During the last three months, 34 analysts shared their evaluations of Nike (NYSE:NKE), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 8 | 18 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 3 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 5 | 8 | 15 | 0 | 0 |

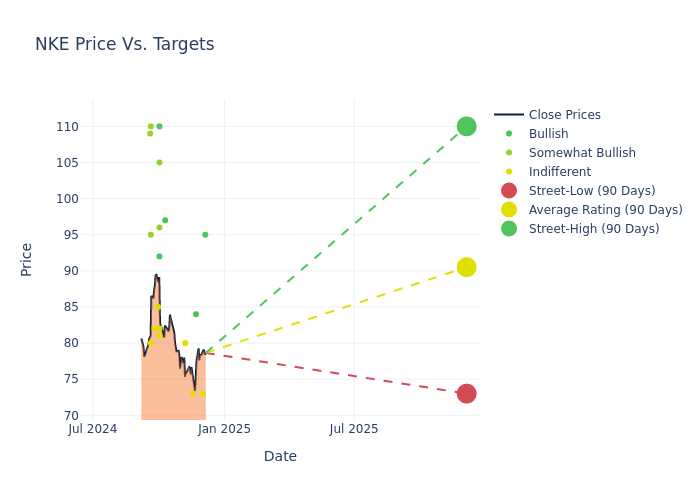

The 12-month price targets, analyzed by analysts, offer insights with an average target of $89.79, a high estimate of $110.00, and a low estimate of $73.00. This upward trend is evident, with the current average reflecting a 0.51% increase from the previous average price target of $89.33.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Nike. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Lorraine Hutchinson | B of A Securities | Lowers | Buy | $95.00 | $100.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $73.00 | $77.00 |

| Tom Nikic | Needham | Announces | Buy | $84.00 | - |

| John Kernan | TD Cowen | Lowers | Hold | $73.00 | $78.00 |

| Piral Dadhania | RBC Capital | Lowers | Sector Perform | $80.00 | $82.00 |

| Joseph Civello | Truist Securities | Raises | Buy | $97.00 | $83.00 |

| Adrienne Yih | Barclays | Lowers | Equal-Weight | $81.00 | $84.00 |

| John Kernan | TD Cowen | Raises | Hold | $78.00 | $71.00 |

| Robert Drbul | Guggenheim | Lowers | Buy | $110.00 | $115.00 |

| Krisztina Katai | Deutsche Bank | Lowers | Buy | $92.00 | $95.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $77.00 | $80.00 |

| Cristina Fernandez | Telsey Advisory Group | Lowers | Outperform | $96.00 | $100.00 |

| Piral Dadhania | RBC Capital | Lowers | Sector Perform | $82.00 | $85.00 |

| Michael Binetti | Evercore ISI Group | Lowers | Outperform | $105.00 | $110.00 |

| Jay Sole | UBS | Raises | Neutral | $82.00 | $78.00 |

| Joseph Civello | Truist Securities | Lowers | Hold | $83.00 | $85.00 |

| Lorraine Hutchinson | B of A Securities | Lowers | Buy | $100.00 | $104.00 |

| Randal Konik | Jefferies | Raises | Hold | $85.00 | $80.00 |

| Joseph Civello | Truist Securities | Maintains | Hold | $85.00 | $85.00 |

| Alex Straton | Morgan Stanley | Raises | Equal-Weight | $82.00 | $79.00 |

| Piral Dadhania | RBC Capital | Raises | Sector Perform | $85.00 | $75.00 |

| Lorraine Hutchinson | B of A Securities | Maintains | Buy | $104.00 | $104.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $80.00 | $83.00 |

| Cristina Fernandez | Telsey Advisory Group | Maintains | Outperform | $100.00 | $100.00 |

| Anna Andreeva | Piper Sandler | Maintains | Neutral | $80.00 | $80.00 |

| Cristina Fernandez | Telsey Advisory Group | Maintains | Outperform | $100.00 | $100.00 |

| Joseph Civello | Truist Securities | Raises | Hold | $85.00 | $81.00 |

| Ike Boruchow | Wells Fargo | Raises | Overweight | $95.00 | $86.00 |

| Alex Straton | Morgan Stanley | Maintains | Equal-Weight | $79.00 | $79.00 |

| Michael Binetti | Evercore ISI Group | Raises | Outperform | $110.00 | $105.00 |

| Krisztina Katai | Deutsche Bank | Maintains | Buy | $92.00 | $92.00 |

| Jonathan Komp | Baird | Raises | Outperform | $110.00 | $100.00 |

| Aneesha Sherman | Bernstein | Lowers | Outperform | $109.00 | $112.00 |

| Adrienne Yih | Barclays | Raises | Equal-Weight | $84.00 | $80.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Nike. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Nike compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Nike's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Nike's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Nike analyst ratings.

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Breaking Down Nike's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Decline in Revenue: Over the 3 months period, Nike faced challenges, resulting in a decline of approximately -10.43% in revenue growth as of 31 August, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Nike's net margin excels beyond industry benchmarks, reaching 9.07%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Nike's ROE excels beyond industry benchmarks, reaching 7.41%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Nike's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.77% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Nike's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.87, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.