A Hunter man is looking for answers after he noticed that a single demerit point pushed his insurance premium up by almost $200.

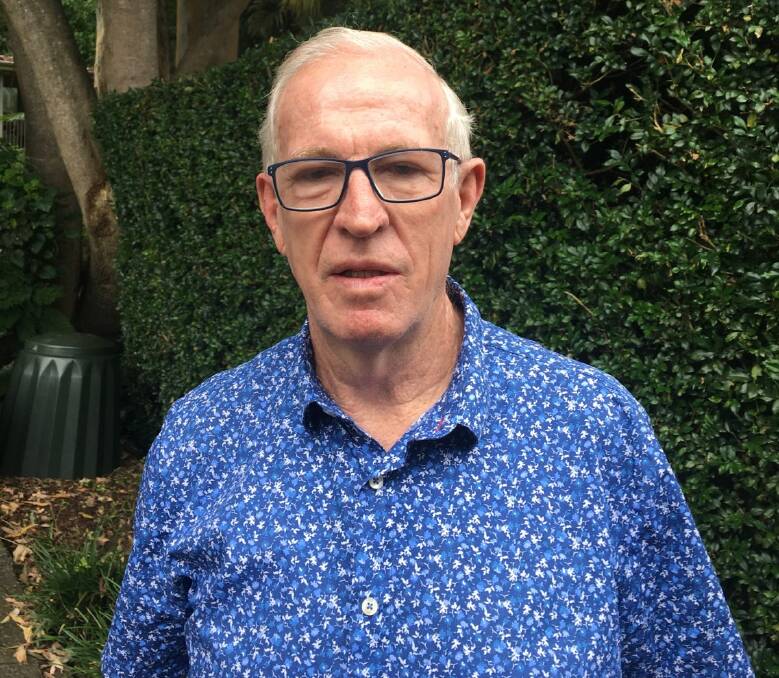

Jim Edwards, a 73-year-old from Garden Suburb, says he recently received the first demerit point of his decades-long driving career for travelling 5km/h faster than the speed limit.

Mr Edwards said he was shocked to find that, when it was time to pay for his next compulsory third party (CTP) insurance policy - a necessity in NSW - his insurer had increased the cost of his premium from $278.35 to $457.94.

He said a check of a handful of other companies showed similar increases in the cost of his premium.

"The demerit scheme is a gentle reminder to motorists that if they keep losing points they could lose their driver's licence. It is not a criminal record," he said.

"There are no courts involved and no reasonable chance of defence against these point losses.

"For me, this price rise adds $718.36 over four years to a $123 speeding fine."

Mr Edwards has been liaising with the State Insurance Regulatory Authority (SIRA), the government body that oversees CTP insurance in NSW.

He argues that increasing insurance premiums on top of fines acts as a secondary - and often harsher - punishment outside the penalties the law sets out.

"The government, through SIRA, is allowing open slather on prices by insurers with no benefit to anyone but the insurer," he said.

"Tying the CTP green slip to demerit points is a rort. This has netted the insurers millions of our dollars."

In response to questions from the Newcastle Herald, the regulator said CTP insurance policies were "sold in a competitive market".

"Insurers set their own green slip prices based on a variety of risk rating factors that will either increase or reduce the cost of a driver's premium," a spokesperson said in a statement to the Herald.

"Insurers may consider factors such as the vehicle age, where it is garaged, the driver's safety record ... and any demerit points the driver has."

The SIRA spokesperson did not answer questions about whether insurers should be able to capitalise on vehicles involved in traffic infringements. But the regulator encouraged people to shop around before buying CTP insurance.