Dell (DELL) stock has been volatile lately.

The shares are up 3.3% on Tuesday, almost reversing their 3.8% stumble on Monday. They gained nearly 4% Friday. On Thursday they were up 6% at one point and finished just 1.45% higher. And it fell 5.3% last Wednesday.

Clearly, investors haven't been able to make up their minds following the computer giant's earnings report on Thursday, June 1.

The company delivered a top- and bottom-line beat of analyst expectations, but sales fell 20% year over year and management's guidance for next quarter missed analysts’ expectations ($20.7 billion vs. $21.1 billion).

Investors are likely grappling with some of Dell’s more positive attributes vs. the current struggle in its business.

Don't Miss: Coinbase Stock: Buy the Dip or Avoid After SEC Lawsuit?

For instance, the shares currently trade at just 8.5 times this year’s consensus earnings forecast of $5.53 a share. While that’s down more than 25% from 2022, sub-10 times earnings is fairly cheap by most investors’ standards.

It helps that expectations call for a revenue and earnings rebound in 2024 (although estimates are always susceptible to revisions).

Further, the stock pays out a 3.1% dividend yield, which may also entice investors.

Of course, it doesn’t help that FAANG has been in high demand, while others like Microsoft (MSFT) and Nvidia (NVDA) continue to perform quite well, too. In other words, there's a clear divide between the market leaders and the market laggards.

Trading Dell Stock

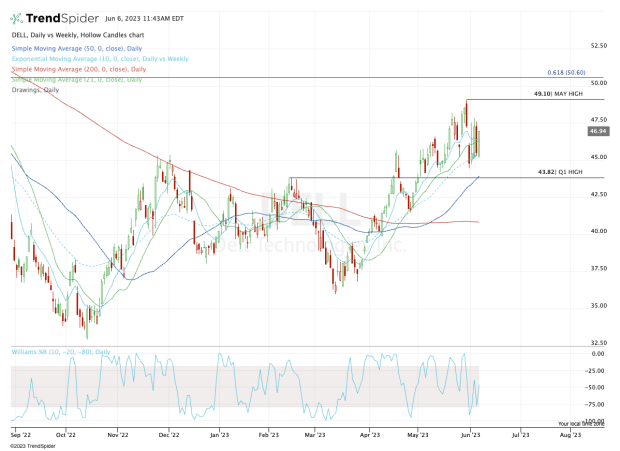

Chart courtesy of TrendSpider.com

As investors try to figure out if this stock is a buy or a sell, Dell shares are bouncing between $45 and $47.50 and gyrating around the 10-day and 21-day moving averages.

Until a clearer short-term trend emerges, the 10-day and 21-day moving averages are not helpful to traders. But if we zoom out, we’ll notice that the larger trend since mid-March has been bullish.

That allows us to use the 10-week and 50-day moving averages to better gauge the stock.

While Dell stock is holding the 10-week for now, I’d be interested in seeing how it handles the 50-day moving average on a deeper correction.

That’s as this measure currently aligns with the first-quarter high at $43.82.

Don't Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

If the shares instead continue higher from here, see how Dell stock handles $47.50. Above this measure puts the May high in play near $49 and above that, the 61.8% retracement of the 2022 range comes into play near $50.50.

Bottom line: Over $47.50 could put $49, then $50.50 in play. A pullback below $45 opens the door to an area of potentially stronger support just below $44.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.