When it comes to evaluating the latest developments in what is now perhaps the fastest growing segment of TV, the rapidly evolving world of FAST (free-ad-supported TV) is proving to be a moving target.

Even the acronym—from FASST (where the extra “S” stood for streaming) to FAST—captures the dynamic and volatile progression of the medium. And there’s the avalanche of new packages from media stalwarts, such as Comcast Corp. (via its Xumo co-venture with Charter Communications), and Paramount Global (Pluto TV) which are cascading into the market alongside aggressive young content aggregators including Tubi, Freevee (Amazon), Roku and MuxIP.

Add to this mix the walled-gardens of FAST channels offered by TV-makers: Samsung, LG Electronics, Vizio among other purveyors of connected TV (CTV) sets. Not to mention the early-stage quandary about whether FAST is best suited for live events (news and sports, which is why one of the hopefuls is going after regional sports networks) or vast content libraries.

And don’t forget the constant introduction of “alternative” distribution options. For example, in mid-July The Roku Channel FAST service became available on Google TV and other Android TV OS devices, downloadable through the Google Play Store. Until then, the Channel was only accessible on Roku devices, Fire TV, Samsung TVs, the Roku mobile app and online.

Amid this flurry of activity, there’s the predictable enthusiasm of entrepreneurs, such as Tom Link, founder/CEO of five-year old MuxIP, who recognizes the new competitive challenge.

“At the end of Q4 last year, the industry became actively engaged in exploiting the FAST ad models,” Link told TV Tech. “Tier 1 media companies are trying to get into this space. There’s a lot of noise about how to make money and where are the audiences.”

But this ebullience is countered by the inevitable skepticism, reflected in July’s Hub Research study that augured the end of “peak TV.” The Hub study claims that “consumers are reaching their limit for video sources.”

Moreover, the data deluge about FAST has triggered confusion about whether ad-filled linear streaming videos—especially when delivered via wireless—is anything new. This led one exasperated legacy broadcaster to bluntly admonish that Free Ad-Supported Streaming TV is "just television.”

More Questions Than Answers

FAST’s IP platforms are compatible with wired and wireless delivery—including NextGen TV—and also offer opportunities to integrate programs into existing structures, such as cable channels.

FAST is a linear format of AVOD.”

Srinivasan KA, Amagi

Moreover, FAST has emerged alongside AVOD (ad-supported video-on-demand), posing another conundrum from some viewers. Srinivasan KA, co-founder and chief revenue officer at Amagi Corp., explains that, “FAST is a linear format of AVOD,” and his company is developing ways to integrate the ad-based variations.

Amidst this chaotic evolution, there are continuing data benchmarks, such as June’s Circana “TV Switching” study, which attests that 14% of U.S. households tune into a FAST service daily. Circana, the technology analytics firm created in last year’s merger of Information Resources, Inc. and The NPD Group, also reports that in the past six months, 55% of U.S. internet households have used at least one FAST service, up from 52% late last year.

NBCUniversal’s recent launch of nearly 50 FAST channels, with programs pulled from its film and TV vaults, has focused even more attention on the diversity of the FAST platforms. The shows—ranging from “Saturday Night Live” and “The Real Housewives” episodes to nostalgic “Lone Ranger” and “Little House on the Prairie” series to Telemundo programs—are organized into genre-based streams of “comedy, criminality, monsters” and more. The complex distribution plans include relationships such as using Xumo to make the shows available to third-party distributors, such as Freevee, the Amazon FAST purveyor.

Organizing such arrangements will be increasingly complex, especially since NBCU also offers similar subscription-only content on its Peacock streaming platform.

John Buffone, vice president, industry advisor-Media Entertainment & Connected Intelligence, told TV Tech that, “some FAST services are beginning to limit the amount of new content brought onto the platform as the existing content array is already so vast.

“Look for the providers to leverage their core assets to grow their share of viewership in this saturated and highly competitive market,” Buffone added. He cited the approach that some FAST providers are taking—notably Xumo and Pluto TV, which “have their parent company [NBCU and Paramount] assets to offer.”

