Many people find it difficult to maintain appearances and keep up with the Joneses in a challenging economy. This can often lead to overspending, a habit that is hard to break once it’s started.

Fifty-one percent of Americans admit to overspending to impress others, a trend more pronounced among younger generations and men. During a time when household debt has reached record highs, managing spending and implementing a budget has never been more important.

Related: The average American faces one major 401(k) retirement dilemma

Many people face mounting costs yet are unwilling to reduce recreational spending.

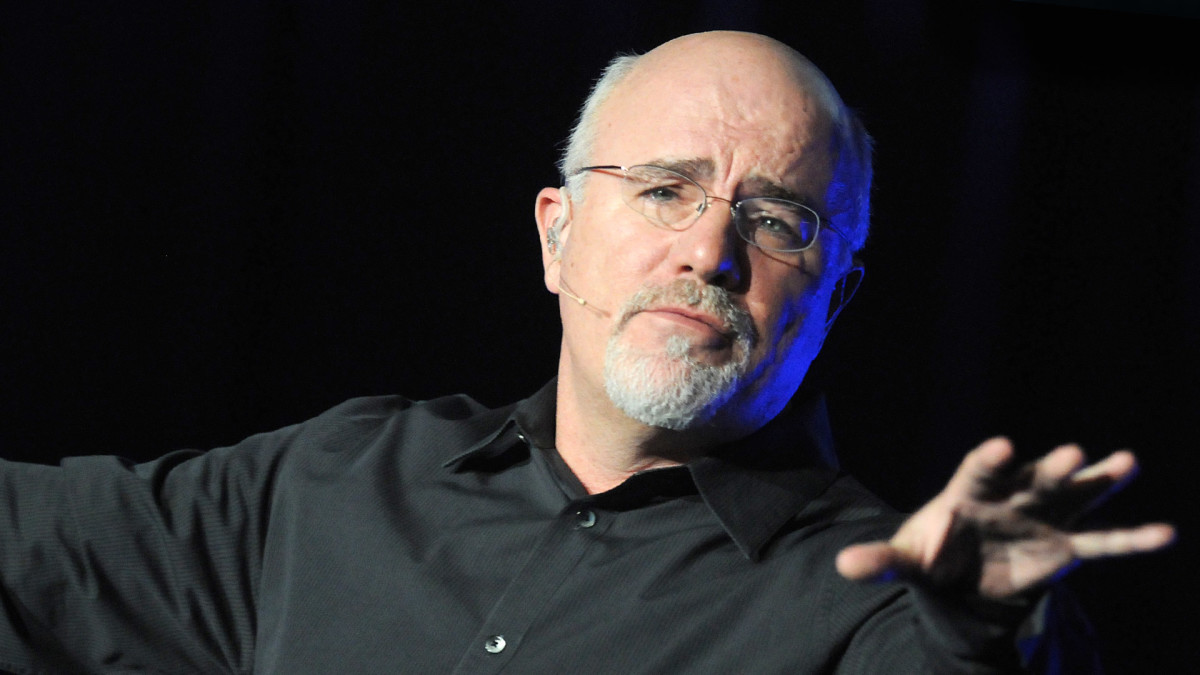

TheStreet sat down with personal finance guru Dave Ramsey to discuss the importance of self-awareness in managing finances, particularly debt. He offers anecdotes from his own experience of getting out of debt to help others do the same.

Creating a budget is half the battle

Ramsey doesn't hold back when asked about behavioral changes those in debt need to make.

“Most people don't have anything written down as a budget. They don't have any idea where their money is going," he said. "So when you start being intentional like that, that's a self-awareness activity. Look at what we're spending here on eating out.”

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey touches on the growing reliance on frictionless spending, primarily through online purchases.

“Personal finance is actually about 80% behavior. It's only about 20% math or head knowledge," he said. "But what happens is that we start to spend money we don't have. We feel like we're trapped or we feel like we have to keep up or we keep hitting the Amazon Prime button over and over and over again and buying superfluous stuff.”

“It's all about self-awareness," Ramsey continued. "One of the things that happened to me when I was in my 20s, I was broke and lost everything. Through that experience, I looked in the mirror and found the problem. It was me. I was the idiot; I was the problem.”

On a positive note, Ramsey highlights that you control your future. It’s not too late for those struggling with debt to turn their finances around.

“And the good news is that I also found the solution. I can change it tomorrow. I can just decide. I'm not spending money I don't have any more," he said.

Shutterstock

Cutting spending is a short-term sacrifice with a long-term payoff

Despite the increase in personal income, McKinsey has found that consumers plan to reduce ‘splurge’ purchases due to a lack of disposable income.

However, dining out has proven to be the biggest splurge category across the board for all consumers.

“One guy sitting in one of our groups said, ‘I think I found out why we don't have any money in retirement when we did our budget. I think we're eating it.’ And that's exactly right. They're going out to eat every night,” Ramsey explained.

Related: Dave Ramsey explains how to thrive with a fulfilling retirement

“And I'm not against restaurants,” he said. “I love restaurants. But you can't go out to eat every night if you're broke. So again, all of these things are about self-awareness so that you put your finger on something very important there.”

However, diminishing disposable income doesn’t always deter people from living above their means; half of adults in the U.S. carry credit card debt month-to-month.

Ramsey notes that sometimes, a brutally honest approach is needed to help others take control of their finances.

“People call it tough love, but it's just that I love you enough to tell you the truth, and nobody else will," he said. "And sometimes that sounds harsh to people, but it's not harsh. I actually care deeply that you get that.”

“What I found when I sat down and planned the budget on a yellow notepad – I had been spending a lot of money on what other people saw," he added. "I bought watches I couldn't afford for people to see me wearing those watches. I was driving a Jaguar because I cared what people thought about what I drove.”

“I cared way too much about what other people thought. I'm no longer driving cars based on what somebody thinks. I drive a car I like. Now, it's a nice car, but what you think about my car is irrelevant to me. And when you quit caring what other people think, you will suddenly be on the path to wealth building.”

Related: Veteran fund manager picks favorite stocks for 2024