Dick's Sporting Goods (NYSE:DKS) will release its quarterly earnings report on Tuesday, 2024-11-26. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Dick's Sporting Goods to report an earnings per share (EPS) of $2.67.

The market awaits Dick's Sporting Goods's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

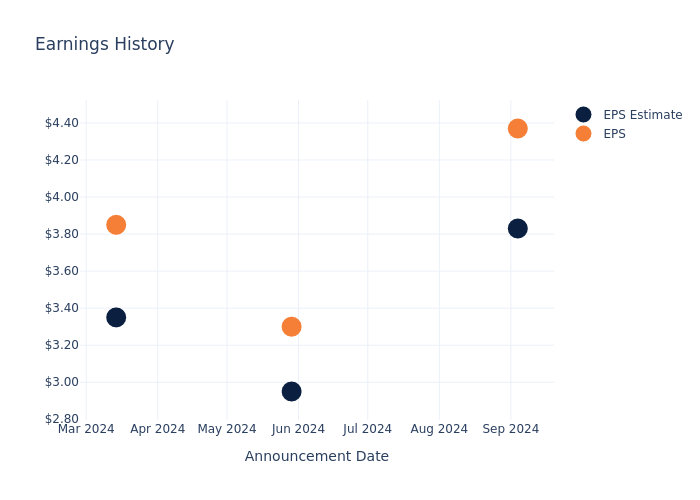

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.54, leading to a 2.69% drop in the share price on the subsequent day.

Here's a look at Dick's Sporting Goods's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 3.83 | 2.95 | 3.35 | 2.45 |

| EPS Actual | 4.37 | 3.30 | 3.85 | 2.85 |

| Price Change % | -3.0% | -1.0% | -2.0% | 0.0% |

Stock Performance

Shares of Dick's Sporting Goods were trading at $210.16 as of November 22. Over the last 52-week period, shares are up 68.61%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Dick's Sporting Goods

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Dick's Sporting Goods.

The consensus rating for Dick's Sporting Goods is Neutral, derived from 13 analyst ratings. An average one-year price target of $249.15 implies a potential 18.55% upside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of Ulta Beauty, Chewy and Tractor Supply, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Ulta Beauty, with an average 1-year price target of $408.76, indicating a potential 94.5% upside.

- As per analysts' assessments, Chewy is favoring an Outperform trajectory, with an average 1-year price target of $34.07, suggesting a potential 83.79% downside.

- The consensus among analysts is an Buy trajectory for Tractor Supply, with an average 1-year price target of $299.42, indicating a potential 42.47% upside.

Peer Analysis Summary

Within the peer analysis summary, vital metrics for Ulta Beauty, Chewy and Tractor Supply are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Dick's Sporting Goods | Neutral | 7.75% | $1.28B | 12.91% |

| Ulta Beauty | Neutral | 0.88% | $978.18M | 10.87% |

| Chewy | Outperform | 2.63% | $843.84M | 52.96% |

| Tractor Supply | Buy | 1.65% | $1.29B | 10.51% |

Key Takeaway:

Dick's Sporting Goods ranks in the middle among its peers for Consensus rating. It is at the top for Revenue Growth, indicating strong performance in this area. The company is in the middle for Gross Profit, suggesting average profitability compared to peers. Dick's Sporting Goods is at the bottom for Return on Equity, showing lower returns relative to its peers.

Discovering Dick's Sporting Goods: A Closer Look

Dick's Sporting Goods retails athletic apparel, footwear, and equipment for sports. Dick's operates digital platforms, about 725 stores under its namesake brand (including outlet stores and House of Sport), and about 130 specialty stores under the Golf Galaxy and Public Lands nameplates. Dick's carries private-label merchandise and national brands such as Nike, The North Face, Under Armour, Callaway Golf, and TaylorMade. Based in the Pittsburgh area, Dick's was founded in 1948 by the father of current executive chairman and controlling shareholder Edward Stack.

Understanding the Numbers: Dick's Sporting Goods's Finances

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Dick's Sporting Goods displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 7.75%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Dick's Sporting Goods's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 10.43%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 12.91%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Dick's Sporting Goods's ROA excels beyond industry benchmarks, reaching 3.69%. This signifies efficient management of assets and strong financial health.

Debt Management: Dick's Sporting Goods's debt-to-equity ratio stands notably higher than the industry average, reaching 1.5. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Dick's Sporting Goods visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.