In the preceding three months, 13 analysts have released ratings for Marathon Petroleum (NYSE:MPC), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 7 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 3 | 4 | 0 | 0 |

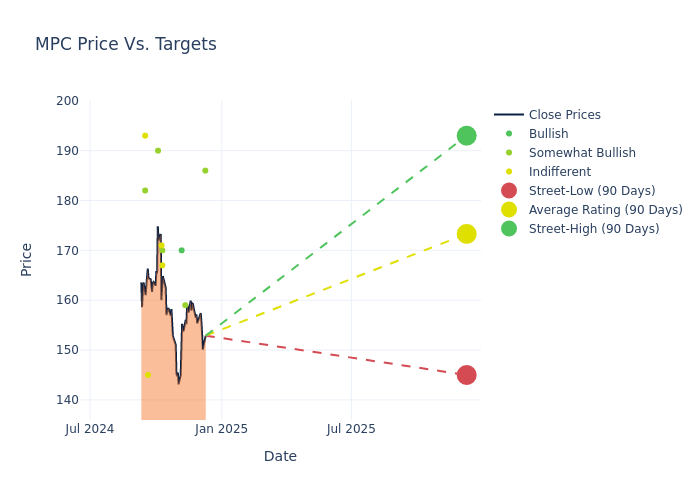

The 12-month price targets, analyzed by analysts, offer insights with an average target of $173.54, a high estimate of $193.00, and a low estimate of $145.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 5.37%.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Marathon Petroleum among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Roger Read | Wells Fargo | Raises | Overweight | $186.00 | $183.00 |

| Theresa Chen | Barclays | Lowers | Overweight | $159.00 | $168.00 |

| Jason Gabelman | TD Cowen | Lowers | Buy | $170.00 | $174.00 |

| Vikram Bagri | Citigroup | Lowers | Neutral | $167.00 | $172.00 |

| Paul Cheng | Scotiabank | Lowers | Sector Outperform | $170.00 | $191.00 |

| Theresa Chen | Barclays | Lowers | Overweight | $168.00 | $180.00 |

| John Royall | JP Morgan | Lowers | Neutral | $171.00 | $172.00 |

| Roger Read | Wells Fargo | Lowers | Overweight | $183.00 | $196.00 |

| Phillip Jungwirth | BMO Capital | Lowers | Outperform | $190.00 | $200.00 |

| John Royall | JP Morgan | Lowers | Neutral | $172.00 | $186.00 |

| Ryan Todd | Piper Sandler | Lowers | Neutral | $145.00 | $168.00 |

| Connor Lynagh | Morgan Stanley | Lowers | Overweight | $182.00 | $196.00 |

| Nitin Kumar | Mizuho | Lowers | Neutral | $193.00 | $198.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Marathon Petroleum. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Marathon Petroleum compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Marathon Petroleum's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Marathon Petroleum's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Marathon Petroleum analyst ratings.

Unveiling the Story Behind Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility has the ability to produce 730 million gallons a year of renewable diesel. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Marathon Petroleum's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Negative Revenue Trend: Examining Marathon Petroleum's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -14.2% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Marathon Petroleum's net margin is impressive, surpassing industry averages. With a net margin of 1.77%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Marathon Petroleum's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.09%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.75%, the company showcases effective utilization of assets.

Debt Management: Marathon Petroleum's debt-to-equity ratio surpasses industry norms, standing at 1.55. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.