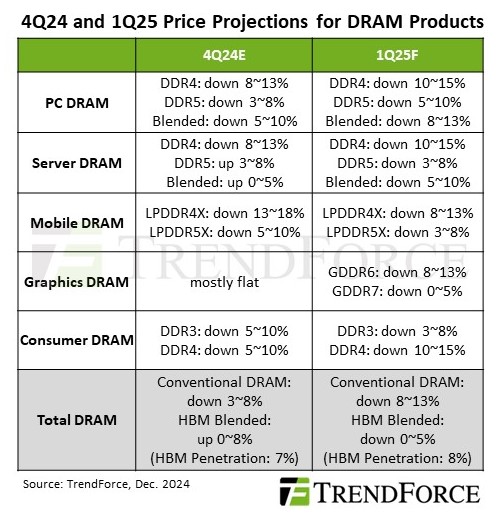

The DRAM market is heading for a notable price drop in the first quarter of 2025, with PC, server, and GPU VRAM segments expected to see significant declines. According to TrendForce's latest forecast, seasonal demand fluctuations combined with strategic inventory management by buyers are driving the downward trend.

In the PC DRAM market, prices are projected to drop by 8–13%. This decline is primarily due to weak consumer demand and an oversupply of DDR4 memory modules. Chinese manufacturers have increased DDR4 production, further saturating the market and putting additional pressure on prices. While DDR5 adoption is steadily growing, it has not yet reached the scale necessary to offset the oversupply of older-generation DDR4 modules. Consequently, PC manufacturers are capitalizing on the lower prices to build up their inventories, albeit cautiously, to avoid overstocking amid uncertain demand.

Server DRAM prices are also expected to decline, though less sharply than PC DRAM, with forecasts predicting a drop of 5–10%. The ongoing transition from DDR4 to DDR5 and high-bandwidth memory (HBM) continues to shape the server DRAM market. Major suppliers are reallocating production capacity from DDR4 to newer technologies to meet increasing demand in data center and AI applications. However, the oversupply of DDR4 memory, combined with cautious purchasing strategies by enterprise customers, is keeping prices suppressed. While DDR5 adoption is growing, its current uptake remains insufficient to counterbalance the excess supply of DDR4.

In the GPU VRAM segment, prices are expected to fall by 5–10%, primarily due to subdued demand and elevated inventory levels. Although some production capacity has shifted to HBM, particularly for high-performance GPUs used in AI and data center applications, demand for conventional graphics DRAM remains weak. The gaming and professional graphics markets have yet to recover fully from a period of high inventory levels and soft consumer demand, leading to a continued decline in GPU VRAM pricing.

The ongoing decline in DRAM prices aligns with a broader trend observed over the past two years. Previous reports indicate significant price drops in early 2023, with DRAM costs plunging by as much as 20% in the first quarter alone. These reductions were driven by a combination of oversupply and sluggish consumer demand, causing consistent price erosion throughout the year.

By 2024, although the pace of decline slowed, the market continued to face challenges. Manufacturers dealt with high inventory levels, and demand remained weak across key sectors such as consumer electronics, gaming, and data centers. Additionally, the slow adoption of newer memory technologies like DDR5 and HBM contributed to a prolonged surplus of older-generation DRAM modules, further destabilizing prices.

As 2025 begins, these challenges show no signs of immediate resolution. The interplay of cautious purchasing strategies by buyers and the persistent supply-demand imbalance is expected to sustain suppressed pricing in the DRAM market. This situation allows buyers to secure lower-cost components but continues to strain suppliers navigating an increasingly competitive landscape.