Many potential home buyers have been patiently watching both the market and interest rates, waiting for the right time to buy.

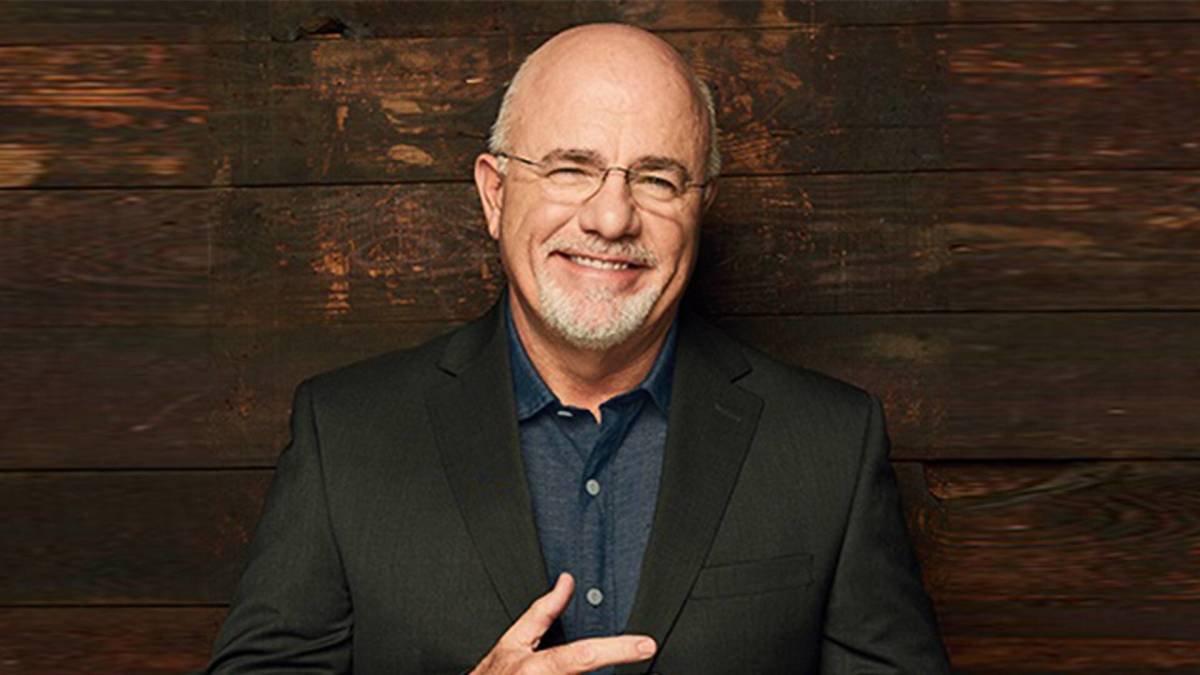

Bestselling author and personal finance personality Dave Ramsey has some words on the subject.

Related: Dave Ramsey explains one vital money move everyone should make now

He believes that if an individual or household has a few key financial considerations in place, relatively high interest rates ought not be too big of a concern.

"If later the interest rates come back down, you're not stuck," he has said, according to TheStreet. "Just refinance and dump the old mortgage."

The financial considerations that need to be in place involve, Ramsey said, any other types of debt a prospective home buyer might have while contemplating the purchase.

"When the Fed raises interest rates, mortgage rates almost always go up too," wrote Ramsey Solutions, his company's website. "And a mortgage lender won't lend you as much since higher interest rates increase your debt-to-income ratio — that means you'll have less buying power when you're shopping for a house."

How other debt plays a role in decision making

Higher interest rates mean higher monthly payments. The question of whether to buy a house depends on a person's financial situation relative to other debt, Ramsey believes.

"If you have consumer debt — like a credit card balance, student loans or a car payment — you should focus on paying that off before you buy a house. You also should kick buying a house down the road if you don't have a fully funded emergency fund worth 3 – 6 months of your typical expenses," wrote Ramsey Solutions.

"Why? If you have to make payments on debt in addition to your house payment, you'll feel like you’re drowning," the website continued. "Not only that, but it'll also be hard to find room in your budget to accomplish other important financial goals, like investing for retirement and saving to help pay for your kids' college."

Shutterstock

If a potential home buyer does have enough cash set aside for emergencies and is debt-free, Ramsey says it's a great time to buy a house.

"Sure, the interest rates and home prices are high, but they're only going to keep climbing," Ramsey Solutions wrote. "And because interest rates are high right now, fewer folks are buying — that means you won’t have as much competition when you make offers."

It is never a popular move in the real estate business when the Federal Reserve decides to raise interest rates. But Ramsey says it's not the end of the world.

"This is still a great time to buy a house — you just might pay a little bit more than you would’ve a few months ago," Ramsey Solutions wrote. "It's also a good time to sell a house. And if you already have a fixed-rate mortgage locked in, you're in good shape too."

"Don’t listen to the doom and gloom that’s all over the internet and in the news. Owning a home is still more than possible, and you still control your financial future."

Get the smart plays to grow your portfolio. Join TheStreet® | SMARTS and take $10 OFF the original price!