Providing a diverse range of perspectives from bullish to bearish, 20 analysts have published ratings on Lululemon Athletica (NASDAQ:LULU) in the last three months.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 10 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 3 | 8 | 5 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

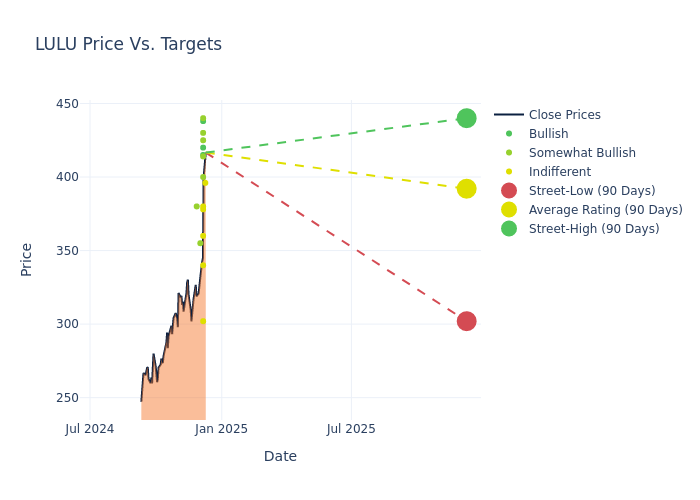

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $383.6, a high estimate of $440.00, and a low estimate of $302.00. This current average has increased by 16.93% from the previous average price target of $328.05.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Lululemon Athletica among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Krisztina Katai | Deutsche Bank | Raises | Hold | $396.00 | $292.00 |

| Paul Lejuez | Citigroup | Raises | Neutral | $380.00 | $270.00 |

| Adrienne Yih | Barclays | Raises | Equal-Weight | $378.00 | $261.00 |

| Alexandra Steiger | Morgan Stanley | Raises | Overweight | $414.00 | $345.00 |

| Simeon Siegel | BMO Capital | Raises | Market Perform | $302.00 | $265.00 |

| Robert Drbul | Guggenheim | Raises | Buy | $415.00 | $350.00 |

| Jay Sole | UBS | Raises | Neutral | $360.00 | $315.00 |

| Matthew Boss | JP Morgan | Raises | Overweight | $425.00 | $338.00 |

| Jim Duffy | Stifel | Raises | Buy | $438.00 | $370.00 |

| Anna Andreeva | Piper Sandler | Raises | Neutral | $340.00 | $260.00 |

| Joseph Civello | Truist Securities | Raises | Buy | $420.00 | $360.00 |

| Mark Altschwager | Baird | Raises | Outperform | $440.00 | $380.00 |

| Ashley Owens | Keybanc | Raises | Overweight | $400.00 | $350.00 |

| Dana Telsey | Telsey Advisory Group | Raises | Outperform | $430.00 | $360.00 |

| Michael Binetti | Evercore ISI Group | Raises | Outperform | $355.00 | $300.00 |

| Brian Nagel | Oppenheimer | Lowers | Outperform | $380.00 | $445.00 |

| Alexandra Steiger | Morgan Stanley | Raises | Overweight | $345.00 | $314.00 |

| Mark Altschwager | Baird | Raises | Outperform | $380.00 | $350.00 |

| Joseph Civello | Truist Securities | Raises | Buy | $360.00 | $310.00 |

| Alexandra Steiger | Morgan Stanley | Lowers | Overweight | $314.00 | $326.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Lululemon Athletica. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lululemon Athletica compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Lululemon Athletica's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Lululemon Athletica's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Lululemon Athletica analyst ratings.

Delving into Lululemon Athletica's Background

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Financial Insights: Lululemon Athletica

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, Lululemon Athletica showcased positive performance, achieving a revenue growth rate of 8.73% as of 31 October, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Lululemon Athletica's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.68% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 8.78%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Lululemon Athletica's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 5.09%, the company showcases efficient use of assets and strong financial health.

Debt Management: Lululemon Athletica's debt-to-equity ratio is below the industry average at 0.38, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.