A large number of Americans seeking advice about retirement planning are told about balancing Social Security monthly payments with regular income from money saved and invested during their working years.

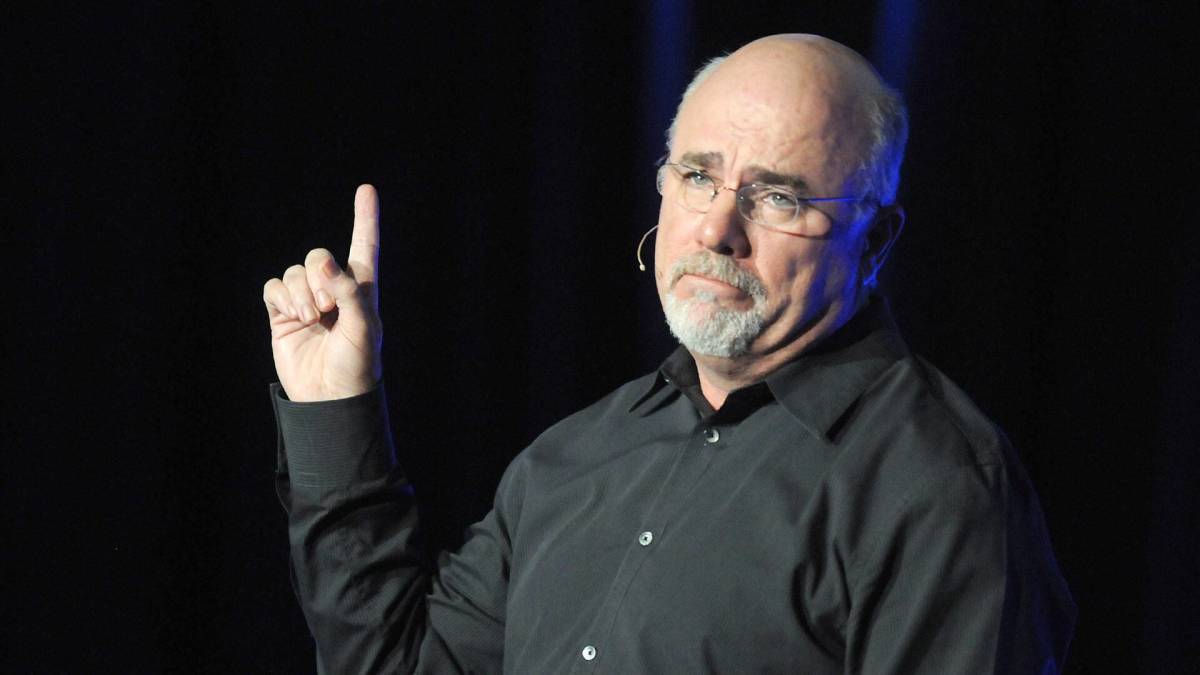

Personal finance bestselling author and radio host Dave Ramsey has a word of warning for American workers, who would be well-advised to understand the role of Social Security benefits in their retirement plans and the importance of contributing to 401(k) plans and Roth Individual Retirement Accounts (IRAs).

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter

Participating in an employer-sponsored 401(k) plan is a great place to start. With an employer match, the percentage of income a person contributes automatically doubles in value, and that is before any gains in the stock market are added.

The money invested in a 401(k) grows free of taxes, and people do not have to pay taxes on those funds until they withdraw money in retirement.

Related: Dave Ramsey warns Americans about a major Medicare problem

With a Roth IRA, taxes are paid upfront. It offers tax-free growth — and withdrawals once a person retires are made tax-free.

Ramsey explains that there are mistakes that can be made, and he urges people to avoid them, keep on track and succeed in planning for a comfortable retirement.

Shutterstock

Dave Ramsey warns on Social Security's limits; how Roth IRAs and 401(k)s can help

Social Security monthly payments were never meant to cover the full cost of expenses during retirement. In fact, the average paycheck of about $1,900 works out to around $23,000 annually, barely enough to be above the 2025 poverty level of $21,150 for a household of two.

So the burden of saving and investing, using Ramsey's recommended retirement tools that include Roth IRAs and 401(k)s, falls on the individual worker during the course of their career.

Related: Dave Ramsey’s net worth: The personal finance pundit’s wealth in 2025

And the stark reality is that people who plan well very often succeed — and those who don't find out the hard way that they have made mistakes along the way.

"When it comes to retirement, most people find themselves either sitting in the regret of past money mistakes or winning big-time with money, on track to enjoy a retirement they’ve always dreamt about," Ramsey wrote.

More on Dave Ramsey:

- Dave Ramsey warns retired Americans to avoid one mortgage mistake

- Finance author has blunt words on Medicare for retirees

- Dave Ramsey candidly discusses buying a home now

Ramsey says the difference between those who are on track for a healthy retirement and those who are not often comes down to who has a plan and has executed on it and who has not.

"Those who are on track to reach their retirement goals have a plan," Ramsey wrote. "They’re intentional, focused, and they took the time to really think about the kind of future they wanted. And then they worked their plan with full-speed ahead intensity—they didn’t let anything get in their way."

Related: Dave Ramsey warns U.S. workers on a Roth IRA, 401(k) blunt truth

Dave Ramsey says after 401(k)s, a Roth IRA is your next best friend

Ramsey discusses the fact that, if a person does not have access to a 401(k) or is not happy with their employer's available investment options, the next best thing is a Roth IRA.

He explains that IRAs are not limited to the small number of investment options in the way 401(k) choices are presented.

"One of the great perks with IRAs is that you get to choose from thousands of mutual funds in the open market instead of the limited menu of options provided by a 401(k) plan, and you have more flexibility and control over your account," Ramsey wrote.

Ramsey also emphasizes that people should understand the fact that IRAs have lower contribution limits than 401(k)s. In 2025, the IRA contribution limit is $7,000, but people over the age of 50 can add another $1,000.

The personal finance coach adds a pro tip: If you have more to invest for retirement after reaching those IRA limits, the best thing to do is invest the rest in your existing 401(k), even if you have surpassed the employer matching percentage.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast