Shares of Disney (DIS) are active on Thursday, rising as much as 5.8%, then at last check fading to a gain of 1.9%.

This comes after, as TheStreet's Martin Baccardax reports, returning CEO Bob Iger determined to clean house at the House of Mouse.

The executive unveiled a raft of changes at the media and entertainment group as it fends off an activist challenge from the billionaire investor Nelson Peltz.

Iger detailed 7,000 job cuts, $5.5 billion in cost reductions and a new three-part organizational structure focused on Parks, Entertainment and ESPN. The company also delivered better-than-expected earnings results. And it reported a dip in streaming subscribers.

More broadly, Disney stock had rallied in five straight weeks and rose by a third ahead of its fiscal-first-quarter report, which came on Wednesday after the close.

At first, investors were gobbling up the stock. Recession fears don’t seem to be weighing on Disney and a focus on the bottom line is adding to investors' confidence.

That said, the shares are fading from today’s highs. Perhaps Disney stock enjoyed too strong a rally into the print.

Trading Disney Stock

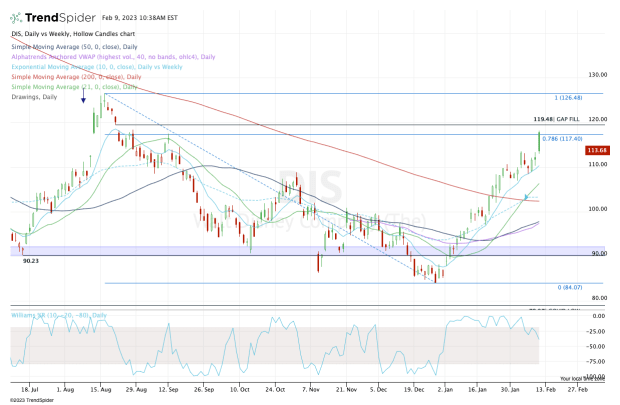

Chart courtesy of TrendSpider.com

There’s good news and bad news with today’s fade.

First, the stock had a positive post-earnings reaction and will look to log its sixth straight weekly gain. In other words, the trend is firmly in the bulls’ control.

Second, the stock is fading from a key area on the charts, between $117.50 and $119.50.

There we have the 78.6% retracement and gap-fill from August. That fade is neither a pro nor a con — simply an observation — but it’s not as if Disney stock is fading simply due to a lack of buyers. Instead, the fade comes from a key area on the chart.

Lastly, the stock has now filled the post-earnings gap on the downside, too.

The bulls’ best bet from here would be to see Disney shares reset near support, in order to enjoy a more sustained rally going forward.

On the downside, they’d like to see the $110 area hold as support, along with the 10-day moving average.

Below that could open the door down to the 10-week and 200-day moving averages just above $100.

On the upside, a move through Thursday’s high puts $119.50 in play. Above $120 and the August high near $126.50 could be in play.