Investors with significant funds have taken a bullish position in Charles Schwab (NYSE:SCHW), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in SCHW usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 8 options transactions for Charles Schwab. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 87% being bullish and 12% bearish. Of all the options we discovered, 7 are puts, valued at $293,215, and there was a single call, worth $50,370.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $85.0 for Charles Schwab over the recent three months.

Analyzing Volume & Open Interest

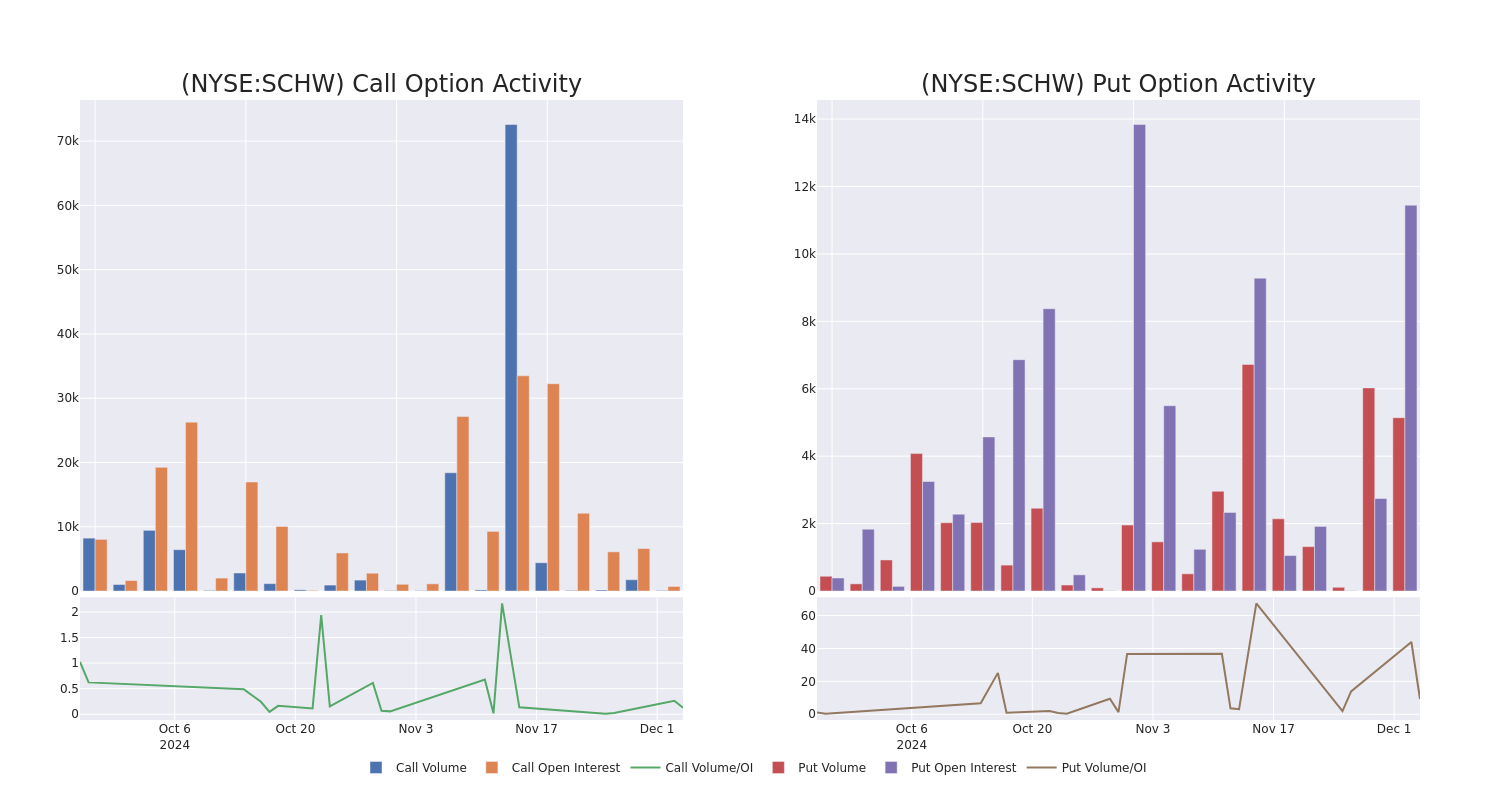

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Charles Schwab's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Charles Schwab's substantial trades, within a strike price spectrum from $70.0 to $85.0 over the preceding 30 days.

Charles Schwab Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SCHW | PUT | SWEEP | BULLISH | 01/15/27 | $8.1 | $7.65 | $7.66 | $75.00 | $76.5K | 17 | 100 |

| SCHW | PUT | SWEEP | BULLISH | 07/18/25 | $3.75 | $3.65 | $3.65 | $75.00 | $52.2K | 92 | 143 |

| SCHW | CALL | SWEEP | BEARISH | 03/21/25 | $6.95 | $6.9 | $6.9 | $77.50 | $50.3K | 714 | 91 |

| SCHW | PUT | SWEEP | BULLISH | 01/17/25 | $0.55 | $0.47 | $0.48 | $72.50 | $47.5K | 2.2K | 1.8K |

| SCHW | PUT | SWEEP | BULLISH | 01/17/25 | $0.26 | $0.25 | $0.25 | $70.00 | $32.7K | 8.2K | 2.3K |

About Charles Schwab

Charles Schwab operates in brokerage, wealth management, banking, and asset management. It runs a large network of brick-and-mortar brokerage branch offices and a well-established online investing website, and it has mobile trading capabilities. It also operates a bank and a proprietary asset-management business and offers services to independent investment advisors. Schwab is among the largest firms in the investment business, with over $8 trillion of client assets at the end of December 2023. Nearly all of its revenue is from the United States.

Charles Schwab's Current Market Status

- Trading volume stands at 2,154,700, with SCHW's price down by -0.33%, positioned at $80.85.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 42 days.

What The Experts Say On Charles Schwab

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $80.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Charles Schwab with a target price of $80.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Charles Schwab, Benzinga Pro gives you real-time options trades alerts.