Buffone explains that FAST resembles cable TV in numerous ways, such as the electronic program guide, but “it is also new and different.”

“Among the notable differences is the varied content array each service offers,” Buffone says. “One, such as Tubi TV, may stand out for news while another, such as Pluto TV, will offer curated programs on owned-and-operated channels that reflect the depth of the Paramount content library. As long as the content differentiation exists, viewers will continue to find value in using multiple services.”

Indeed, FAST users tune into an average of 3.6 FAST services across a six-month time horizon, showing they value the varied programming mix, according to Circana’s analyses.

From the Connected TV Viewpoint

Smart TVs are playing a major role in the FAST adoption, especially as major OEMs (original equipment manufacturers) plunge into the programming field.

Rick Ducey, managing director at BIA Advisory Services and a long-time analyst of media economics, points out that the CTV opportunity is so substantial for TV set makers because the data it generates can potentially “produce more revenue than TV set sales,” at least in the near term. He points out that broadcast and cable networks “enter this market from a content-first strategy versus the OEMs’ entry point of tech first.”

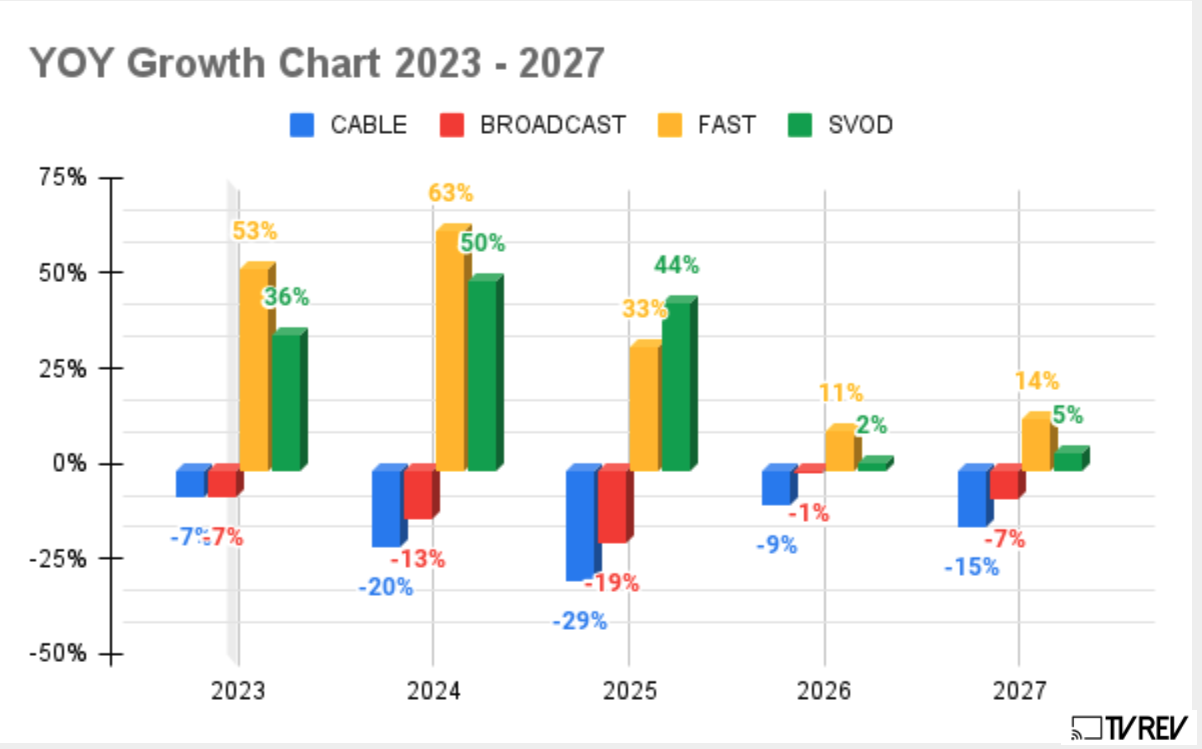

Like many enthusiasts for FAST and AVOD opportunities, Ducey says that, “both linear and on-demand channel platforms, and services will continue to grow in viewing and ad spending at the expense of linear TV like traditional broadcast and MVPDs.”

