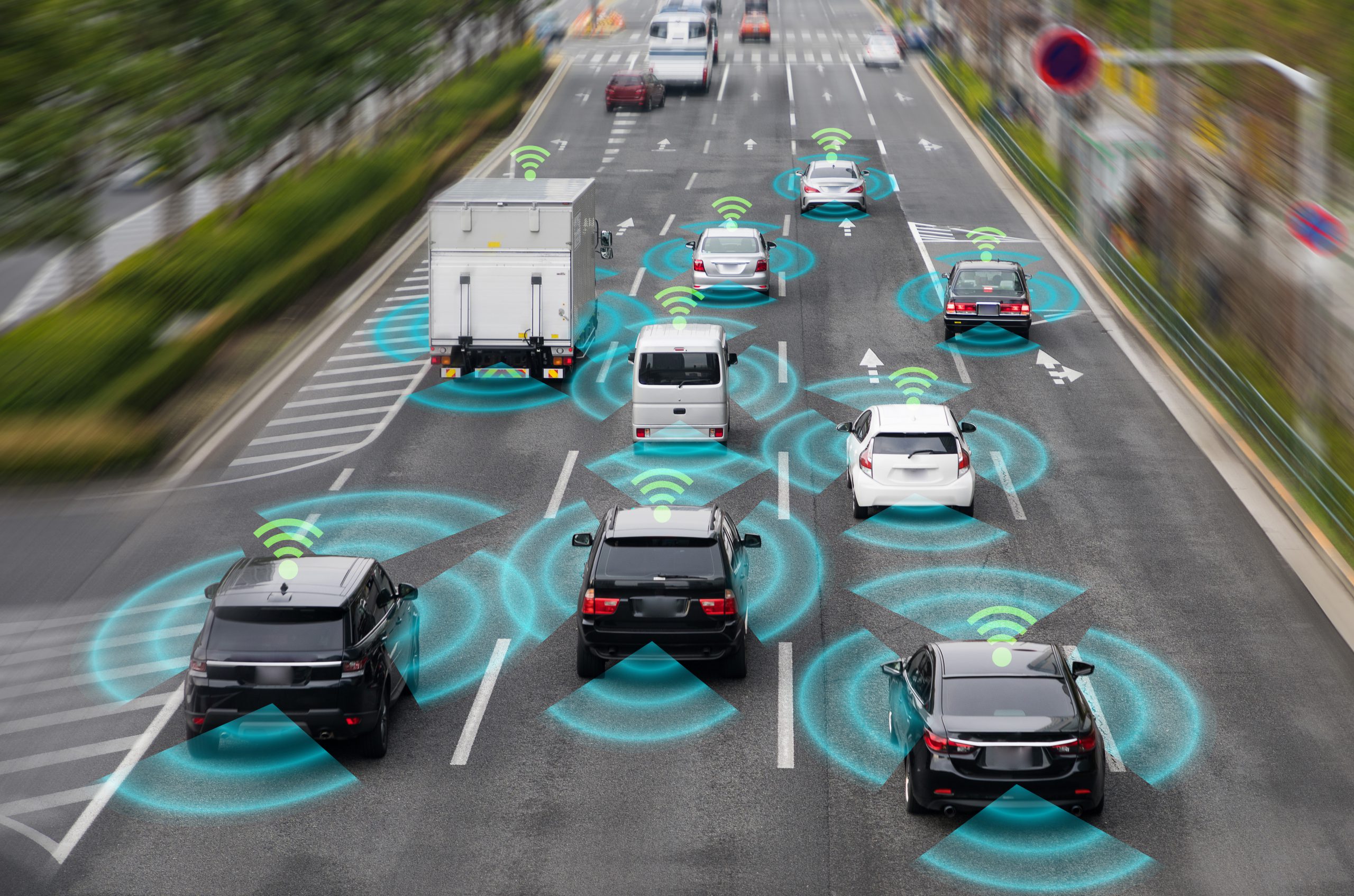

MicroVision, Inc. (MVIS) in Redmond, Wash., specializes in autonomous driving technology and lidar sensors. It is a pioneer in MEMs-based laser beam scanning technology.

