With the collapse of the former second-largest DeFi ecosystem – Terra and the crash of the associated LUNA token having accentuated the bear season that still affects the crypto landscape, DeFi has lost 45% of its value since the end of April, according to a report.

DappRadar’s Blockchain Industry Report for May 2022 states that since the (CRYPTO:Terra) halt, (CRYPTO: BTC) and (CRYPTO: ETH) have lost 25% and 40% of their value.

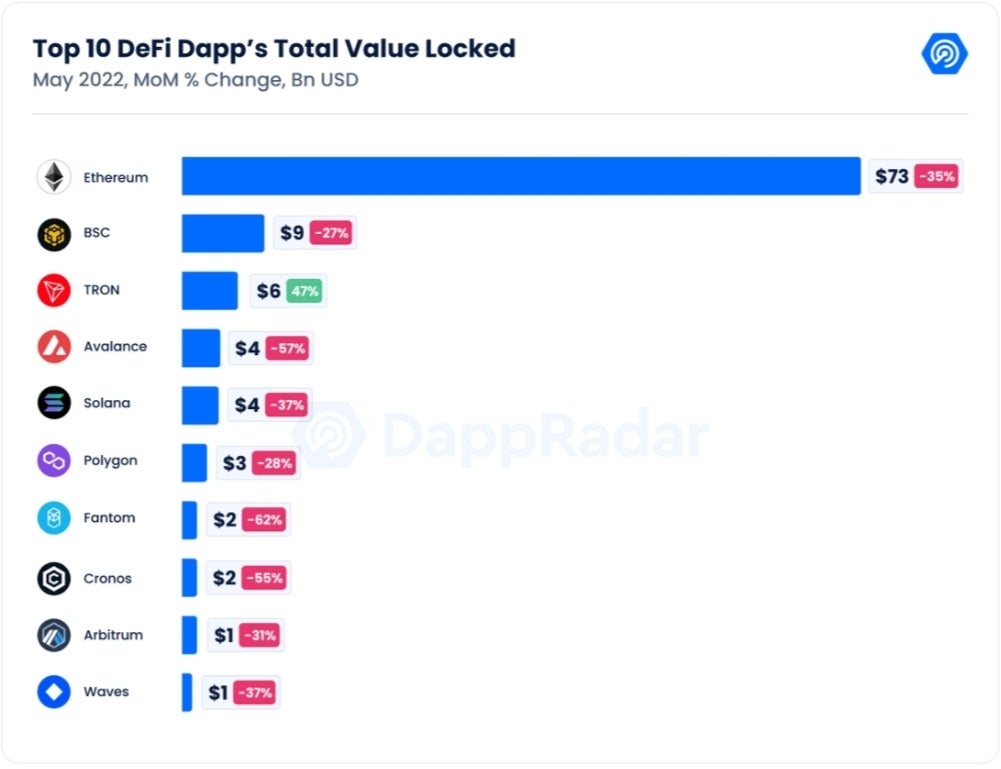

The industry’s TVL lost 45% since the end of April and is currently estimated at $117 billion. Yet, the DeFi space has gained 11% in value locked since May 2021.

Meanwhile, Justin Sun's Tron (CRYPTO: TRX) was the only blockchain DappRadar tracks to experience growth in May, having increased its TVL by 47%.

