Staying a step ahead of China is a recurring theme in U.S. foreign policy. Yet the most expansive effort on the table right now to keep China in check sadly emulates the communist country's greatest weakness: the blurred line between where the state stops and the market begins. Congress is set to get the government deeply involved in the critical market of semiconductors.

In a 64-33 vote, the Senate passed the CHIPS Act on Wednesday and it will likely be signed into law by President Biden soon.* This law traces its roots back to a 2020 bill to provide $16 billion in research and development (R&D) funding for the semiconductor industry. Government R&D funding is often wasteful, but such an amount for this purpose is not unheard of.

The current legislation has swelled to a total cost of more than $400 billion. The core of the bill is $76 billion in direct funding for domestic semiconductor manufacturing through a variety of grants and tax credits. The rest of the money, beyond doubling the budget of the notoriously silly spenders at the National Science Foundation, is predictably a billion here and a billion there for vaguely named programs with even more ambiguous purposes. For example, as the Wall Street Journal editorial board pointed out, "The Commerce Department gets $11 billion, most of which it intends to plow into creating 20 new 'regional technology hubs,' which will somehow expand 'U.S. innovation capacity.'"

If the cost isn't offensive enough for Americans reeling from the effects of the pandemic-induced spending spree in Washington, the CHIPS Act may as well derive its name from the tortilla-chip flimsy arguments underlying the $76 billion handout to the semiconductor industry at the center of the bill.

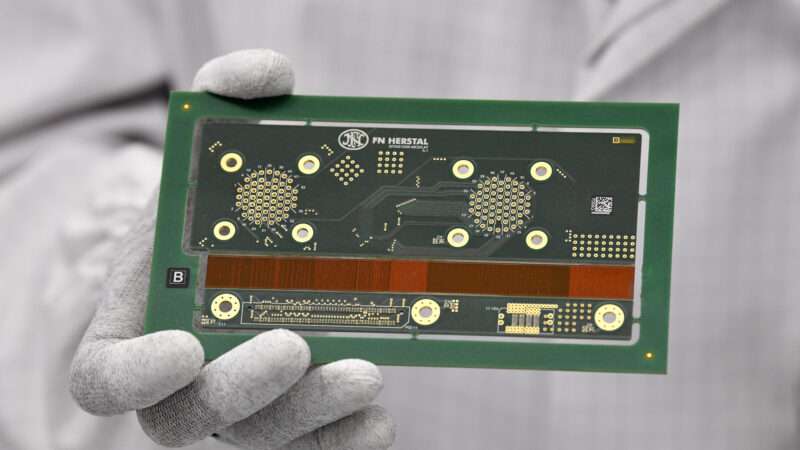

Proponents of the legislation would have you believe that the U.S. is overly reliant on foreign, unreliable suppliers of semiconductors, particularly those under threat from China. Semiconductors are unbelievably important components in practically countless goods relied on every day, but that's no excuse to ignore the fact that the domestic semiconductor industry is, per a 2020 report by the Semiconductor Industry Association, "on solid footing." U.S.-based semiconductor firms hold nearly half of the global market share, and 44 percent of that production already occurs in the U.S. Moreover, these figures don't even capture firms based in allied countries such as South Korea and Taiwan that are currently spending billions of dollars to open semiconductor manufacturing facilities in the U.S.—without the need for funding.

Naturally, supporters of the CHIPS Act would argue that these major chipmakers in South Korea and Taiwan are the products of the very kind of industrial policy that the bill represents. Research by Samuel Gregg, a distinguished fellow in political economy at the American Institute for Economic Research, shows that the success of the major firms in South Korea and Taiwan correlates with a move away from government direction, despite initial investments. "Whether it is explaining East Asian economic successes or the rise of Taiwanese semiconductor companies, industrial policy explanations constantly come up short," explains Gregg.

Semiconductors may be at the leading edge of the economy and technological innovation, but that doesn't mean the industry is immune from the laws of economics and pitfalls of government intervention. While indeed there has been a recent global chip shortage, manufacturers are already reporting signs that the issue is easing, miraculously without the help of 1,000 pages and a half-trillion dollars worth of new federal programs.

The resulting waste and subsidy dependency of the CHIPS Act are bound to make competition with China more difficult by further emulating the communist state's involvement in the private sector.

UPDATE: This piece has been updated to include the Senate's passage of the CHIPS Act.

The post Don't Give U.S. Chipmakers a $76 Billion Government Handout appeared first on Reason.com.