American workers frequently worry about whether they are saving and investing enough for their future retirement years.

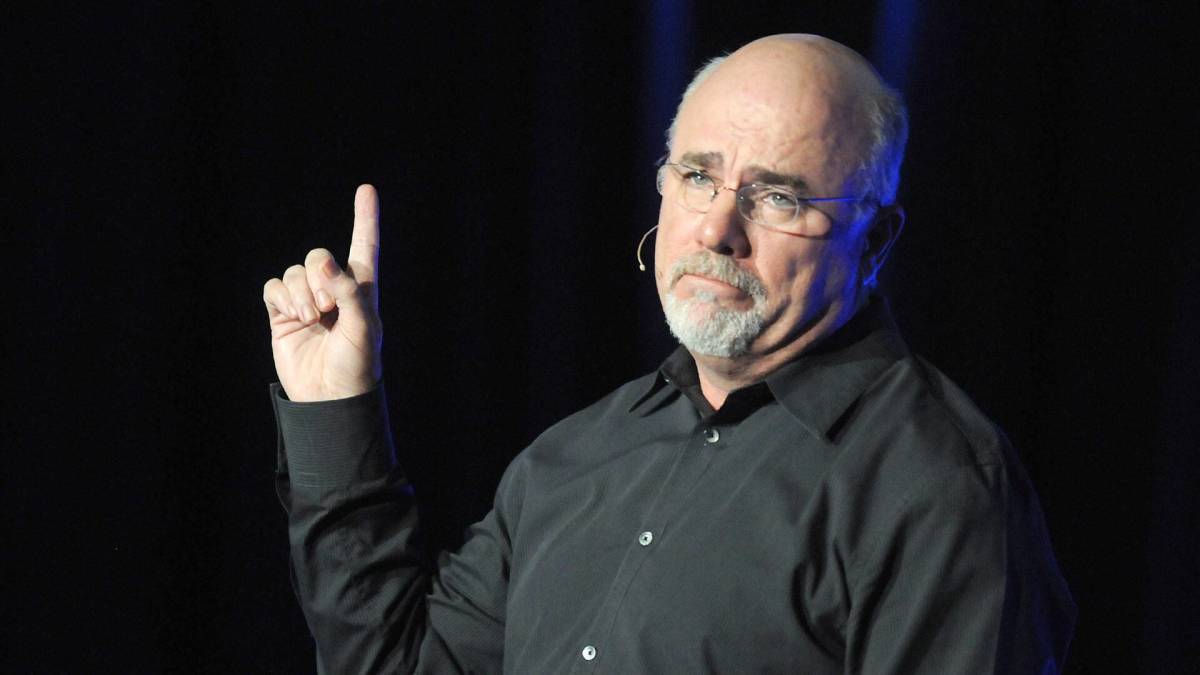

Personal finance bestselling author and radio host Dave Ramsey has a warning for people concerned about their retirement savings, explaining that bad habits can only be broken by doing something differently that they aren't currently taking care of enough.

💰💸 Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💸

Many workers feel behind on their savings as they attempt to balance their day-to-day living costs with saving and investing for retirement. This concern can lead to a deprioritization of retirement savings efforts.

Inflation contributes to a lot of anxiety. As costs rise, kitchen table expenses become difficult to manage.

Related: Dave Ramsey warns Americans on Medicare major mistake to avoid

People are also concerned with volatility in the stock market, leaving many to wonder if their investments are on solid ground for future needs.

Social Security is another cause of angst. While many workers understand that the federal program's monthly paychecks will not be enough upon which to live comfortably in retirement, they are also concerned about projections that its trust funds will run out of money by 2034 — and their benefits could be reduced to only about 80% of current estimates.

Health care, including the need to pay premiums and other costs that Medicare does not cover, is a primary worry for many Americans.

Given these financial realities, Ramsey offers a warning — and also a plan of action — regarding a blunt truth about a behavior people can change to boost their chances of a achieving a rewarding retirement.

Related: Dave Ramsey’s net worth: The personal finance pundit’s wealth in 2025

Shutterstock

Dave Ramsey explains a blunt truth on 401(k)s and Roth IRAs

Ramsey clarifies his belief that saving for retirement in a healthy and productive way is possible, but thinking about it is not enough. Action must be taken, and soon.

"You have to do something different if you want your habits — and your future — to change," he wrote. "And the truth is, saving for retirement is easier than you think."

More on Dave Ramsey

- Dave Ramsey sounds alarm on Social Security for retired Americans

- Finance author has blunt words on Medicare for retirees

- Dave Ramsey candidly discusses buying a home now

The first step, Ramsey explains, is that workers ought to be investing 15% of their savings in tax-advantaged accounts such as 401(k)s and Roth Individual Retirement Accounts (IRAs).

This only begins with making use of an employer's matching 401(k) plan. He suggests that one be sure they are, at a minimum, taking full advantage of the maximum matching amount.

Ramsey recommends investing the remainder of the 15% in a Roth IRA, which allows workers to pay taxes on their contributions up front. Withdrawals made after age 59 1/2 are handled free of taxes.

"That's a win-win," Ramsey wrote.

The maximum Roth IRA contribution one can make annually is $7,000, or $8,000 if one is 50 years of age or older.

Ramsey explains further why he believes a Roth IRA is the cream of the crop when it comes to retirement accounts.

Related: Tony Robbins warns U.S. workers on 401(k)s, IRAs, future taxes

Ramsey encourages U.S. workers to set up a Roth IRA now

Ramsey emphasizes the fact that a Roth IRA is not an investment in itself. He describes it as an "umbrella" that encompasses investments and, most importantly, protects them from taxes.

The Ramsey Show host explains a number of reasons he believes Roth IRAs are a great investment tool for retirement and why it's important for workers to get one started.

For starters, people can contribute to them as long as they meet requirements for income. A single contributor (or head of household) cannot contribute to a Roth IRA if they make more annually than $161,000. If married (or filing taxes jointly) that limit is $240,000.

People are not required to take distributions when they reach a specific age. This is different than a traditional IRA that mandates a person begin withdrawals at age 73.

Workers can also continue to make Roth IRA contributions while working beyond their retirement age.

And, importantly, one can choose to have their beneficiaries inherit their Roth IRA. Those beneficiaries can withdraw money from those accounts tax-free as well.

Related: Veteran fund manager issues dire S&P 500 warning for 2025