Investors gave a bearish reaction to First Solar's (FSLR) earnings in late April.

On Friday the stock erupted higher, touching 52-week highs. The rally came after clarity regarding the Inflation Reduction Act.

As reported by TheStreet's Todd Campbell: “The U.S. Treasury Department addressed those concerns with new guidance on Friday, sparking a widespread rally.”

First Solar ended Friday more than 26% higher. The rally bailed out the stock from a nasty post-earnings skid. The shares had fallen about 10% heading into the earnings report, then fell roughly 15% afterward.

First Solar was the most noteworthy winner among the solar stocks on Friday. SolarEdge Technologies (SEDG), Enphase Energy (ENPH) and others rallied as well.

Let’s take another look at FSLR now that it’s at annual highs.

Trading First Solar Stock

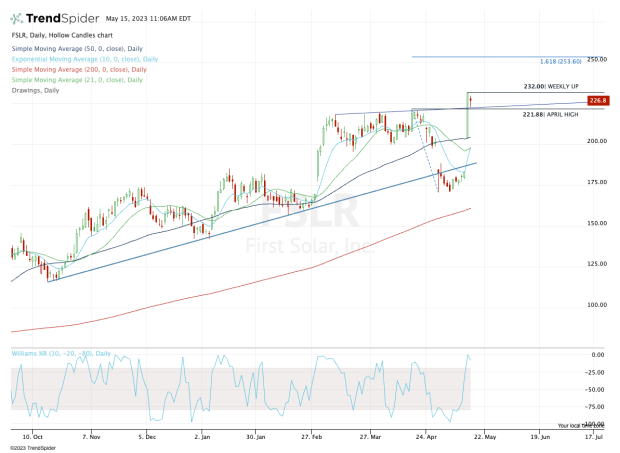

Chart courtesy of TrendSpider.com

At the beginning of the month, we took a look at First Solar and Enphase Energy, and at the time, the latter was significantly weaker than the former. First Solar itself, however, was not winning any awards for its performance.

At the time FSLR had broken below its main uptrend measure (blue line), and although there was a path back to $200, it did not include a 26.5% one-day spike to new highs!

That’s how the stock market goes, though, and it’s a good reminder that almost any scenario is possible — even if there is only a remote chance of it occurring.

In the current action the bulls want to see the April high near $222 hold as support. Staying above the $220 to $222 area will be key, as this zone was resistance all throughout the first few months of the year.

If First Solar stock can clear last week’s high of $232, it opens the door to higher prices. It could potentially put the $250s in play, as the 161.8% extension of the admittedly large range comes into play at $253.60.

Particularly if the overall market moves higher, First Solar stock could continue to rally.

If the $220 area fails as support, a decline all the way down to the low-$200s is technically possible. In that scenario, the bulls would look for one of the short-term moving averages — like the 10-day — to act as support, should such a pullback occur.

For now, though, traders should watch $220 on the downside and $232 on the upside.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.