Investors with a lot of money to spend have taken a bearish stance on Deere (NYSE:DE).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Deere.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 55%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $170,258, and 4 are calls, for a total amount of $150,386.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $360.0 to $465.0 for Deere over the last 3 months.

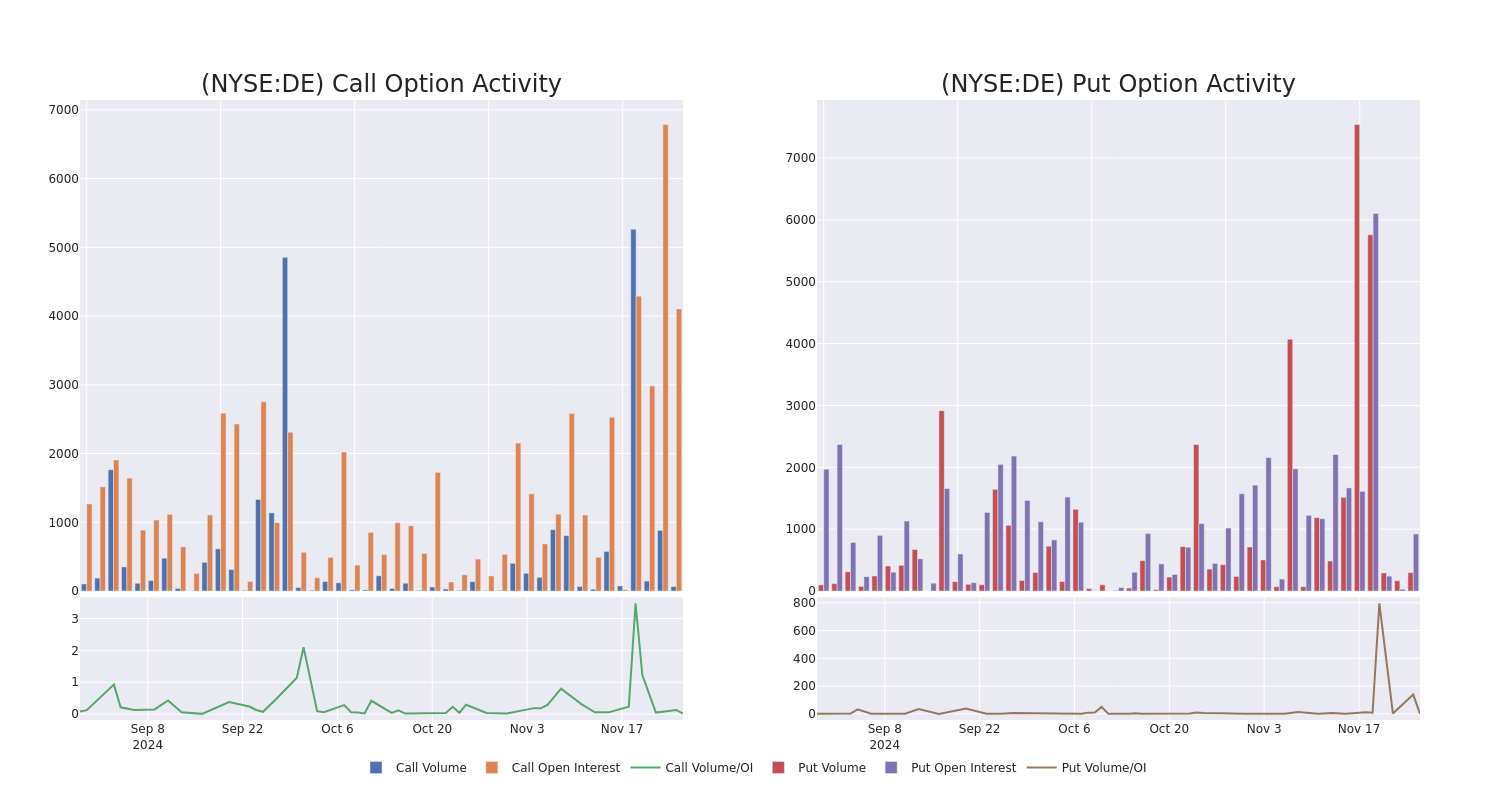

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Deere's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Deere's significant trades, within a strike price range of $360.0 to $465.0, over the past month.

Deere 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | SWEEP | BEARISH | 01/17/25 | $20.7 | $19.75 | $19.95 | $450.00 | $49.9K | 1.6K | 54 |

| DE | PUT | TRADE | BULLISH | 06/20/25 | $23.85 | $23.25 | $23.25 | $440.00 | $44.1K | 91 | 19 |

| DE | PUT | TRADE | BEARISH | 12/20/24 | $6.0 | $5.65 | $5.9 | $450.00 | $41.3K | 221 | 75 |

| DE | CALL | TRADE | NEUTRAL | 01/16/26 | $125.75 | $122.2 | $123.97 | $360.00 | $37.1K | 30 | 3 |

| DE | CALL | TRADE | NEUTRAL | 12/20/24 | $45.0 | $35.0 | $40.05 | $420.00 | $32.0K | 1.5K | 0 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

After a thorough review of the options trading surrounding Deere, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Deere

- Trading volume stands at 571,053, with DE's price down by -1.95%, positioned at $453.65.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 79 days.

What The Experts Say On Deere

5 market experts have recently issued ratings for this stock, with a consensus target price of $475.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Deere with a target price of $462. * Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Deere, targeting a price of $450. * Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Deere, targeting a price of $477. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Deere with a target price of $450. * Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Deere, targeting a price of $538.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Deere with Benzinga Pro for real-time alerts.