FedEx Corporation (NYSE:FDX) was flying more than 15% higher on Tuesday after the company announced it will raise its quarterly dividend from 75 cents per share to $1.15 per share.

The transportation, e-commerce and supplies company headquartered in Memphis, Tennessee, also said it would unveil additional details on how it plans to increase shareholder value at its investor day scheduled for June 28 and June 29.

The news of the increased dividend comes at an ideal time as traders and investors look for less risky investments amid a bearish market cycle. Some investors may be searching for stocks with high dividends to park their money in until the outlook improves and the general markets become less volatile.

Although FedEx was trading in sympathy with the S&P 500, having lost 20% between Jan. 4 and Monday, Tuesday’s news caused FedEx to erase a good portion of the loss to trade about 12% down from its 2022 highs.

The stock has much to prove yet before entering into a bull cycle, which may provide traders and investors an entry point lower than the current share price. For more conservative investors, FedEx would look more secure if the stock was able to regain support at the 200-day simple moving average (SMA)

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

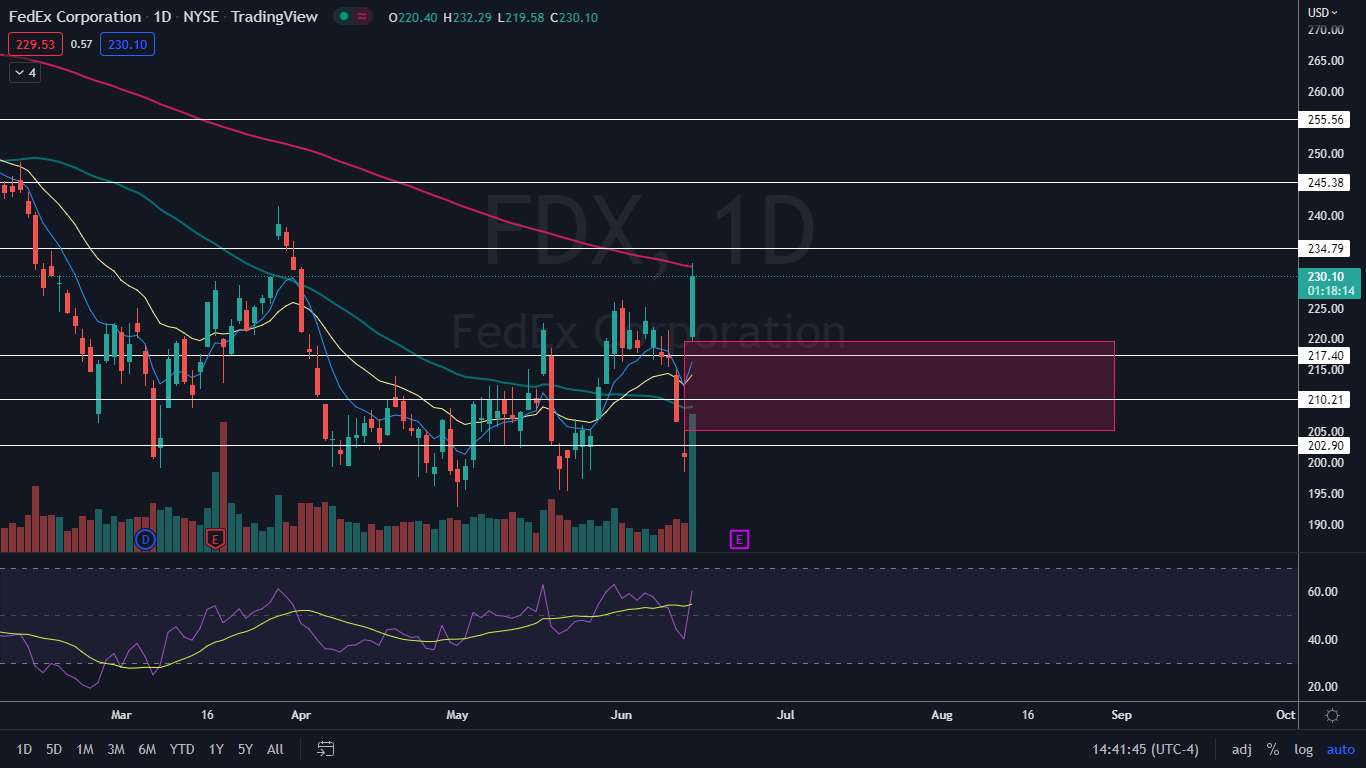

The FedEx Chart: On Tuesday, FedEx attempted to regain support at the 200-day SMA but failed and wicked from the level. The surge came on higher-than-average volume, however, which indicates a huge amount of interest has returned to the stock, which could allow FedEx to regain the important level if high volume continues on Wednesday.

- FedEx negated its downtrend by printing a higher high above the most recent lower high, which was printed on June 6 and $225.15. A new uptrend hasn’t confirmed yet because FedEx needs to print a higher low above Monday’s low-of-day at the $198.42 mark.

- Tuesday’s price action left a gap below between $205.05 and $219.58. Gaps on charts fill about 90% of the time, making it likely FedEx will fall down to fill the empty trading range in the future. If that happens and the stock forms a reversal candlestick, such as a doji or hammer candlestick, at or near the bottom of the range, it could provide a solid entry point for bullish traders who aren’t already in a position.

- If FedEx closes the trading day near its high-of-day price, the stock will print a bullish kicker candlestick, which could indicate higher prices will come again on Wednesday. If the stock closes the trading day with an upper wick, it could indicate the stock is being held down by sellers at the 200-day SMA and FedEx will trade lower on Wednesday.

- The stock has resistance above at $234.79 and $245.38 and support below at $210.21 and $202.90.

See Also: How to Read Candlestick Charts for Beginners

Photo: Dennis Diatel via Shutterstock