Option spreads are useful strategies that traders can employ to risk less capital while maintaining leveraged exposure to equities.

There are a few different types of spreads, but today, we’re going to talk about the two types of vertical spreads: credit and debit spreads.

What are vertical spreads? What are credit and debit spreads?

Vertical spreads are an option strategy that involves buying an option and selling another option with the same expiration date, on the same stock. When you use two different options in the same strategy, they’re called “legs”.

By purchasing an option, you are gaining leveraged exposure to an underlying asset, roughly equivalent to the amount of delta in the option multiplied by 100. 50 delta? That option has leverage roughly equivalent to 50 shares of the stock. By selling an option, you lower the premium cost associated with buying an option. However, your delta also changes, and your maximum profit becomes capped at the strike of your short option.

When you are buying (long) a vertical spread, that’s a debit spread. When you are selling (short) a vertical spread, that’s a credit spread.

To initiate a debit spread, you would buy an option closer to the money while selling another option (with the same expiration date) further out-of-the-money. To initiate a credit spread, you would do the opposite — buy an option further from the money while selling another option closer to the money.

You can make both bullish and bearish bets with debit and credit spreads. To make a bullish bet, you can either sell a put credit spread, or buy a call debit spread. To make a bearish bet, you can either sell a call credit spread, or buy a put debit spread.

How to calculate the max value and max risk of a vertical spread

It’s easy to calculate the maximum value of a vertical spread. You simply subtract the two strike prices from one another and multiply by 100 (don’t forget that options are contracts that represent 100 shares of an asset). For example, if you have a 100/90 vertical spread, the max value is $1,000.

To calculate the max risk (or cost) of a vertical spread, you simply subtract the premium (price) of your long option from the premium (price) of your short option.

Is it a positive number? Congratulations, you are now the proud owner of a debit spread, and that positive number is the amount of premium (the debit) you must risk in order to use the strategy.

Is it a negative number? Then it’s a credit spread, and that negative number is the maximum profit (or credit) that you can gain if the strategy goes your way. In the case of a credit spread, you must allow the brokerage to hold on to collateral — which is the maximum amount you can potentially lose in the trade.

It’s important to note that both credit and debit spreads carry defined risk. That means you cannot lose more than you initially risk when putting on either strategy. In other words, your max risk is what you paid.

Are all the numbers getting confusing? Let’s look at a real-life example.

Real-Life Example of a Credit and Debit Spread: Adobe (ADBE)

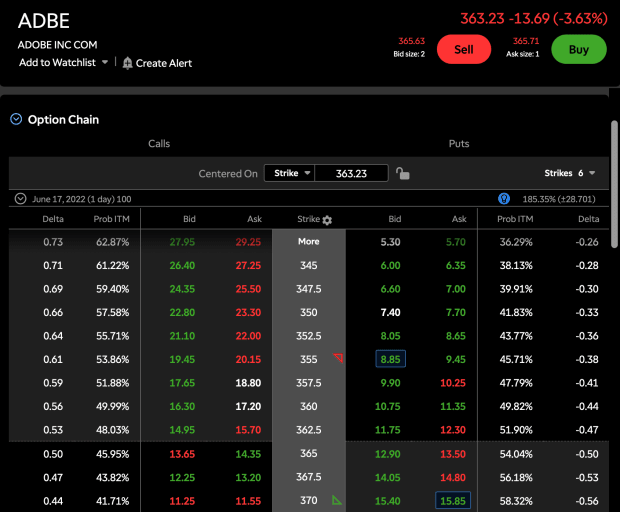

In the above example, we’re looking at a real options chain from June 16th, 2022 in Adobe (ADBE). Notably, this is one day before earnings, and because of the high IV associated with earnings events, these options are looking pricey. Sounds like a great opportunity to limit our maximum risk with a vertical spread.

Let’s imagine we want to make a bearish prediction: Adobe (ADBE) will fall to at least $355 by June 17th. (Which by the way, it did.) Which would be a better strategy to use: A put debit spread, or a call credit spread?

