slight price elevations caused by the earthquake" will "normalize swiftly."