Providing a diverse range of perspectives from bullish to bearish, 10 analysts have published ratings on Valley Ntl (NASDAQ:VLY) in the last three months.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 7 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 4 | 1 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

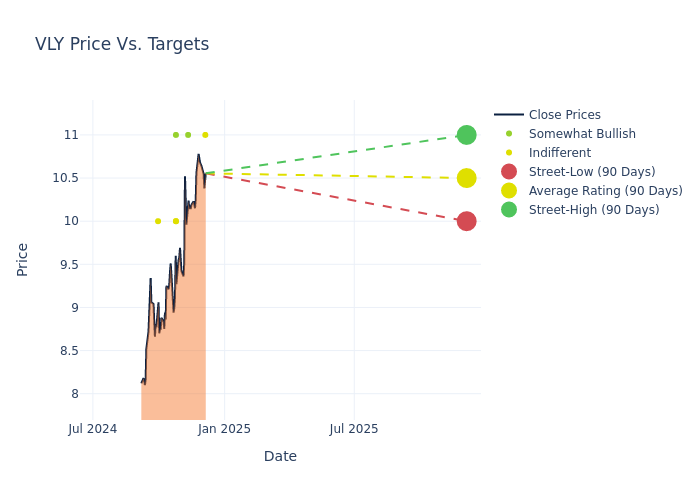

The 12-month price targets, analyzed by analysts, offer insights with an average target of $10.2, a high estimate of $11.00, and a low estimate of $9.00. Marking an increase of 8.51%, the current average surpasses the previous average price target of $9.40.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Valley Ntl among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jared Shaw | Barclays | Raises | Equal-Weight | $11.00 | $10.00 |

| Steven Alexopoulos | JP Morgan | Raises | Overweight | $11.00 | $10.50 |

| Jared Shaw | Barclays | Raises | Equal-Weight | $10.00 | $9.00 |

| Jon Arfstrom | RBC Capital | Raises | Outperform | $11.00 | $10.00 |

| Jared Shaw | Barclays | Raises | Underweight | $9.00 | $8.00 |

| Frank Schiraldi | Piper Sandler | Raises | Neutral | $10.00 | $9.00 |

| David Chiaverini | Wedbush | Maintains | Neutral | $10.00 | $10.00 |

| Steven Alexopoulos | JP Morgan | Raises | Neutral | $10.00 | $9.00 |

| Manan Gosalia | Morgan Stanley | Raises | Equal-Weight | $10.00 | $9.50 |

| David Chiaverini | Wedbush | Raises | Neutral | $10.00 | $9.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Valley Ntl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Valley Ntl compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Valley Ntl's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Valley Ntl's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Valley Ntl analyst ratings.

About Valley Ntl

Valley National Bancorp is a bank holding company whose principal wholly-owned subsidiary is Valley National Bank. It provides a full range of commercial, retail, and trust and investment services largely through its offices and ATM network throughout northern and central New Jersey, New York City Long Island, Florida, and Alabama. The segments of the group are commercial lending, consumer lending, investment management, and corporate and other adjustments, of which key interest income is derived from the commercial lending segment. In recent years, the company has focused on acquiring companies that operate outside of traditional banking and has emphasized wealth and capital management.

Valley Ntl: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Negative Revenue Trend: Examining Valley Ntl's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -0.12% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Valley Ntl's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 19.78%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Valley Ntl's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.4%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Valley Ntl's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.15%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Valley Ntl's debt-to-equity ratio stands notably higher than the industry average, reaching 0.56. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.