Vehicle costs are one of the main expenses causing Americans headaches on a regular basis.

In fact, monthly payments have recently begun to hit some astonishing new heights, forcing people living paycheck to paycheck into some tough financial predicaments.

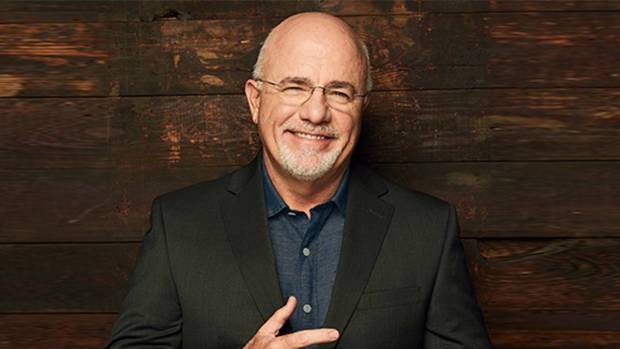

DON'T MISS: Dave Ramsey Weighs In With Tough Words On Student Loans

Specifically, the percentage of Americans making monthly payments of $1,000 or more has been increasing the past few years.

"As of April 2023, there are nearly three times as many consumers willing to pay $1,000 or more for their car or truck than there were in 2019. That's more than double the average monthly payment of $416, among consumers with a single monthly auto payment," a report from Experian found.

Personal finance author and radio host Dave Ramsey believes spending a significant portion of one's income on car payments is not a good financial plan.

"Americans love their cars," wrote Ramsey's website, Ramsey Solutions. "Unfortunately, that love affair has led a lot of folks to make some really dumb financial decisions."

Pay For Cars With Cash By Buying Used Ones

Ramsey advises paying for cars with cash. For most, that means forgetting about a new car and focusing on a good used one.

The most widely sold used cars for 2022 in the U.S. were Ford's (F) -) F-150 truck, GM's (GM) -) Chevrolet Silverado and Equinox, Fiat Chrysler's Dodge Ram and the Honda (HNDAF) -) Civic, according to Autoweek.

Another Experian report revealed three key data points about buying new cars that Ramsey Solutions highlighted.

- About 8 out of 10 new cars are purchased with a loan or a lease.

- The average new car loan totals $40,851 with monthly payments of $725 at 6.58% interest.

- The average new car loan term is 68 months -- that’s more than five and a half years!

The Ramsey Solutions article takes a deeper look at what these data mean.

Now, take a second and let those numbers sink in. Research shows that new cars lose around 60% of their value after five years. So if you’re the average car buyer, you’ll spend the next five and a half years paying more than $49,000 for a car that’ll probably be worth about $16,000 when it’s paid off (if you’re lucky). Does that sound like a good deal to you?

By then, the new car smell has worn off. So, you go out and buy another new car, and the process starts all over again.

It’s no wonder millions of Americans feel like they're stuck in the mud, spinning their wheels without ever gaining traction. It’s time to say goodbye to car payments once and for all!

Ramsey provides one specific example of how it can be possible to handle car finances in what he believes to be a more practical way.

"Let's say the paid-for car you're driving now is worth $15,000. Instead of taking out another loan to buy a new car, stick with your set of wheels a little longer, Ramsey Solutions wrote. "In the meantime, put your $725 car payment into a good money market account specifically to save for a car replacement. In about two years, you’ll have more than $17,000 cash plus your trade-in to buy a nicer, new-to-you car without owing the bank a single penny."

"Getting rid of car payments isn't a fairy tale," it continues. "It just takes planning and patience. And isn’t your future worth it? No car -- no matter how fancy -- can give you peace of mind in retirement. That kind of security comes from having a plan and following through with it."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.