Last month, the company showcased its automotive lidar sensor technology at CES 2022 in Las Vegas.

However, shares of MVIS have retreated 41.5% in price over the past year and 23% year-to-date to close yesterday’s trading session at $3.86. This reflects continued bearish investor sentiment surrounding the penny stock.

Here is what could shape MVIS’ performance in the near term:

High Short Interest

Approximately 30.75 million shares of MVIS are currently sold short, translating to 18.7% of its total outstanding share volume. The company’s shares had a short interest ratio of 6.1 as of Dec. 31, 2021. Roughly $154.06 million worth of MVIS shares is currently sold short.

MVIS gained popularity among meme investors last year due to its high short interest. However, despite frequent mentions on popular Reddit forums, investors have failed to trigger an MVIS short squeeze.

Equity Dilution

MVIS entered a $140 million at-the-market equity market offering agreement with Craig-Hallum Capital Market Group last year. Under the agreement, MVIS can sell shares of its common stock (totaling up to $140 million) through Craig-Hallum from time to time, at management’s discretion. The company plans to use the offerings’ net proceeds to fund its general corporate expenses, working capital, and capital expenditures.

However, these equity offerings will increase the total number of outstanding MVIS shares, thereby reducing earnings per share and return on equity for existing shareholders.

Poor Financials

MVIS’ total revenues increased 12.4% year-over-year to $718,000 in its fiscal third quarter, ended Sept. 30, 2021. This can be attributed to a 33.2% rise in License and Royalty revenues. However, the company’s loss from operations widened 257.3% from the same period last year to $10.06 million, due to a 212.3% rise in total operating expenses. Its net loss widened 232% from the prior-year quarter to $9.38 million. And excluding the gain on debt extinguishment, MVIS’ net loss amounted to $10.07 million. Its adjusted EBITDA loss widened 190.4% year-over-year to $6.20 million, while loss per share widened 200% from its year-ago value to $0.06.

POWR Ratings Reflect Bleak Prospects

MVIS has an F overall rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

MVIS has an F grade for Value, Stability, and Sentiment. The stock’s 254.24 forward Price/Sales multiple is 6,337.5% higher than the 3.95 industry average, which is in sync with its Value grade. In addition, its 3.42 beta justifies the Stability grade.

Moreover, the Street expects MVIS’ EPS to decline 125% in the current quarter (ending March 2022) and 29.6% in its fiscal 2022, justifying the Sentiment grade.

Of the 45 stocks in the Technology – Electronics industry, MVIS is ranked #43.

In addition to the grades I have highlighted above, view MVIS ratings for Growth, Momentum, and Quality here.

Bottom Line

Founded in 1993, MVIS has more than two decades of experience in developing lidar sensors and autonomous driving technology. However, the company does not have any concrete partnerships to sell its products and services to auto manufacturers. It generated revenues through royalties and licensing in its last reported quarter, while its product revenues were zero. Given the immense competition in the autonomous driving space, MVIS’ poor business model is expected to limit its growth. Thus, we think MVIS stock is best avoided now.

How Does MicroVision, Inc. (MVIS) Stack Up Against its Peers?

While MVIS has an F rating in our proprietary rating system, one might want to consider looking at its industry peers, AstroNova, Inc. (ALOT), Brother Industries, Ltd. (BRTHY), and Arrow Electronics, Inc. (ARW), which have an A (Strong Buy) rating.

MVIS shares were trading at $3.64 per share on Tuesday afternoon, down $0.22 (-5.70%). Year-to-date, MVIS has declined -27.35%, versus a -3.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

Does MicroVision Deserve a Place in Your Portfolio? StockNews.com