/Northrop%20Grumman%20Corp_%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $63.5 billion, Northrop Grumman Corporation (NOC) is a leading global aerospace and defense technology company specializing in advanced systems and solutions across multiple domains. With a strong presence in the United States and internationally, the company delivers cutting-edge capabilities in autonomous systems, cybersecurity, C4ISR, strike, and logistics.

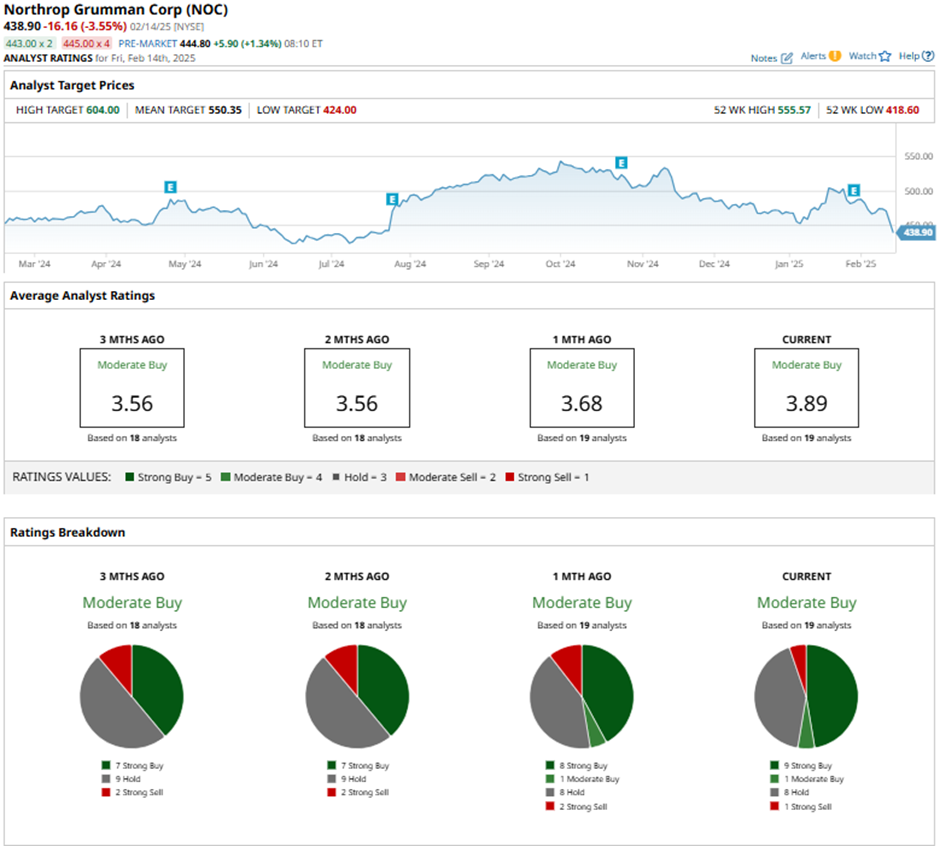

Shares of the defense contractor have lagged behind the broader market over the past 52 weeks. NOC has declined 1.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 22.3%. Mowever, shares of NOC are down 6.5% on a YTD basis, compared to SPX’s nearly 4% gain.

Focusing more closely, the Falls Church, Virginia-based company has underperformed the Industrial Select Sector SPDR Fund’s (XLI) 16.7% return over the past 52 weeks and a 4.4% YTD gain.

Despite reporting weaker-than-expected Q4 2024 total sales of $10.7 billion, shares of Northrop Grumman recovered marginally on Jan. 30 due to the company’s adjusted EPS of $6.39, beating the consensus estimate, reflecting a significant rebound from the prior year’s loss. Additionally, the ongoing global conflicts, such as the Russia-Ukraine war and tensions in the Middle East, have bolstered demand for military equipment. The company's positive outlook for 2025, including expected double-digit growth in international sales, helped reassure investors. Additionally, Northrop's announcement of a $327 million deal to sell its training services business signaled strategic growth potential.

For the current fiscal year, ending in December 2025, analysts expect NOC’s EPS to grow 7.6% year-over-year to $28.05. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” eight “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with seven “Strong Buy” ratings on the stock.

On Feb. 1, RBC Capital analyst Ken Herbert lowered Northrop Grumman's price target to $500, citing a 10 bps margin expansion forecast for 2025. The analyst maintains a “Sector Perform” rating due to softer defense sentiment despite positive B-21 and 2026 sales growth outlook.

As of writing, NOC is trading below the mean price target of $550.35. The Street-high price target of $604 implies a potential upside of 37.6% from the current price levels.