Disney (DIS) shares did not trade well after the entertainment giant reported earnings in mid-February. But they're now gaining some momentum and trying to claw back some of their losses.

When the shares opened for trading on Feb. 9, the stock was up close to 6% from the previous trading day. They then faded hard, reversing their initial post-earnings gains and closed lower 1.3% lower on the day.

That kickstarted a painful losing streak in Disney stock, which closed lower in five of the next six weeks.

Don't Miss: Can Intel Stock Hold Key Support After Earnings Rally?

Since then, it’s been a different story. The shares gained in three of the past six weeks and the three weekly declines rang in at just 0.16%, 0.17% and 0.33%.

Despite this entertainment stalwart having multiple business segments — like its studio, parks and streaming — investors have been on the fence about whether to own Disney stock or not.

Perhaps the charts can help them decide as the stock tries to break out.

Trading Disney Stock

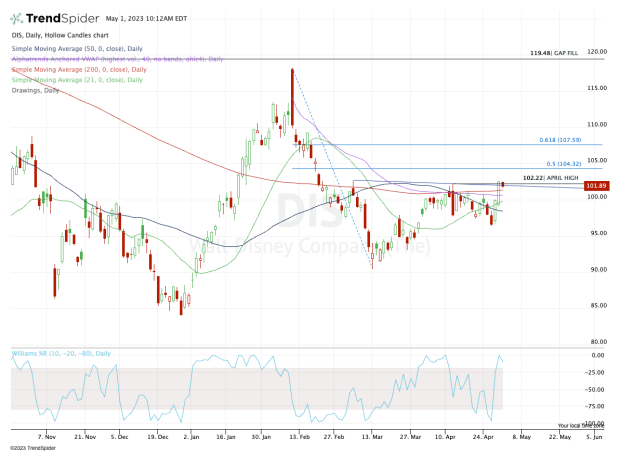

Chart courtesy of TrendSpider.com

Once Disney stock finally touched a low near $90.50 in mid-March, it slowly but surely began to push higher.

It struggled with its daily moving averages — like the 50-day and 200-day — as well as the daily VWAP measure. But a two-day surge late last week sent Disney stock about 6% higher, putting it over these measures and putting a key breakout in play.

Specifically, the $102 to $102.50 area for a few months has been resistance, while the April high sits at $102.22. In other words, a rotation over this area could open up more upside.

Don't Miss: Buy or Sell Amazon Stock on Earnings? Chart Lends a Clue

Specifically, it would have bulls looking at the 50% retracement near $104.30, then the 61.8% retracement at $107.50. Above that puts $110 in play.

On the downside, watch the $100 level. Not only is this a key psychological level, but a break below this measure puts Disney back below the 200-day moving average and the daily VWAP measure.

It could also put last week’s lows in play near $96.50.

For now though, let’s not be overly concerned about the downside.

What we really want to watch is the $102 to $102.50 zone. Above that and the bulls can harness control. Below this zone and there’s no real reason for active buyers to show any interest in the name.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

.png?w=600)