NFT market volume down 45%

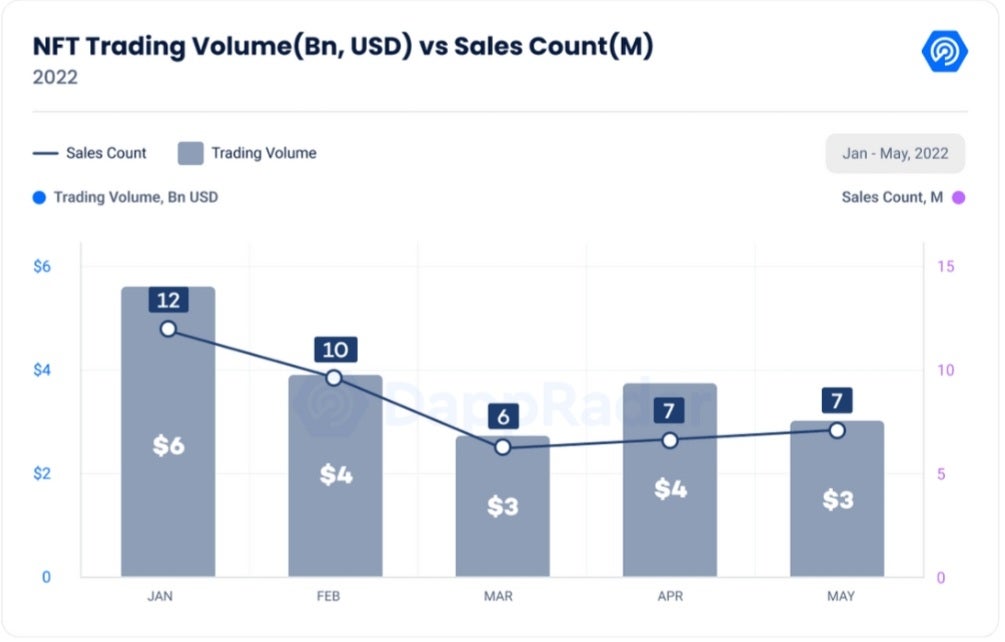

The NFT market generated $3.7bn in May, 20% down from the USD volumes registered in April. However, the volumes measured in tokens show a 6.5% decrease.

Overall, NFT market volume fell 45% to $10bn, down from $18bn in April, primarily because blue-chip collections had a tumultuous month.

For instance, the Bored Ape Yacht Club (CRYPTO:BAYC) saw its floor price plunge 38% during May, from 150 Ethereum to 93.

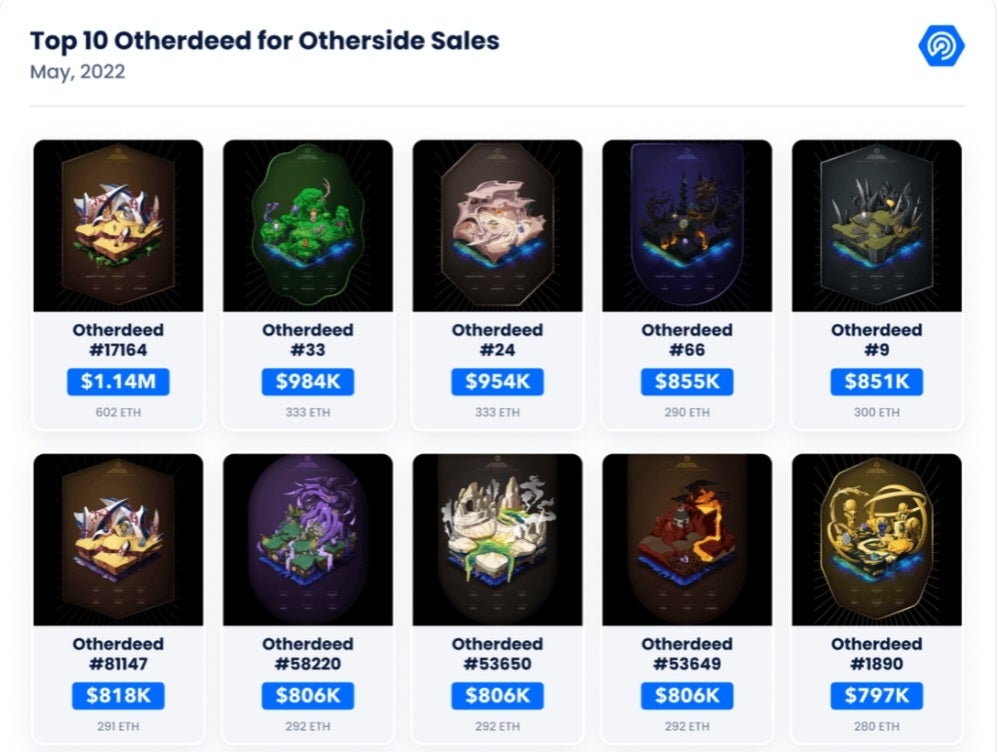

But the loss has been a boon for newer collections like Otherdeeds, land parcels for the BAYC metaverse game, and Goblintown, which has done $31 million in trading volume since its launch.

Blockchain games sidestepping crash?

According to the report, investments have kept piling up in Blockchain games, with the gaming category resisting the crypto crash with only a 5% decrease in activity and 197% growth year-over-year.

In May, Dapper Labs announced a $725m fund to accelerate growth in the Flow ecosystem along with a16z’s massive $4.5bn commitment for its Crypto Fund 4, which will focus on developing blockchain projects.

Overall, blockchain gaming kept adding more adepts with dApps like STEPN or Genopets embedding a gamification element to physical activities in the move-to-earn trend. Also, Otherside, the play-to-earn BAYC metaverse project generated $760m in May, spurring virtual world NFTs to their best month with $850m.

“The macroeconomic situation and the Terra event have accentuated the effects of the bear season, dragging crypto prices down along with a slight decrease in enthusiasm for the industry. Still, it is a positive signal that user adoption and the number of web3 developers are rising,” DappRadar states.

“Likewise, it is encouraging to see that the dApp industry has matured into a multi-chain ecosystem able to resist an adverse event of the magnitude of Terra,” it adds.