· Devon Energy is now an oil company centrally based in the US. Combined production output was 584,000 boe/d in 4Q 2020.

· Devon seemed to choose wisely new oil and gas plays to buy into and develop: two prime examples are the Barnett shale where they started the shale revolution, and the Delaware basin where they locked in 4 or 5 stacked layers called the Bone Spring and Wolfcamp that constitute the premier oil and gas basin in the US. Two monster wells were announced in 2018 making 11,000-12,000 boe/d in an early 24-hour period.

· Despite this, the company and its stock were pummeled by three hard blows: the great recession of 2008, the oil price crash of 2015, and the Covid pandemic of 2020 which, along with lack of cash returns, led to a stock price decline lasting 12 years.

· Devon was the biggest gas producer in the Barnett before they sold. Devon is now the third biggest oil producer in the Delaware basin, after EOG Resources and Concho.

· The market increased Devon’s stock price in 2021, as expected, but there is still uncertainty in the future. The chief question is climate change and the potential effect of government policy, bank and investor and insurance response to the threat, and stockholder voting.

· As an example, if President Biden’s climate policies take hold, the US demand for oil and gas could fall by 24-32% by 2035-2040.

Starting with a unique business model.

Devon was founded by John Nichols and his son, Larry, 50 years ago. John was the financier while Larry took on the geology and engineering.

John and Larry found European investors in 1971 who wanted to invest in the USA. A unique approach at the time, they designed a tax-efficient method to flow funds back and forth between Europe and the United States.

Devon’s first significant enterprise was in the San Juan basin where they bought into NEBU, the Northeast Blanco Unit, and started operating coalbed methane wells. This was a new challenge for a company of less than 20 people. But they succeeded, along with Burlington and Amoco, the major company who was getting into coalbed methane in a very big way, to make the Fruitland coal the biggest coal play ever.

A big enterprise was Barnett shale. Devon didn’t discover slick-water fracking, but they applied it many times to a horizontal well that was almost a mile in length. That started the shale revolution. By 2013, over 17,000 wells had been drilled in the Barnett and production was over 5 billion cubic feet/day (7% of all natural gas produced in the US).

In 2013, Devon Energy was the top of 235 operators in the Barnett ranked by gas volume produced. In October 2020, they sold to BKV Corporation for $570 million.

Devon’s business model was to grow by buying companies that were established in a certain area, then to innovate and improve the technology or the financing. Six acquisitions and two mergers ensued in early years up to 2003.

Innovation is their heritage. “There is nothing that we do that you cannot figure out a better way to do it.” Another motto from Devon’s website is “Achievement is our future.”

A tale of two market trends.

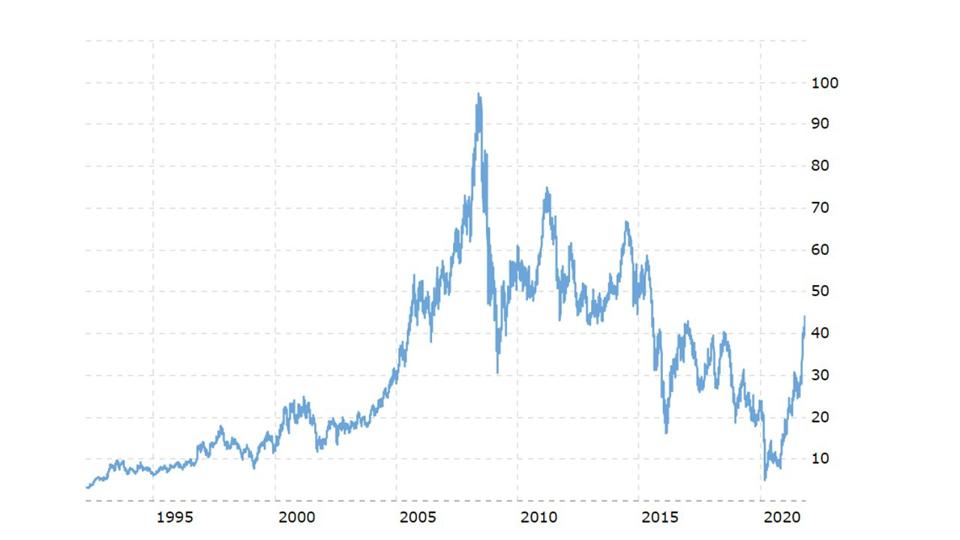

The stock market has been both kind and harsh to Devon Energy (Figure 1). The period from 1993 – 2008 saw stock prices rise from $3 to $97 – an increase by 32 times. Lots of acquisitions and mergers occurred through 2003, via Devon’s business model, when the company grew to 4,000 employees.

In 1989, Devon bought into coalbed methane properties in the San Juan basin. In 2002 they bought Mitchell Energy properties in the Barnett shale where Devon initiated the shale revolution.

Devon stock reached a peak in 2008, but the gas price plunged from $13 to below $5/Mcf when the great recession hit shortly after.

Although stock prices recovered a little by 2010, the trend continued downward until 2014 -2015 when the price of crude oil crashed from above $100 to about $40/barrel.

The worst was still to come. In 2020 the Covid pandemic crushed the world, and the price of oil actually fell to zero for a short while. Devon’s stock fell to $9 — its lowest level since 1995.

Compounding this was the poor return on investment by oil and gas companies in general, due to an emphasis on rapid growth instigated by the shale revolution. After 2015, this led to divestitures, rescinding of dividends, stock buy-backs, improving drilling and fracking efficiencies, and job layoffs.

Jobs directly related to the oil and gas extraction industry of the US were at a peak of 200,000 in 2015 but fell to 160,000 in 2020 and have never recovered.

Focusing on free cash flow.

Devon engaged in many mergers and acquisitions before 2003. After 2008 the hard times led to more divestitures than mergers. But Devon Energy merged with WPX about one year ago.

Devon had become a US-based oil company so, along with an oil price advance to $80/barrel and the efficiencies that resulted from the merger, there has been an uptick in stock price in 2021 from $9 to $45 (Figure 1).

Clay Gaspar, COO for the new Devon Energy, said the merger with WPX now has wellheads over the entire Delaware basin in New Mexico and Texas. This is the heart of the company and the future, Gaspar said. “About 70% of our production, about 80% of our capital, about 70% of our upside potential or remaining inventory is in the Permian, specifically in the Delaware Basin.”

Combined, Devon and WPX in 4Q 2020 produced 584,000 boe/d. In the Delaware, production averaged 350,000 boe/d. Anadarko production averaged 81,000 boe/d. The Eagle Ford averaged 37,000 boe/d. Powder River output averaged 22,000 boe/d. The Williston averaged 87,000 boe/d.

Devon’s earnings in the last quarter beat Wall Street predictions, while their free cash flow increased by eight times the fourth quarter of 2020. They are building a business that is low growth and therefore able to create free cash flow, which was one goal of the merger, according to Gaspar.