Target (TGT) stock lately has been hit hard.

At today’s low, the retailer's shares were down 3.2%, and if Target closes lower on the day — it’s flat at last glance — it will mark the stock’s 10th straight decline.

In that stretch the shares have fallen more than 20%. From the high, Target stock has lost more than half its value

I wouldn’t say a decline of this magnitude is unprecedented, but it’s uncommon for a stock of Target’s caliber. And it is the stock’s largest decline since the 2007-09 bear market, during which the shares fell more than 60%.

Don't Miss: Buffett's Berkshire Hathaway: Another Opportunity to Buy the Dip

Even though the company’s guidance was uninspiring last quarter, analysts are still calling for strong earnings growth in 2023 and 2024 despite sub-2% revenue growth for both years.

Currently, consensus expectations call for almost 40% earnings growth this year and nearly 25% growth in 2024. If it comes to fruition, investors are currently paying 15.5 times this year's earnings for Target.

Lastly, the firm raised its dividend by 20% last year, marking its 51st consecutive increase to the annual dividend.

So at the very least today’s buyers are getting a stock at a 50% discount to its all-time high, at a reasonable valuation. To boot, it has a 3.3% yield on a dividend that not only has been paid but has been raised every year for more than five decades.

Now, the charts may be cooperating.

Where to Buy the Dip in Target Stock

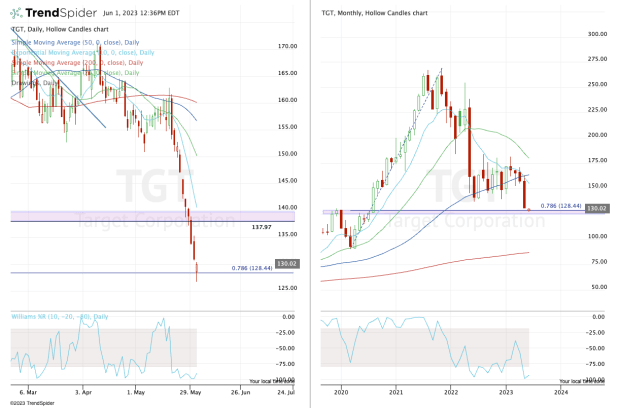

Chart courtesy of TrendSpider.com

I had flagged the $140 area as a potential support area -- and that zone failed, which opened up an area that I'd mentioned but did not think Target stock would see. Or at least I didn’t think we’d see it this quickly.

But after a violent decline, the shares are now testing into the 78.6% retracement, as measured from the all-time high down to the covid-19 lows. You can see on the daily chart (on the left) that Target made new lows on the move, but is reversing to the upside and pressing new session highs. It’s a promising start.

Don't Miss: Time to Buy Telecom? Charting Verizon, AT&T and T-Mobile

But a few hours of action — or even a full day — doesn't make a trend. On Friday, the bulls will want to see Target stock clear Thursday’s high, embarking on its push back to the $138 to $140 zone. At the very least, active bulls will want to see Target stock hold today's low.

On the monthly chart (on the right), investors may also notice that this zone was pivotal in first-half 2020, so this level of interest is more than a retracement zone.

If the stock can clear $140, the 10-month moving average currently just above $150 could be on the table.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.