Shares of Zillow (Z) are doing well on Friday, up 17% after the company reported better-than-expected quarterly results.

That has the stock rallying on the day and trading near its session high, even as the overall stock market still tries to sort out where it wants to trade following yesterday’s inflation report.

As for Zillow, inflation and a strong housing market should have helped its home-buying business, although even its poor results in that unit weren’t enough to weigh the stock down today.

Thankfully, the company is winding down that business, while Zillow also delivered a revenue beat for the fourth quarter.

Investors are clearly relieved with the report and are now bidding up the stock in response. At its recent low, Zillow stock was down 78.5% from its 52-week high.

Is it time to wave the “all-clear” sign? Let’s look at the chart.

Trading Zillow Stock

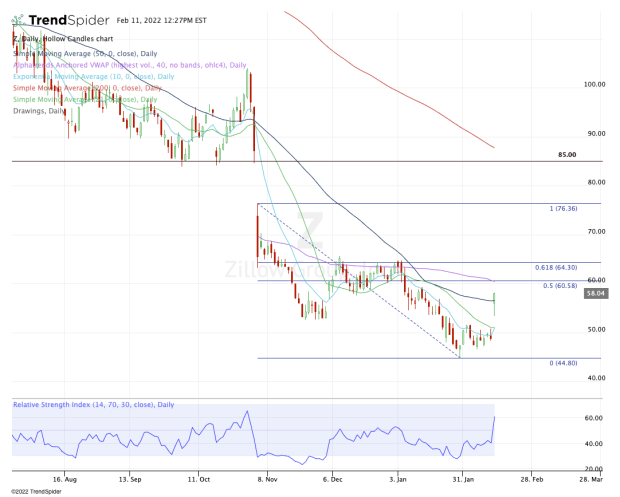

Chart courtesy of TrendSpider.com

With this morning’s rally, shares are powering through the 10-day and 21-day moving averages. Previously, these two moving averages were resistance for Zillow stock.

However, shares are now rallying right into the 50-day moving average.

Not to rope Twilio (TWLO) into the discussion, but this high-quality growth stock also rallied to its 50-day moving average yesterday on better-than-expected earnings.

While it had the backdrop of far more market-wide volatility and big losses in the indices, Twilio faded pretty hard from this level.

That all said, Zillow is not Twilio and for now it’s not fading. I can’t help but have that price action in the back of my mind, though.

If Zillow stock were to fade, keep an eye on today’s low at $53.32. A break of this low could cause shares to fill the rest of today’s earnings gap down to $50.77 and/or give the stock a test of its 10-day and 21-day moving averages.

On the upside, the levels are also quite clear.

A move up through the 50-day moving average puts the 50% retracement of the current range in play, which also comes into play with the daily VWAP measure.

Through these two measures and the levels remain pretty clear on the upside as well: $64 to $65 — where it finds former support and resistance, as well as the 61.8% retracement — the top of the recent range at $76.36 and the gap-fill up near $85.