Shares of BlackBerry (BB) are not trading well on Friday, down about 11% on the day after the company reported earnings.

It comes on a tough day in the market, as the S&P 500 is caught in a three-day skid following a monstrous 11 day surge.

Given the trend of this stock though, it seems unlikely that the overall market’s performance would have much of an impact on this one.

While AMC Entertainment (AMC) and GameStop (GME) have both been trading well lately — and the latter has been particularly good and now plans for a stock split — BlackBerry has not enjoyed the same ride as some of its other meme-stock peers.

BlackBerry stock is now down close to 20% from this week’s high and is down almost 30% so far for the year. Further, shares are down 67% from the 52-week high.

Now the worry becomes, will BlackBerry go on to make new 52-week lows?

Trading BlackBerry Stock

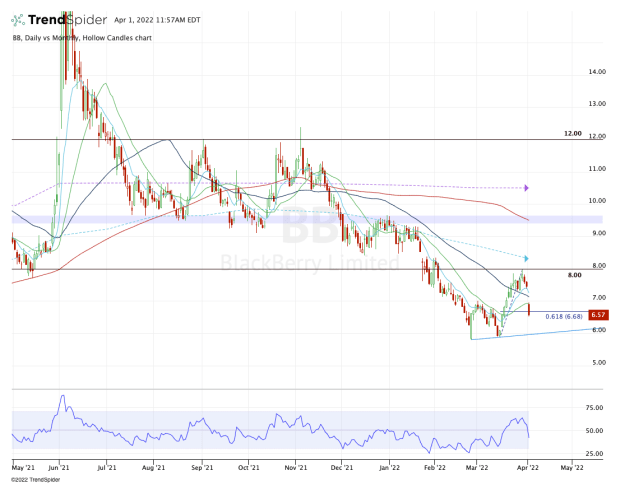

Chart courtesy of TrendSpider.com

As I look at the daily chart, I notice that BlackBerry stock has a real tendency to flip between support and resistance at certain levels.

While that characteristic is not necessarily unique to BlackBerry, it’s quite pronounced in this case. Look at the way $9.50 went from support to resistance. The same thing has now happened with $8, which rejected the stock a few days ago.

Now rotating lower on a bearish earnings reaction, BlackBerry stock has gapped below the 10-day, 21-day and 50-day moving averages.

With the continued selling throughout the session, shares are also trading below the 61.8% retracement of the current range as well.

If the stock continues lower from here, it could have $6 written all over it.

That’s about where uptrend support (blue line) comes into play, while BlackBerry has posted significant bounces from the $5.80 to $5.90 area twice in the last two months.

At this point, BlackBerry is not a stock I want to be long. Not only is it struggling fundamentally, but the technicals are not cooperating either. In fact, the technicals are bearish.

At a time where we have companies with bullish fundamentals and bullish technicals — or at least one of the attributes — why choose a stock with neither?

Back above today’s high could put an earnings gap-fill in play, but again, I’d rather look elsewhere for opportunities. If Blackberry is rebounding, there's a good chance others are as well.