The Department of Defence will launch an Australia-first pilot to direct venture capital and other investors towards small defence businesses, however insiders have warned the government will need to be prepared for some investments to fail for the scheme to be a success.

Venture capital has been the seed of tech sector darlings from Atlassian to Canva, however investors have traditionally been wary of investing in defence firms, due to a perceived higher level of risk.

In its Defence Industry Development Strategy, released in February, the government outlined its intention to draw on private capital to fund Australian defence industry, to complement government investment.

"The Commonwealth will explore with venture capital fund managers and other investors a pilot project to assess appetite, fund size and opportunities for investors to invest equity (or debt) in eligible Australian businesses who have developed defence capability, which is identified as a priority," the strategy identified.

This has resulted in an expression of interest, published this week, that seeks to assess the appetite of private investors to contribute to Australia's multibillion dollar defence pipeline via a $100 million to $200 million pilot fund.

A Defence spokesperson said the program would look at what the market was for investment in small defence companies.

"The intent of the Pilot Fund project is to assess appetite for small business to more readily and economically access equity or debt products to further develop Defence and dual use capabilities," they said.

"This would improve Defence's ability to leverage those capabilities into Australian and New Zealand Defence capability programs."

The EOI documents explicitly target investment in small or micro-businesses with less than 50 employees, an area that has been particularly starved of private investment, managing partner at Periscope Capital Mark Stevens said.

"The real need is in this micro, small-space, which is what this fund is focused on," Mr Stevens said.

While the EOI itself is not expected to open the floodgates of private capital, it will be used to identify whether there is enough interest from investors to further develop the proposal.

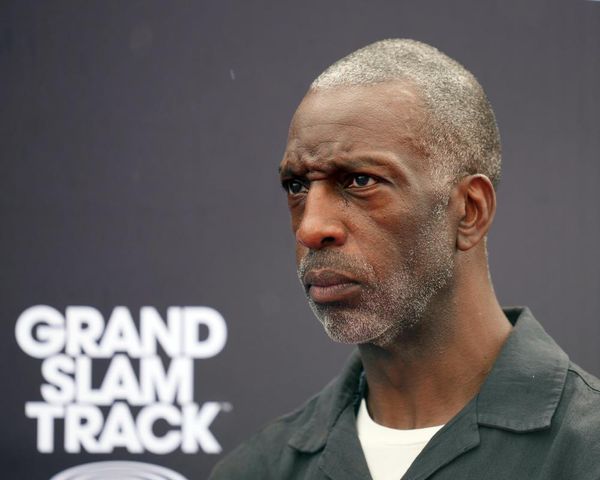

Mr Stevens, who has 25 years of experience in the defence industry, following a 15 year career in the Australian Army, said the success of the scheme would hinge upon its design and the involvement of the Defence department.

"I think there's a problem if the Department is too involved in that, because they don't have the capital markets experience and the experience in investing in and managing an investment in small companies, which is quite a specialised field."

While companies that have emerged from venture capital funding rounds such as Afterpay have become household names, these are the exception, rather than the rule, with as much as 75 per cent of venture-backed companies never producing a return, according to Harvard Business School lecturer Shikar Ghosh.

These failures however are outweighed by the multi-billion dollar pay days of the most successful companies.

Mr Stevens said this appetite for risk in the venture capital industry would be new for Defence.

"My fear is that we'll go down this path and capital will be deployed and then some of the companies won't thrive and then people will be saying, well this is a failed initiative, which it absolutely wouldn't be, it's just the nature of early stage investment and everyone needs to be aware of that."

Funds would be directed to firms that could contribute to areas of sovereign defence industrial priorities, including: sustainment of aircraft, naval shipbuilding, domestic manufacture of guided weapons, autonomous systems and battlespace awareness and management systems.

The move to tap private capital comes after concerns Defence's existing innovation system was not delivering on its targets.

The former Coalition government commissioned a $2.2 million inquiry that covered $1.5 billion in grants programs, however the report was heavily redacted and a full version was not provided to incoming Defence Industry Minister Pat Conroy.

After coming to government, the Albanese government scrapped the $800 million Defence Innovation Hub, replacing it with the Advanced Strategic Capabilities Accelerator.

While the venture capital fund is a separate effort, Mr Stevens said the initiative was a "brave" step for and one that could return enormous dividends, both financially and strategically.

"Programs like this would be a very good way to get good capital into the hands of good companies that are doing work that will deliver products that will be good for the ADF."