On Thursday evening, Tegna-owned TV stations were, as expected, taken off the programming grids of DirecTV's three pay TV platforms.

Tegna counts 64 network affiliates in 51 markets, while DirecTV insists the actual tally is 66 network stations in 52 metro regions.

“Despite months of effort, DirecTV has refused to reach a fair, market-based agreement with Tegna,” the broadcaster said in a statement. "As a result, DirecTV and AT&T U-Verse customers will lose access to NFL and college football conference championship games, as well as some of the most popular national network programming and top-rated local news. We urge DirecTV to continue to negotiate with us until a deal is reached that restores our stations to their customers.”

Also read: DirecTV and Tegna Queue Up Another Blackout Do-Si-Do

Back at DirecTV headquarters in El Segundo, Calif., the operator's top program licensing negotiator, Rob Thun, shared a deck with Next TV over Zoom.

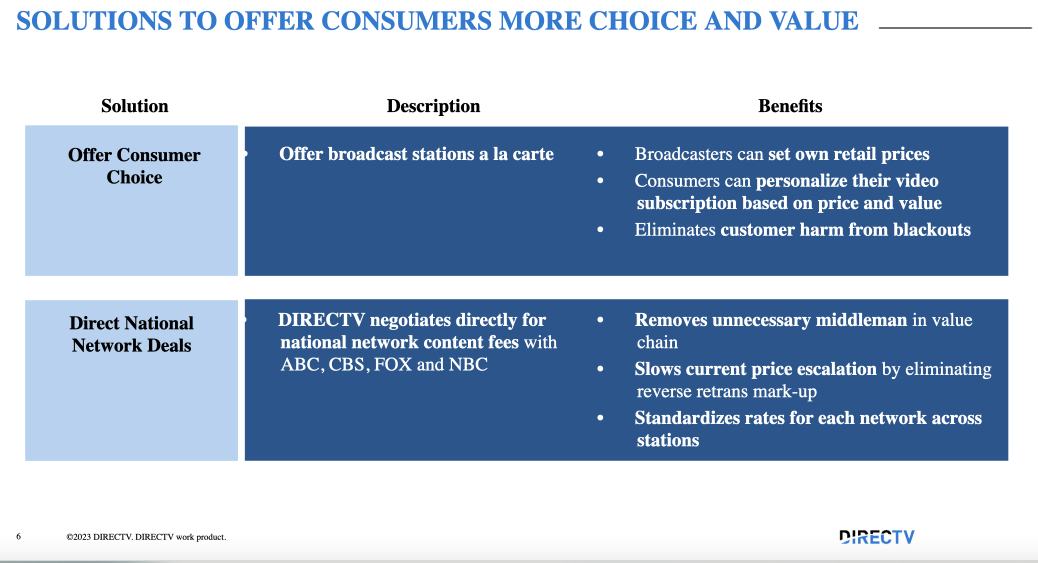

Taking a page from a playbook that worked effectively for Charter Communications two months ago in pivotal program licensing dispute with Disney, DirecTV and Thun put together a "proposal" for Tegna to either set consumer pricing itself and let DirecTV customers decide whether they want to pay for its local channels a la carte, or let DirecTV negotiate directly with the broadcast networks itself.

With NBCUniversal/Comcast, CBS/Paramount and ABC/Disney committing more than $2 billion a year each over the next decade to the NFL, Thun contends that station groups like Tegna are accepting spiraling reverse retransmission rates from conglomerates and passing the pain to pay TV operators.

“The broadcasters seem to not want to take the same aggressive tactics in negotiations with the networks themselves, and then they just pass the trash down the line to the pay TV providers. They assume we’re going to eat it and ultimately pass it on to our consumers. But we've hit the wall in terms of what prices our customers are willing to pay,” Thun told Next TV.