The easy way is to let volatility decide. If you think the implied volatility is high, and about to come down, you should arm yourself with a credit spread, because credit spreads are negative vega. That means they stand to benefit from a drop in volatility.

If you think the opposite - that the IV is too low, and bound to increase, you should opt for a debit spread. They’re positive vega, which means they benefit from an increase in volatility.

So to answer the question from earlier: With the IV high, earnings incoming, and IV crush in bound, the right choice in this situation is likely a credit spread.

In this case, you could do that by buying the out-of-the-money $370 strike call (at a mid-price of $11.40), and selling the in-the-money $355 strike call ($19.80). $11.40 subtracted by $19.80 = -$7.40, which is the maximum profit (or credit) associated with this trade. The maximum risk (collateral) is $7.60, and your breakeven is $362.40.

Vocab check: Breakeven — The stock price a trade must reach in order for the trader to “get back” what they initially risked.

Ready to start trading credit spreads? Try Smart Spreads — credit spread trade ideas crafted by a licensed CMT, around key technical levels, delivered straight to your inbox every week.

Call Credit Spreads vs. Long Puts: Pros and Cons

Let’s compare the $370/$355 call credit spread to the long $370 put from Adobe’s option chain.

One big difference between these two trades is the breakeven. In the example above, the $370 put costs the trader 15.63 (using the mid price, rounded up at the half-penny). That means the breakeven is $354.37. Compare that to the breakeven of the $370/$355 call credit spread we built above, which carries a breakeven of $362.40. That’s a difference of two percentage points. Because the breakeven of the credit spread is closer to the money, that makes it easier for this trade to become profitable.

And in the case of Adobe, which fell to about $355 on the expiration date, we know in hindsight that the credit spread would have been a much more effective tool than a long put. The credit spread finished with near full profitability, the long put didn’t even reach breakeven.

However, imagine that by the expiration date, Adobe (ADBE) dropped to $300! An unlikely event, but on the eve of an earnings event, anything is possible. The long $370 put described above would now be worth roughly $70.00 (a real-dollar amount of $7,000). Conversely, that spread is capped at a max value of $15.00 ($1,500), meaning no extra-credit beyond a share price $355 (the short leg). In extreme cases like this one, a long put would take the cake.

Other use cases for the credit spread

The above scenario in Adobe looks at a situation where the options are expiring in one day. However, many traders use credit spreads for an entirely different purpose: collecting theta decay.

By selling a spread that is already out-of-the-money, you expose yourself to positive theta. That means that unlike your standard long call or put (which are negative theta), you benefit from the passage of time. Even if the underlying stock doesn’t move, your spread is gaining value with each passing moment.

The downside of this strategy is that you must often risk more in collateral than you stand to gain in credit. That’s because probability is already in your favor — it’s more likely that the options (which are out-of-the-money) remain OTM.

Other use cases for the debit spread

Debit spreads don’t have to be bought all at once. Rather than buying the whole thing in one clip, you can leg in! Remember that long calls on their own will always have a higher delta than their debit spread equivalent. Higher delta means a faster move in price.

Traders can get the best of both worlds when they leg into spreads. To perform this move, you would first buy the call leg, and later, once the call is profitable, sell a further out-of-the-money call against it at the same expiration — thus “locking in” a portion of the profit, while maintaining some exposure to the position!

This is a popular strategy that Market Rebellion Co-Founder Jon Najarian uses all the time.

Conclusion

Learning about options can feel overwhelming, but it’s worth it. Every option strategy is like a tool, and the more strategies you can master, the larger your toolbox becomes. Over the course of reading this article, you’ve learned strategies that can be used to:

- Lower the cost basis of your option trade (albeit, with capped potential)

- Lower your breakeven and thus increase your chance of profitability

- Mitigate or even benefit from time decay

- Lock in profit while maintaining exposure to a position

But your work isn’t done yet! Get out there and experiment with these strategies — preferably with paper trading, until you get comfortable. Not only that, but by learning the ins and outs of these strategies, you’ll build the foundation to discover other, more advanced options strategies, like iron condors and more!