This is the second in a set of three blogs about projections for digital storage and memory in 2022 and beyond. The first blog focused on developments and projections for magnetic recording (HDDs and magnetic tape). This blog focuses on various types of solid state memory and storage. We will also have some discussion on NVMe and NVMe over fabrics (NVMe-oF) as well as memory networks using CXL for far memory (higher latency) and looking at possible near memory (lower latency) developments and discuss how these will change computing architectures.

NAND flash memory has become the dominant primary storage in data centers and enterprises and is the storage used in consumer devices such as smart phones and tablets and now dominates as storage in PCs. Active data now lives on SSDs with colder data kept on HDDs or magnetic tape,

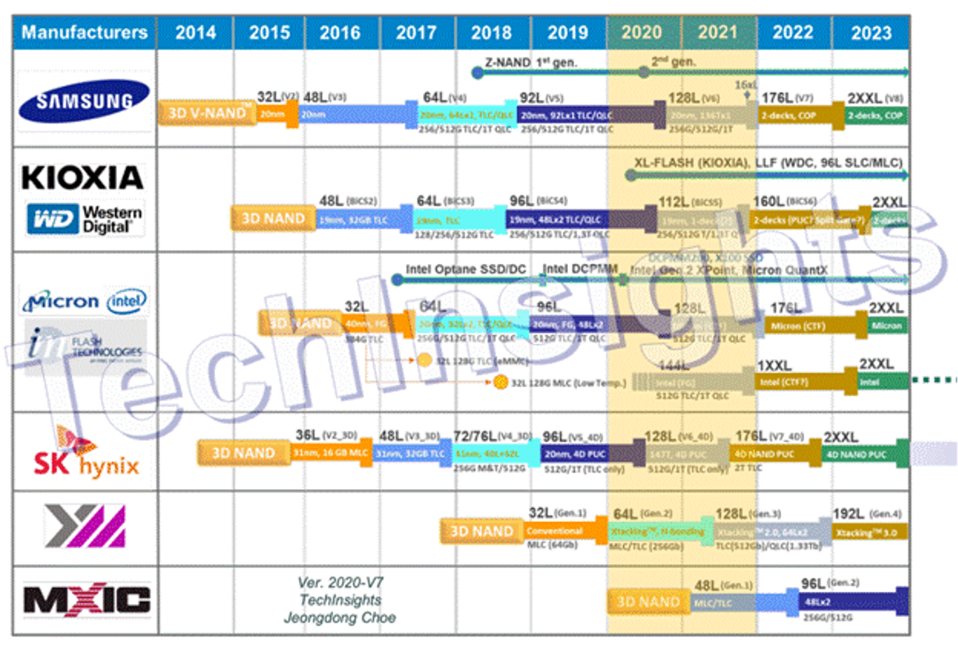

SSD companies are trying to put pressure on HDDs for secondary storage. They are primarily doing this with very high layer count NAND flash as well as quad-level cell (QLC) flash that stored 4-bits per flash memory cell (Kioxia and WDC have talked about 5-bit per cell NAND flash, although no products are in production).

Micron was the first to announce 176-layer NAND flash in 2020 followed by SK hynix, late in 2020. WDC and Kioxia announced a 162-layer NAND flash in February 2021. Samsung released its 7th generation V-NAND in a consumer SSD in 2021.

The Samsung 7th generation V-NAND has 176 layers without increasing the modules height compared to its 6th generation product with 128-layers, with a 35% smaller cell volume. Samsung is using a single stack NAND layer etching technology that allows a smaller chip area and height. Samsung says it can go up to 256-layer single stack NAND and announced that its Generation 8 V-NAND will be over 200 layers. Samsung has projected that 3D NAND could evolve to over 1,000 layers (SK hynix has said over 600 layers).

All the flash memory companies seem to be migrating to putting the chip logic under the memory, a technology started by Micron a few years ago. Below is a flash memory roadmap presented by Joengdong Choe at the 2020 Flash Memory Summit (there was no FMS in 2021) from TechInsights that shows historical and projected advances in NAND flash memory. The cumulative annual growth rate (CAGR) in flash areal density in 2021 was probably in the range of 20+%, down a bit from prior years.

