Considered by many to be the top airline, Delta Air Lines (DAL) just can’t catch a break.

Investors were looking for a potentially significant rotation to take place over last week’s high. Instead what they’re getting is a 5.5% selloff on Wednesday.

Shares were higher by more than 3% in pre-market trading on news of increasing revenue, capacity and free cash flow.

As reported earlier by TheStreet, Delta's “June quarter revenues should return to pre-pandemic levels with free cash flow in the region of $1.5 billion, even as it cautioned on higher fuel costs.”

While the stock initially spiked higher on the report, perhaps concerns of rising fuel cost are weighing on it during the regular-hours session. Of course, it doesn’t help that the broader market is under pressure as well.

Fresh off a multi-week high, let’s look at the charts for Delta stock.

Trading Delta Stock

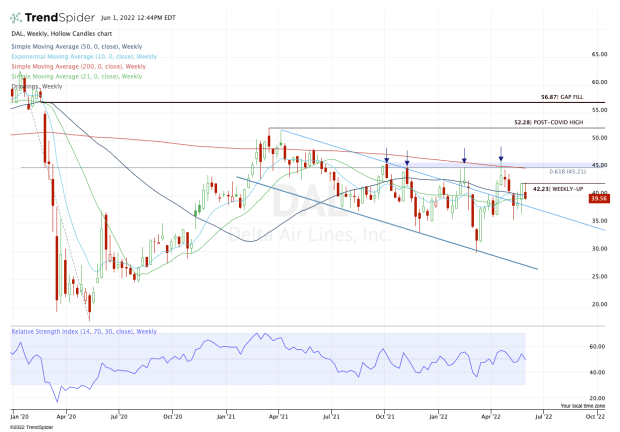

Chart courtesy of TrendSpider.com

If this chart said one thing to me, it would be this: “cautiously optimistic.”

That statement was true before Wednesday’s 5.5% tumble and it’s even more true now. Well, at least the "cautiously" part.

Looking at the weekly chart above, investors can see that Delta stock tried to go weekly-up by clearing last week’s high at $42.23. However, buyers couldn’t keep up the momentum and shares reversed lower.

That said, not all hope is lost.

Delta stock is an important area, as it tries to hold the 10-week, 21-week and 50-week moving averages. The 10-day, 21-day, 50-day and 200-day moving averages are also in this zone around $40.

Put another way, it’s congested. On the plus side, Delta stock has done a great job breaking out of its downtrend channel, then finding prior downtrend resistance to be a rough area of support.

If it breaks below $39 -- and thus all the moving averages listed above -- the hope is that it will find this area to be support again.

On the upside, the $42.25 area remains of interest. If Delta can clear this level later this week (or on a two-times weekly-up rotation next week), we could see a quick push to $45.

There it finds the 200-week moving average and the 61.8% retracement of the Covid-19 decline. It’s also been a major resistance zone since October.

Above that opens the door to $50, then the post-Covid high at $52.28. Lastly, the gap-fill is up at $56.87.