There are many ways Americans are dealing with investments, saving for retirement and planning for their future.

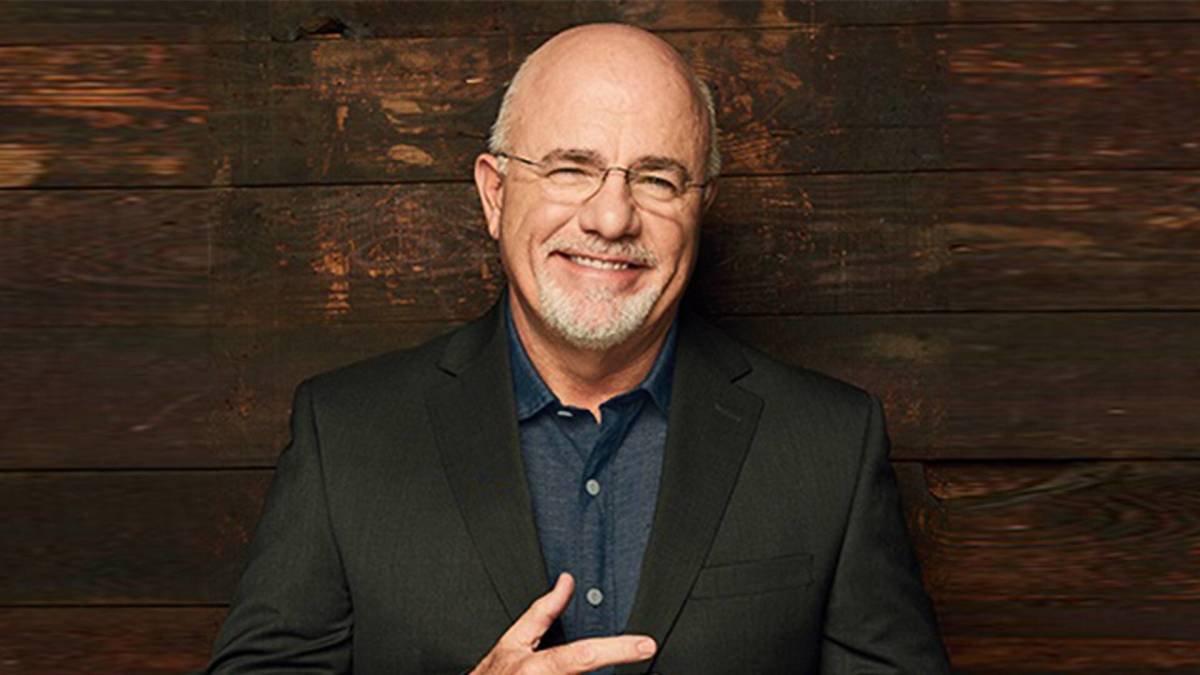

Personal finance expert Dave Ramsey has some blunt words about what he believes can be a major mistake millions of people have been making.

Related: Cathie Wood snaps up 260,000 shares of a stock that's down nearly 30% for the year

One financial issue confronting many parents is the goal of setting their children up for their futures.

Among these considerations is choosing the right life insurance policies, helping children open and manage bank accounts and whether to add children as authorized users on one of their credit card accounts.

Personal finance advisers also suggest appointing a guardian in their wills and involving the children in family financial discussions.

And another major decision involves how to properly set up college savings accounts.

RamseySolutions.com

Dealing with student loans

Ramsey, the author and radio host of The Ramsey Show, warns people about the potential dangers of a student loan.

"The fact is, they don't intend to forgive it," Ramsey recently wrote about the government's repeated statements about an individual's student loan. "It's the biggest scam in history — mathematically speaking — perpetrated on the American public by our government."

One advice-seeker asked Ramsey about his specific situation regarding his efforts to fund his children's college educations.

"Dear Dave," wrote a man identifying himself as Mike, in an e-mail forwarded to TheStreet by Ramsey Solutions. "My wife and I are debt-free except for our mortgage and two Parent PLUS loans for our daughters' college educations."

Direct PLUS (Parent Loans for Undergraduate Students) are federal loans that parents of dependent undergraduate students can use to help pay for college or career school, according to Federal Student Aid.

"One of the loans totals $18,078, and the other is for $41,500," Mike continued. "Both girls want to pay them off using the new extended plan being offered, but I'm 59 1/2, and I've got about $500,000 in a 401(k) from a previous job along with $125,000 from a job I started five years ago. We've been thinking about just paying the loans off for the girls, but we wanted to know your thoughts."

Dave Ramsey offers his advice

Ramsey considered this specific situation and suggested a possible solution.

"If I were in your shoes, I'd just go ahead and pay them off," he wrote. "Technically, you're liable for the loans. They are not."

"The extended plan you're talking about is garbage. In reality, it means the loans are never paid back. The extended plan is 30 years of not even making the principal payment," Ramsey continued. "No interest is paid, and they don't touch the principal. The whole thing works backward for 30 years, and it's the very definition of a stupid government program."

Ramsey said he does not think Mike really wants his daughters to be dealing with these loans.

"But that means you're going to be stuck with paying off these loans. You might as well just own it and pay them off now."

The personal finance personality took a deeper dive into his thoughts about the subject.

I want you to understand this, Mike. I don't advise people to dip into their savings every time a problem comes up prior to retirement. But you're 59 1/2, and at that point there's no penalty. Plus, you’ve got $625,000 sitting there. You’re going to pull less than $60,000 out, plus a little in taxes, to make the problem go away. It's not as bad as it could be, but I'm afraid you’re going to have to pay a little stupid tax on this one. I'm sure your girls didn't know all this, but it’s a perfect example of what can happen when you put your faith in a stupid plan coming out of Washington, D.C.

I hate it for you guys — and everyone else in America who took out a bunch of student loans — because you're getting messed over by your own government. The first way they messed you over was to put a student loan program out there and then tell you the way to success was to borrow tens and hundreds of thousands of dollars for a degree in left-handed puppetry. And now, guess what? You’re a barista! Then, they start shouting they’re going to forgive it all. After that it's, “No, we're not. Yes, we are. No, we're not. Yes, we are.”

More from Dave Ramsey

- Dave Ramsey has blunt advice about buying a house

- Dave Ramsey reveals one key to controlling your 'financial destiny'

- Dave Ramsey has bold advice on a major money strategy now

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.