1TB memory cell phones are now available from the major smart phone manufacturers, although they are still expensive. The introduction of higher bandwidth 5G networks and higher resolution screens as well as higher resolution cameras is helping to drive the demand for more storage in mobile devices. The image below shows a 1TB Apple iPhone 13.

Although NAND flash memory experienced price increases for some NAND flash in 2021, some of it due to supply chain issues (e.g. with controllers) coupled with a significant enterprise SSD demand, the market is expected to return to an oversupply in 2022, continuing NAND flash price declines.

The NVMe interface is now the dominate storage interface for SSDs (replacing SATA and SAS) and this trend will grow in 2022. NVMe over fabrics (such as Fibre Channel and Ethernet) are enabling fast storage networking. NVMe is also the basis for new products offering Computational Storage (standards on computational storage are being developed and promoted by a Computation Storage Working Group in SNIA).

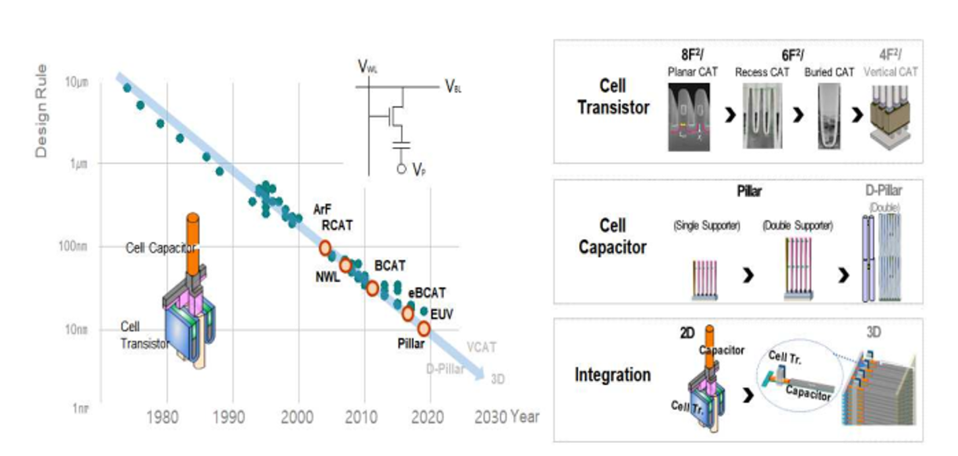

DRAM memory developments continue. DRAM is the working memory in consumer, industrial, PC and data center applications. The figure below shows Samsung’s projections for DRAM development including changes in the cell transistor structure, cell capacitance and eventually 3D DRAM stacking (from Samsung’s plenary talk at the 2021 IEEE IEDM).

CXL appears poised to bring memory networks into computer architectures starting in 2022 (aided by a strong industry consortium). Samsung announced CXL memory modules in the Spring of 2021. CXL provides arbitrated access to memory resulting in somewhat higher latency than direct attached memory, but allowing memory pooling and assisting in greater efficiency in data center computing workloads. CXL also allows using memory with different performance characteristics which is not possible for general purpose DDR memory. Special computing accelerators can also be combined in a CXL network with the memory to create computing near memory applications.

