Summit Materials (NYSE:SUM) underwent analysis by 11 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 2 | 2 | 1 | 0 | 0 |

| 2M Ago | 2 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

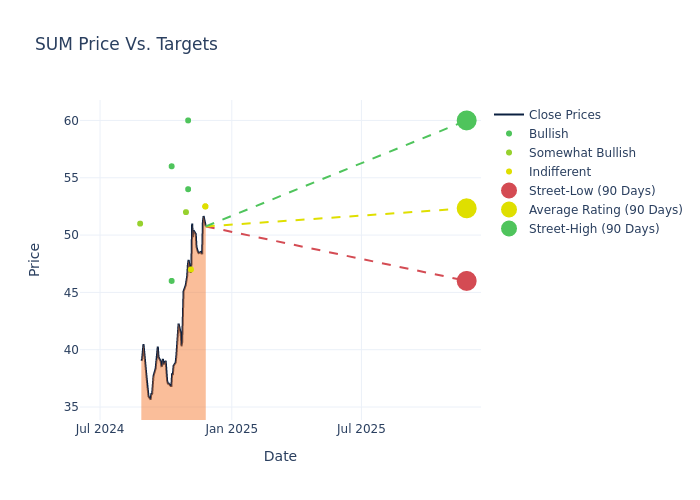

Insights from analysts' 12-month price targets are revealed, presenting an average target of $50.73, a high estimate of $60.00, and a low estimate of $41.00. Witnessing a positive shift, the current average has risen by 6.29% from the previous average price target of $47.73.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Summit Materials by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adrian Heurta | JP Morgan | Raises | Neutral | $52.50 | $43.00 |

| Mike Dahl | RBC Capital | Lowers | Sector Perform | $52.50 | $54.00 |

| Brent Thielman | DA Davidson | Raises | Neutral | $47.00 | $41.00 |

| Garik Shmois | Loop Capital | Raises | Buy | $54.00 | $49.00 |

| Mike Dahl | RBC Capital | Raises | Outperform | $54.00 | $53.00 |

| Keith Hughes | Truist Securities | Raises | Buy | $60.00 | $47.00 |

| Adam Seiden | Barclays | Raises | Overweight | $52.00 | $45.00 |

| Brent Thielman | DA Davidson | Maintains | Neutral | $41.00 | $41.00 |

| Philip Ng | Jefferies | Lowers | Buy | $56.00 | $58.00 |

| Anthony Pettinari | Citigroup | Lowers | Buy | $46.00 | $47.00 |

| Adrian Heurta | JP Morgan | Lowers | Overweight | $43.00 | $47.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Summit Materials. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Summit Materials compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Summit Materials's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Summit Materials's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Summit Materials analyst ratings.

Discovering Summit Materials: A Closer Look

Summit Materials Inc is engaged in the production and sale of aggregates, cement, ready-mix concrete, asphalt paving mix and concrete products and owns and operates quarries, sand and gravel pits, two cement plants, cement distribution terminals, ready-mix concrete plants, asphalt plants and landfill sites. It is also engaged in paving and related services. The Company's three operating and reporting segments are the West, East and Cement segments. It operates in 21 U.S. states and in British Columbia, Canada and has assets in 21 U.S. states and in British Columbia, Canada through its platform.

Key Indicators: Summit Materials's Financial Health

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Summit Materials's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 47.35% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 8.98%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Summit Materials's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.4%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Summit Materials's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.26%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Summit Materials's debt-to-equity ratio stands notably higher than the industry average, reaching 0.65. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.