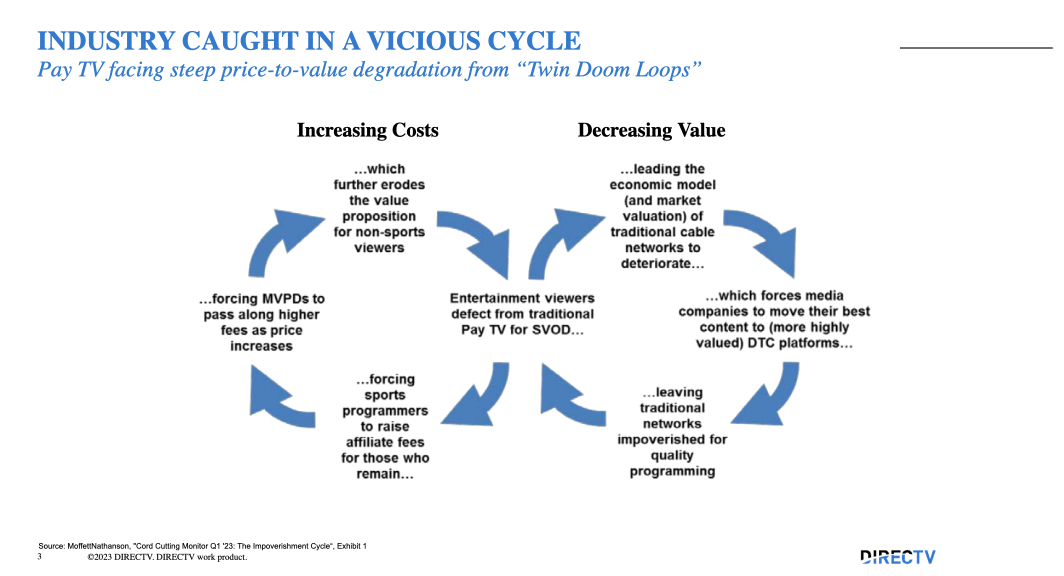

Featuring a potpourri of research including Kagan figures indicating a 270% spike in broadcast retransmission fees since 2015, Thun's deck is reminiscent of some of the “new deal” proposals put forth into the program licensing market recently by Charter CEO Christopher Winfrey and his team. It even includes a citation to the “Doom Loop,” the virtuous cycle signaling the demise of the pay TV industry that was created and published by equity analyst Craig Moffett back in May and also used by Charter in some of its recent messaging.

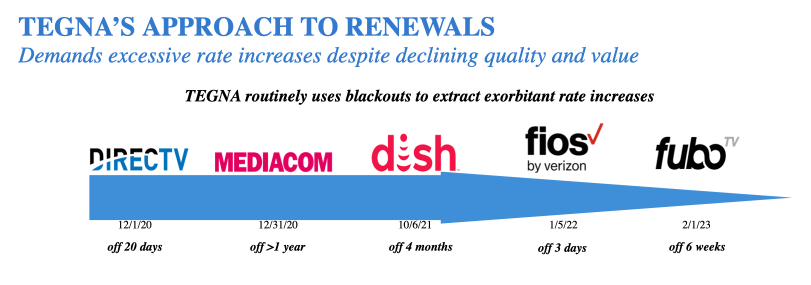

In the deck, DirecTV describes Tegna as a kind of serial blackout causer, involved in 275 impasses with operators since 2010 and demanding the highest retrans rates in the television industry while offering fewer programming enticements than ever to viewers.

Asked by Next TV if his proposal was merely the kind of rhetorical mechanism often seen in an ever-increasing spiral of fee disputes between programmers and distributors, Thun said DirecTV is “dead serious” about it, conveying a similarly earnest pushed-to-the-wall vibe that characterized Winfrey's publish speaking engagements during September's Disney impasse.

Indeed, there are a number of factors suggesting the Tegna dispute might be the point at which DirecTV digs in on retrans:

- We're already in week 13 of the NFL season, and college football's regular season is over. With audience interest dwindling in broadcast TV scripted and reality content, live sports — most specifically live NFL football — remains a key source of urgency for these kinds of disputes.

- In terms of the remaining live football games, 21 Tegna stations are affiliated with NBC, which is also distributed via SVOD Peacock, and 16 Tegna stations are aligned with CBS, which is distributed via Paramount Plus.

- Even the Super Bowl itself will be available for linear viewing outside its 2024 broadcast home, CBS, with Paramount Global vowing to simulcast it on Nickelodeon.

After the football season ends, Thun said, “We’re in a different ball game, because they [Tegna] are going to be in the thick of these elections, right? Two-thirds of their footprint has elections coming up through Super Tuesday across 16 states. I think the whole advertising market, especially for the broadcaster, is expecting the soft ad market to boomerang up based on what will likely be a very contentious election cycle. And it's not going to bode well for them to be off of their largest distributors.”