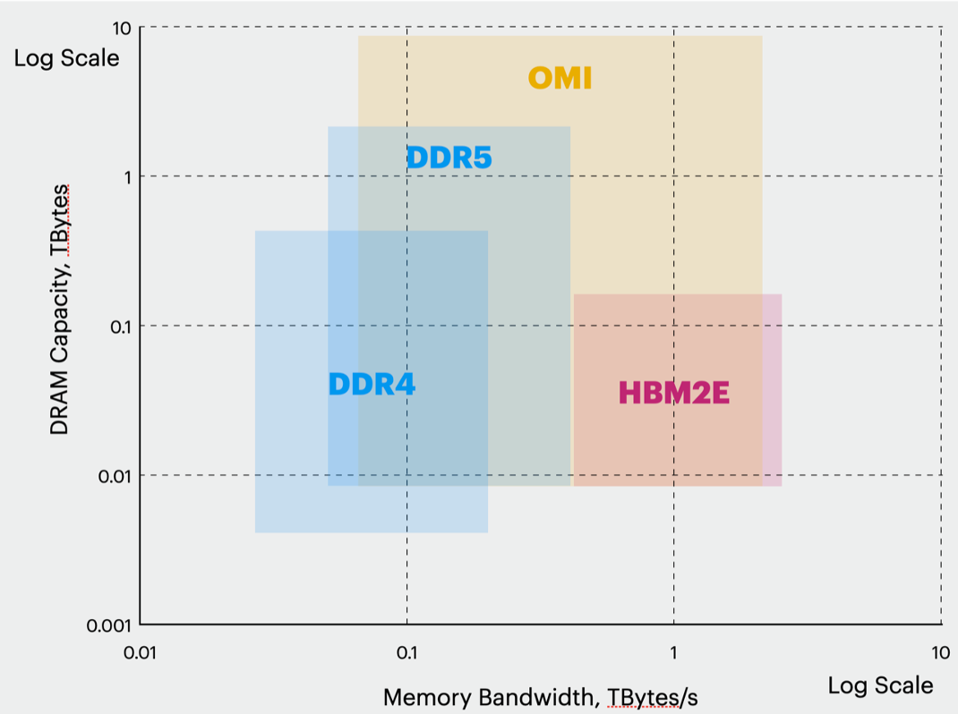

In addition to CXL appearing in enterprise computing systems in 2022 there is also discussion about new approaches for direct attached (lower latency or near) memory. DDR5 will be used in next generation general purpose computing, but going to higher data rate parallel connectors is getting harder. HBM is used to provide high performance but this type of memory is expensive due to the use of through silicon vias (TSVs) and massive parallel connections with stacked chips. In addition, HBM is limited to stacks of at most 12 chips, limiting the available memory capacity.

IBM is trying to get the industry interested in using its Open Memory Interface (OMI) that allows a low latency local area storage network. The chart below shows a comparison of performance and memory capacity available for DDR4, DDR5, HBM and OMI.

Note that OMI can provide close to the performance of HBM and more memory capacity than either DDR or HBM. This combination of high capacity and performance in near memory could be very useful for some computing applications.

