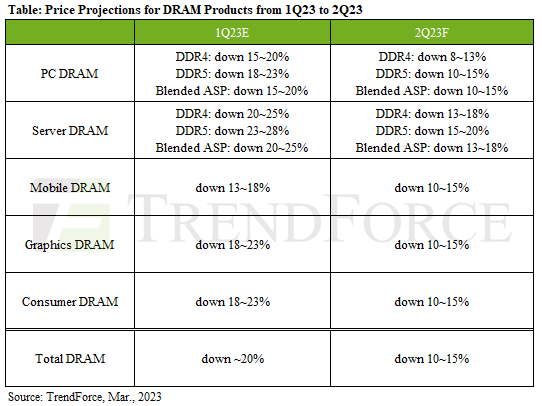

Average selling prices of dynamic random access memory (DRAM) dropped 20% quarter-over-quarter in Q1 2023 as buyers maintained conservative buying behavior, according to TrendForce. Memory quotes are set to drop even further — by 10% to 15% in Q2 2023 — with DDR5 prices declining more significantly than DDR4 prices.

While Micron, Samsung, and SK Hynix have begun to adjust their DRAM output to decrease supply and at least maintain current price levels, makers of PCs, consumer electronics, servers, smartphones, and graphics cards still have plenty of DRAM ICs and are unlikely to accelerate their purchases before they see increased demand for their products. As a result, the efforts of DRAM makers have yet to make a noticeable impact on declining prices, according to the TrendForce report.

Buyers among PC OEMs and ODMs have reduced their purchase quantities of PC DRAMs significantly in the last three quarters, but they still have enough inventory of DDR4 and DDR5 SDRAM to last around 9 to 13 weeks. There's a chance that PC makers may take advantage of low prices and increase their DRAM purchases, but it's not clear if this would relieve the inventory overstock situation for suppliers.

Despite reduced output, TrendForce estimates that the price of an 8GB DDR4 module will decline by over 10% in Q2 2023. In general, the average selling price of PC DRAM is set to decrease 10% to 15% QoQ in the first quarter and then by another 10% to 15% sequentially in Q2, according to analysts.

Unit sales of discrete graphics cards tend to rebound sequentially in the first quarter and then drop in Q2, based on historical data from Jon Peddie Research. Yet, because shipments of desktop GPUs declined drastically in Q3 and Q4 2022, GPU makers have enough GDDR memory chips in stock — and so demand for such ICs is sluggish. TrendForce predicts that average selling price of a 16Gb GDDR6 IC will decline 10% to 15% in Q2 2023 due to constrained demand.

Thanks to slowing demand for PCs, memory makers increased proportion of server memory in their product mix. However, this led to a significant server DRAM inventory pile-up in Q1 2023. Server makers and cloud service providers are also adjusting their inventories, which is why prices for server memory are going south. TrendForce now projects that the server DRAM average selling price will drop by 13% – 18% in Q2 2023.

Although smartphone suppliers' DRAM inventories have dropped to a relatively healthy level, these brands are adopting a cautious approach to handset production. This is likely to limit buyer demand for mobile DRAM in Q2 2023, according to TrendForce.

Despite mobile DRAM production cuts, it will remain a challenge for suppliers to reverse their current overstock situation. Because every DRAM producer wants to sell every LPDDR IC it has at almost any price, this has a drastic impact on average selling prices. TrendForce believes that average prices of mobile DRAM will continue to drop in Q2 2023, though the decline will narrow to 10% – 15%.

As far as consumer electronics memory is concerned, supply continues to outpace demand even though manufacturers have cut down production of appropriate ICs. TrendForce analysts think the average selling price of consumer DRAM will fall 10 - 15% in Q2 2023.