“CTV has the chance to do it right by creating unified identities that are purpose-built for identity graphing across multiple platforms,” he adds. Nonetheless, Ducey points out that, “Platform loyalty will erode a bit as content owners seek incremental revenue by distributing programming across more platforms.

“TV OEMs have a play for now with their… data and they’ve developed clever ways to add value … and monetize it,” Ducey added. “As the industry starts to standardize on both measurement and currency solutions and come to consensus on unified ID solutions, OEMs’ advantages in this area will erode.”

Circana’s Buffone points out set-makers’ advantage: “TV OEMs control the glass which allows for user data acquisition through technology such as audio-content-recognition (ACR). This provides first-party engagement data that will allow for these providers to optimize the viewer experience and ultimately increase engagement.”

Citing Samsung’s marketing campaign for Samsung TV+’s FAST content, Buffone acknowledges that “quality and exclusive programming … will continue to be the primary driver of viewer engagement. In that regard FAST is no different than the distribution platforms that came before.”

“The industry sees an opportunity to enhance the viewer experience and in return they are aiming to generate content and advertising revenues to increase the margins of their TV business, Buffone says. “There are numerous business models that will likely evolve from this and it remains to be seen which will win and which will lose.”

One aggressive example comes from LG Electronics, which has launched “LG Channels,” a FAST offering that includes direct relationships with more than 100 program suppliers and is “developing dozens more for launch this year,” says Matt Durgin, vice president, Content and Services, which manages LG content, ad and technology partnerships.

LG has also licensed hundreds of movies “from all the major studios,” he adds, explaining that the company has integrated the FAST LG Channels into the same guide as the over-the-air broadcast channels so that viewers “who utilize an antenna to receive OTA can see FAST and broadcast channels within the same experience.”

LG is also making exclusive channels for consumers, such as an NCAA channel that offers thousands of college Division 1, 2 and 3 championship games plus an exclusive college sports channel called Rivalries which highlights some of the oldest and strongest college rivalries in the country.

LG has also packaged its own “Majordomo” Cooking Channel, which features exclusive content from renowned chef David Chang.

Building the Backend

Amagi Corp., an India-based SaaS firm, has spent 15 years developing broadcast and streaming TV technology to create, manage, distribute and monetize live linear channels. It now has deployments in 40 countries, with U.S. clients such Sinclair Broadcasting Group and the National Hockey League, the Tennis Channel and World Kickboxing.

Co-founder and CRO Srinivasan KA sees sports as a major driver of FAST experiences. The company’s “Cloudport” can create and distribute the FAST channel with a content line-up that includes pre-game and post-game highlights, such as practice sessions and live press conferences.

“Cloudport is for playing out on live linear channels,” KA said, comparing it to “what a broadcaster would do with a live stream,” inserting commentary, graphics, captioning and other screens from master control.

Moreover, KA emphasizes that, “Because we are being delivered over-the-top, we can measure viewership,” which is attractive to advertisers. This ties into Amagi’s geo-targeted software for ad insertion.

KA says that Amagi’s is working with NBC, Fox, Tegna, Cox, AccuWeather and others—offering “close to 50 channels” and serving as “the connective tissue” to help them deliver FAST service. The company’s relationship with Sinclair Broadcast Group includes those stations’ ATSC 3.0 technology for local news and sports, but KA did not provide details.

As for connected TV, Amagi is working with Samsung, LG and Vizio, which he considers “a huge growth area.”

“FAST is the new linear,” KA proclaims enthusiastically. He believes that CTVs are especially appealing to GenZ viewers. “It is the same thing we had in broadcasting: fantastic programming and free.” He expects “more and more premium content” will be moving into FAST delivery.

Like Live TV

Underscoring the hyper-targeting of the FAST providers is a “Crimeflix” channel introduced by MuxIP in mid-July. The Los Angeles-based provider of automated FAST solutions distributes content via Sling TV, Roku, LG and Amazon’s FreeVee. Its FASTHub for OTT offers “RetroCrime” movies and TV shows and versions in English, French and Spanish of some titles (with German-language dubbing coming soon, the company says).