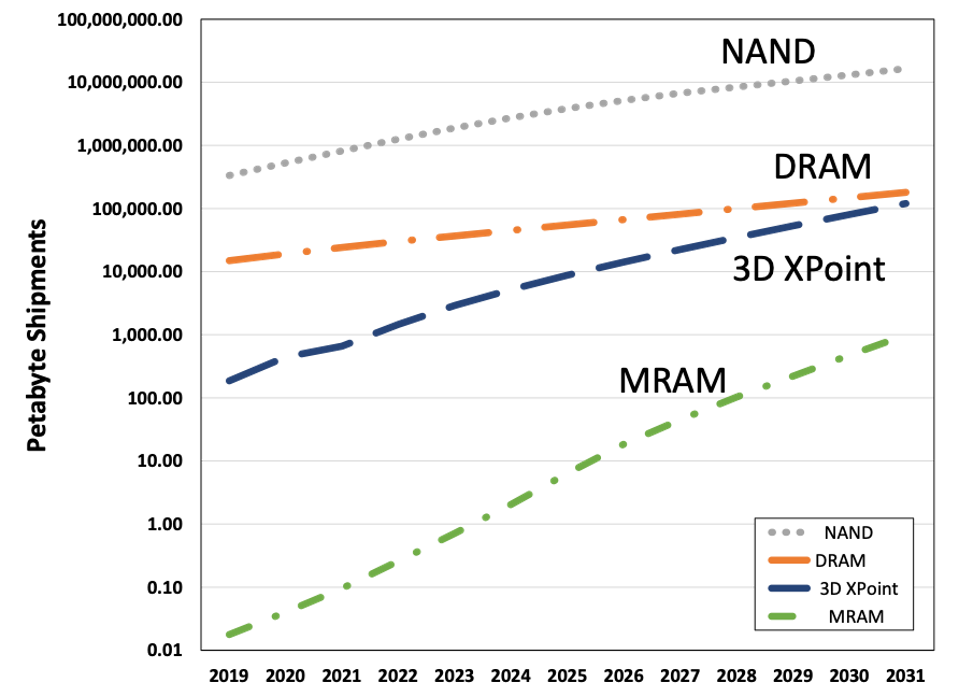

Limitations in NOR-flash scaling (it stops scaling at the 28nm lithographic node) and the increasing need for cache memory for AI inference applications, is driving the growth of emerging memory technologies in embedded devices. MRAM and RRAM are appearing in chips made by major semiconductor foundries. These emerging memory technologies are replacing NOR flash and slower high level SRAM cache memory. Using more non-volatile memory rather than volatile memory, such as SRAM in mobile devices, including phones, could increase the memory density per die and also reduce the energy consumption of these devices, leading to longer battery life.

Both TSMC and Global Foundries have spoken about 22nm and 16nm MRAM and RRAM memories in their foundries and Samsung has made MRAM memory chips being used in some wearable devices. Various fabless semiconductor companies such as Ambiq and Numen have announced MRAM memories in chips made by TSMC. Other foundries such as UMC and SMIC have also announced the availability of MRAM and RRAM memory in their chips.

The image below from a recent report by Coughlin Associates and Objective Analysis (Emerging Memories Take Off) shows projected growth of NAND flash, DRAM, 3D XPoint and MRAM annual shipped capacities out to 2031. Total revenue from the emerging memories will likely exceed $44B by 2031, driven by standalone as well as embedded applications.

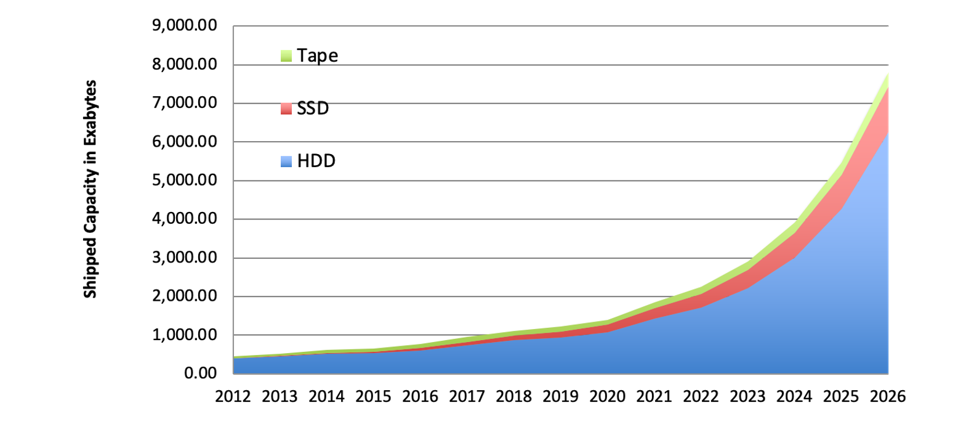

Overall demand for storage technology of all types continues to grow, as the total amount of stored data increases. This storage capacity demand will drive demand for all types of storage technology. The chart below shows historical trends and our projections for the growth in shipped storage capacity for magnetic tape, HDDs and SSDs. Note that we have recently increased our projections for magnetic tape capacity growth.

SSDs are now primary storage in enterprise and data center applications. NVMe is the primary SSD interface with NVMe-oF and important element in storage networking. NAND and DRAM scaling continues to provide higher capacity at lower prices. CXL is poised to transform far memory and OMI could offer advantages for near memory. MRAM and RRAM are enabling new embedded products.