12 analysts have expressed a variety of opinions on Dick's Sporting Goods (NYSE:DKS) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 4 | 4 | 0 | 0 |

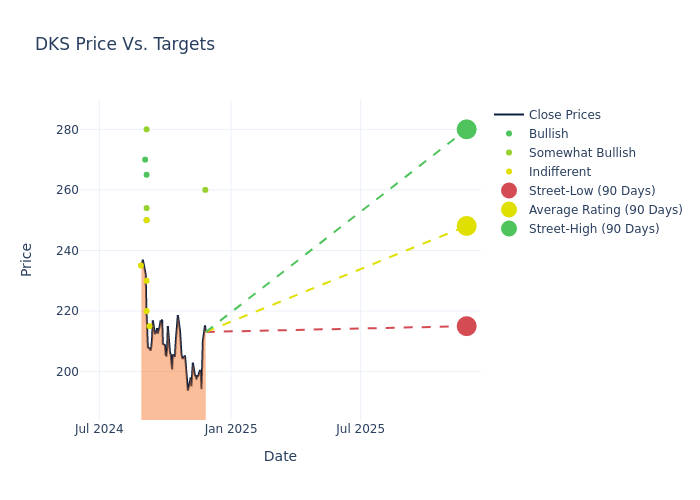

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $251.17, a high estimate of $280.00, and a low estimate of $215.00. This upward trend is evident, with the current average reflecting a 1.25% increase from the previous average price target of $248.08.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Dick's Sporting Goods. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $260.00 | $260.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $215.00 | $211.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $230.00 | $243.00 |

| Warren Cheng | Evercore ISI Group | Maintains | Outperform | $280.00 | $280.00 |

| Anthony Chukumba | Loop Capital | Raises | Hold | $220.00 | $200.00 |

| Robert Ohmes | B of A Securities | Raises | Buy | $250.00 | $240.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $254.00 | $247.00 |

| Michael Baker | DA Davidson | Maintains | Buy | $265.00 | $265.00 |

| Seth Basham | Wedbush | Maintains | Neutral | $250.00 | $250.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $260.00 | $260.00 |

| John Kernan | TD Cowen | Raises | Buy | $270.00 | $266.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $260.00 | $255.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dick's Sporting Goods. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Dick's Sporting Goods compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dick's Sporting Goods's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Dick's Sporting Goods's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Dick's Sporting Goods analyst ratings.

Get to Know Dick's Sporting Goods Better

Dick's Sporting Goods retails athletic apparel, footwear, and equipment for sports. Dick's operates digital platforms, about 725 stores under its namesake brand (including outlet stores and House of Sport), and about 130 specialty stores under the Golf Galaxy and Public Lands nameplates. Dick's carries private-label merchandise and national brands such as Nike, The North Face, Under Armour, Callaway Golf, and TaylorMade. Based in the Pittsburgh area, Dick's was founded in 1948 by the father of current executive chairman and controlling shareholder Edward Stack.

Dick's Sporting Goods's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Dick's Sporting Goods showcased positive performance, achieving a revenue growth rate of 7.75% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 10.43%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Dick's Sporting Goods's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 12.91%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Dick's Sporting Goods's ROA excels beyond industry benchmarks, reaching 3.69%. This signifies efficient management of assets and strong financial health.

Debt Management: Dick's Sporting Goods's debt-to-equity ratio surpasses industry norms, standing at 1.5. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.