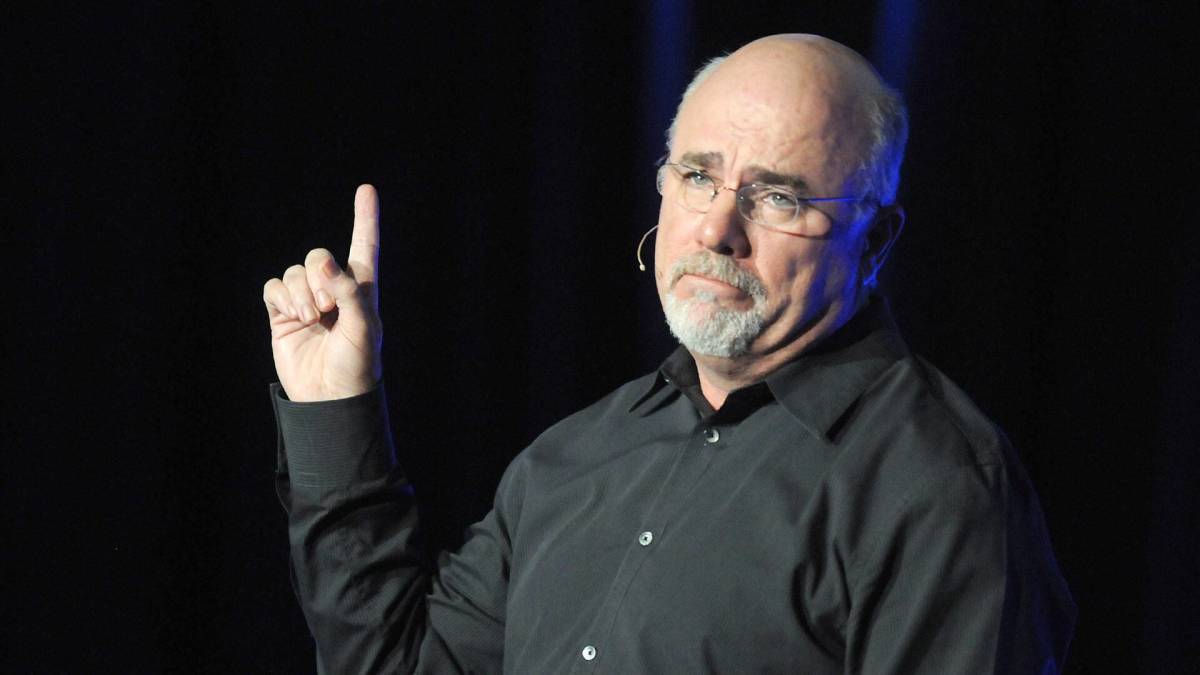

Bestselling author and radio host Dave Ramsey talks frequently about a few key financial moves people should make before purchasing a home.

He outlines these as part of seven baby steps, as Ramsey calls them.

Related: Walmart's anti-theft technology creates a new set of problems

Importantly, the personal finance personality believes one should be entirely debt-free before taking on a mortgage. This includes zero balances on all credit cards, car payments and student loans.

Home ownership involving a mortgage payment is acceptable debt, Ramsey says, because a person is building equity in the property as part of those payments.

Having three to six months saved up in an emergency fund is also a key to financial short-term security before making a purchase such as buying a house, he counsels.

Recently, a woman asked Ramsey for his advice on balancing the need for emergency savings that are fully funded with other financial considerations, including her desire to venture into real estate.

David McNew/Getty Images

When it's the right time to buy a house

Ramsey Solutions recorded some of the words the two exchanged during the conversation.

"Dear Dave," the woman said, identifying herself as Debbie. "My husband and I have just $12,000 to pay off before we’re debt-free. We’ve paid off almost $70,000 in debt in the last two years, and we both just turned 50."

"We would like to buy a house soon, but we know we need an emergency fund," she continued. "It would take us over a year to build up an emergency fund, so since we're getting older, should we make adjustments to the baby steps?"

Ramsey considered the question and offered his opinion.

"You've been making great progress, and you obviously have a good income to be able to pay off debt that quickly," he said. "But it shouldn't take you two a year to build up an emergency fund, considering the rate at which you've been paying off debt."

Ramsey made clear that he believed the emergency fund is necessary, but suggested a way she could look at it to make it seem a little more achievable.

"Yes, you need a fully funded emergency fund of three to six months of expenses set aside before you start saving a down payment for a home," he said. "Maybe in your case, you could lean a little more toward the three-month side with your emergency fund. Then, after you're all moved in, you could revisit the emergency fund and beef it up to six months."

Ramsey concluded the conversation with a few words of encouragement.

"Fifty isn't old, Debbie," he said. "Just stay on course and stick with the plan. You two have plenty of time to get your finances in order and find a great home!"

More from Dave Ramsey

- Dave Ramsey has blunt advice about buying a house

- Dave Ramsey reveals one key to controlling your 'financial destiny'

- Dave Ramsey has bold advice on a major money strategy now

- Dave Ramsey explains a key financial move to make temporarily

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.