Tom Link, MuxIP founder/CEO, says that the company’s “cloud playout service,” which includes automated content ingestion and “dynamic playlist manipulation” enables flexible delivery options.

“We have patents for cue-point ingestion,” such as markers to identify where to insert an advertising pod,” Link told TV Tech. “We can take assets from a variety of inputs and combine them to produce a live experience.”

MuxIP is working with about four dozen content owners, including World Poker Tour, a motorsports network, BlackStar Network (an African-American news channel) and Stellar TV, Link says.

“We do everything from the ad perspective, such as ad insertion. We’re bullish on this space,” Link adds, citing company revenue doubled from early 2022 to first quarter 2023. MuxIP streams its PodcastOne TV to 60 outlets through its FASTHub for OTT platform, including Pluto, Amazon FreeVee, Roku, Samsung TV Plus, LG Channels and Tubi.

Link explains that the MuxIP technology can identify an ad break about 10 seconds beforehand, and allow a request to go to its server to match the ad to the viewer. He’s also looking for ways to overlay ads into specific content.

“MuxIP delivers content in HTTP Live Streaming (HLS) format, that works on many platforms,” Link says, but he insists, this is “not just about technology, which is the cornerstone of what we do.” Rather, he says, MuxIP focuses on the ability to stream on multiple platforms, such as YouTube and social media, “which turns out to be very important.”.

Link says his company is “in talks with a cable operator to take dozens of the MuxIP channels” and he expects to sell some of his channels to OTA broadcasters.

“Not everyone knows how to do this,” he gloats, but offers no further details.

Calculating the Advertising Formula amid content deluge Freevee, the Amazon-owned FAST service formerly known as IMDb TV, offers more than 280 channels in genres featuring original programs, movies, game shows, classic TV, new, reality and sports shows. They can be accessed via Prime Video and Fire TV as well as the Freevee app. A hug batch of shows came online this summer as part of a Freevee deal with MGM and Warner Bros. Discovery.

At LG, its LG Ad Solutions group handles LG’s Smart TV advertising inventory along with holding all of LG’s TV data “which provides privacy-compliant methods of audience development to meet the needs of all advertisers,” Durgin says.

Smackdown from Small Streamers

One indicator of the perceived importance of FAST was the creation in June of the “Independent Streaming Alliance,” a new association of smaller streaming companies which are “joining forces to promote the value of independent streamers, and to work hand-in-hand with platforms, advertisers, and regulatory bodies to ensure that we have a healthy ecosystem that benefits everyone, not just the few,” as Philippe Guelton, Chief Revenue Officer at Chicken Soup for the Soul Entertainment, explained.

Founding members of the ISA include Allen Media Group, Chicken Soup for the Soul Entertainment, Cineverse, Future Today, kweliTV, Revry, E.W. Scripps, Tastemade, TMB and Vevo. Guelton said that the Alliance’s goal is to work with distributors to assure access to audiences and to “ensure members’ ad inventory can be accessed by buyers directly or via programmatic technology.”

As FAST vendors and operators maneuver through the shifting media landscape, the big question remains: how will viewers discover and migrate onto these new platforms? Overall, a slew of forecasters is predicting upbeat growth—reinforcing the expectations of TVREV and Circana, but also disclosing the fickle nature of some viewers.

For example, a recent Antenna “State of Subscriptions” analysis revealed sharp dichotomies in viewer preferences for paid or FAST services. It found that 69% of Comcast’s Peacock streaming customers chose a lower-priced plan with commercials and 58% of Hulu’s subscribers picked an “ad-lite” plan. On the other hand, the Antenna study discovered that only 21% of MAX viewer took the ad option—perhaps a lingering habit from the years of paying for a monthly subscription to HBO (MAX’s predecessor linear service.)

Such results are reminders that consumers are still figuring out how to handle the glut of streaming options. And that possibly FAST won’t mature as fast/quickly as some vendors hope.