Financial giants have made a conspicuous bullish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 24 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $72,495, and 22 were calls, valued at $982,007.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $120.0 for Block, spanning the last three months.

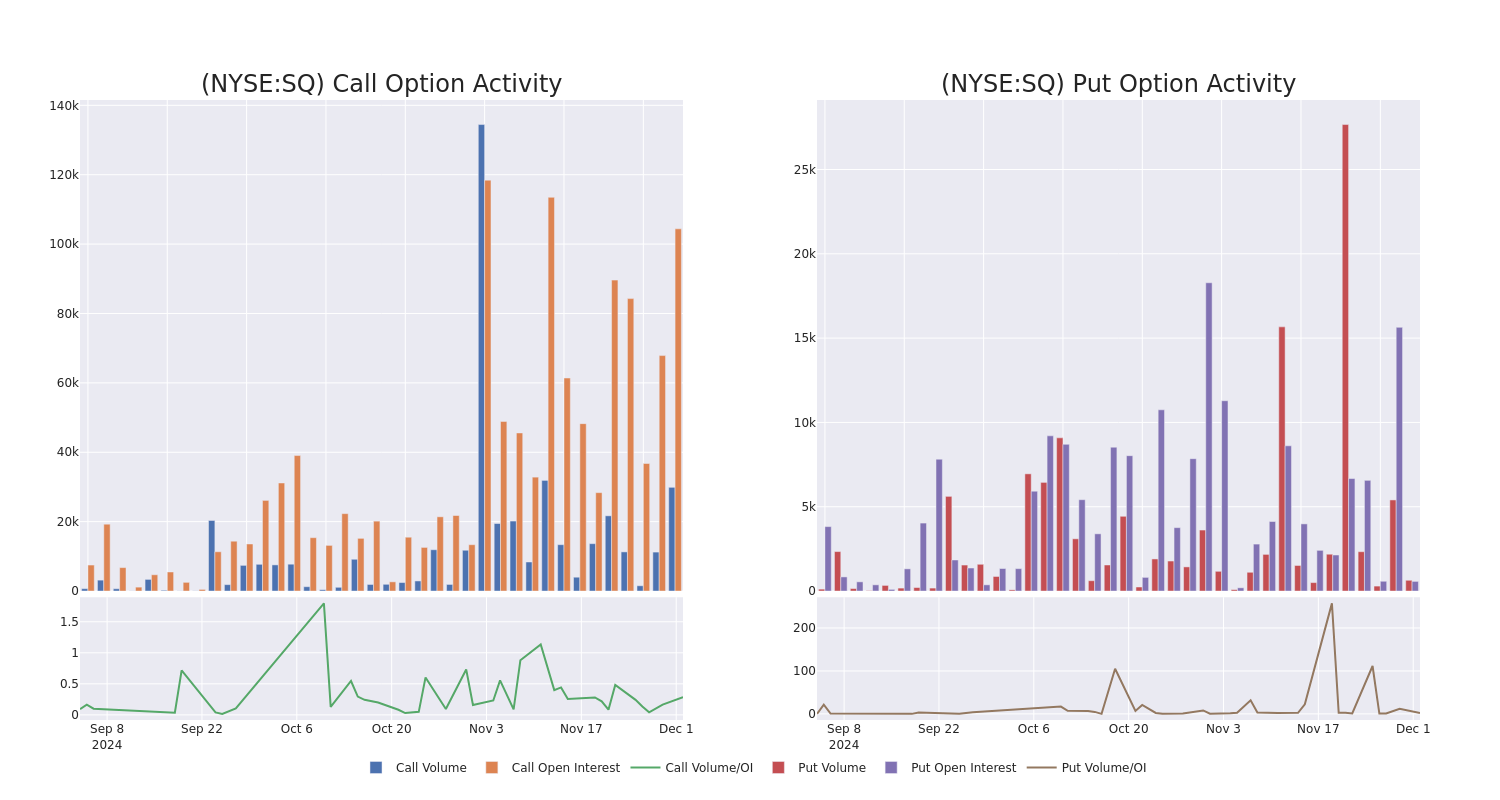

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $70.0 to $120.0 over the preceding 30 days.

Block Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | SWEEP | BEARISH | 12/06/24 | $2.71 | $2.58 | $2.58 | $95.00 | $131.6K | 4.7K | 2.7K |

| SQ | CALL | TRADE | BULLISH | 12/20/24 | $18.0 | $17.55 | $17.96 | $77.50 | $71.8K | 1.7K | 62 |

| SQ | CALL | TRADE | BULLISH | 12/06/24 | $4.9 | $3.1 | $4.8 | $89.00 | $56.6K | 746 | 118 |

| SQ | CALL | SWEEP | BULLISH | 12/20/24 | $7.95 | $7.45 | $7.95 | $90.00 | $53.2K | 5.0K | 1.4K |

| SQ | CALL | SWEEP | NEUTRAL | 12/06/24 | $2.54 | $2.37 | $2.5 | $94.00 | $52.7K | 1.3K | 3.0K |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

After a thorough review of the options trading surrounding Block, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Block's Current Market Status

- Trading volume stands at 5,542,361, with SQ's price up by 6.98%, positioned at $94.73.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 80 days.

What Analysts Are Saying About Block

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $100.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $83. * Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Block with a target price of $120. * Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for Block, targeting a price of $120. * Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Block with a target price of $90. * Reflecting concerns, an analyst from Exane BNP Paribas lowers its rating to Neutral with a new price target of $88.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.