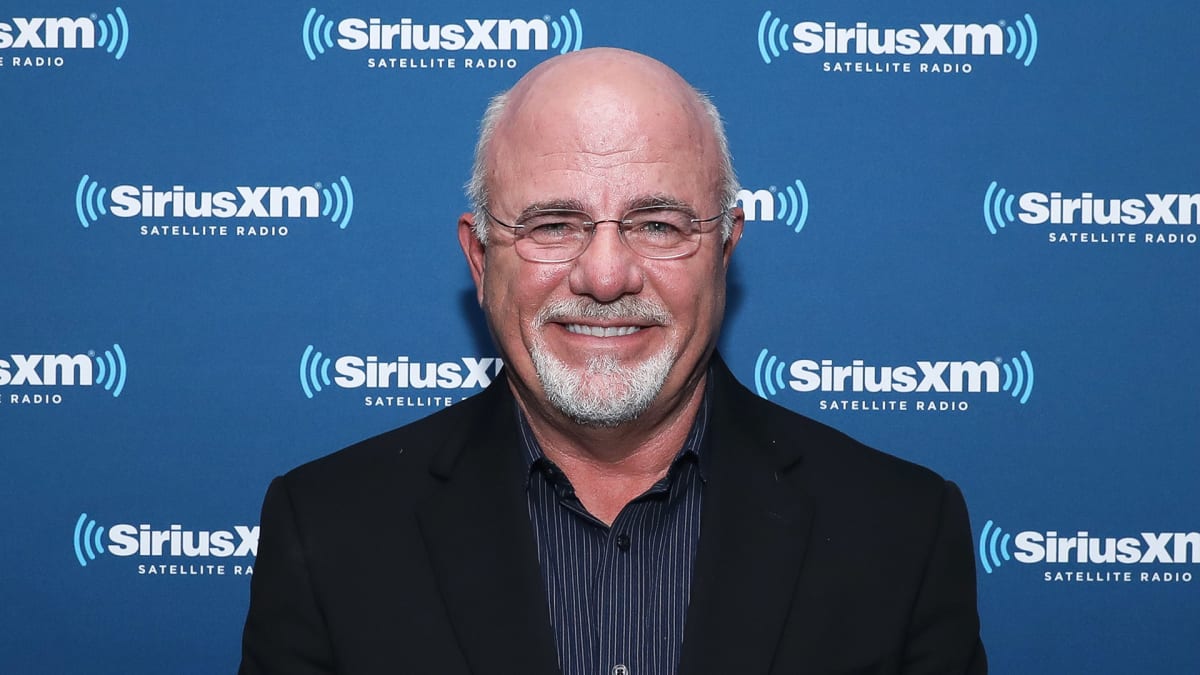

Radio host and author Dave Ramsey regularly offers advice to people looking for help attempting to get their personal finances in order.

In general, people ask him for answers to specific and discrete iterations of difficulties that adhere to similar broad themes. Ramsey, in most situations, has a prepared outline, detailing his suggestions for success, that captures the needs of advice-seekers.

DON'T MISS: Dave Ramsey Confronts Controversy Over Parents Charging Kids for Rent

Ramsey has written several books and hosts a radio show where he addresses a number of these financial challenges.

He is also active on Twitter. The tweets Ramsey posts are instructive for people looking for personal finance answers as well. They offer varying degrees of advice from the concrete to the abstract -- and even the philosophical. Some recent tweets are posted below.

For example, Ramsey has a clear-cut list of things every potential homebuyer should take care of before making the purchase.

Ramsey suggests boiling down how individuals can become wealthy into five general items.

Regarding spending, Ramsey offers some practical advice on keeping it in check.

In a philosophical statement, he offers an alternative way of looking at money mistakes people make.

There is some context for this. Ramsey emphasizes getting out of debt as a recurring theme for a reason.

He had a net worth of over a million dollars by age 26, but lost everything due to short-term debt and filed for bankruptcy, according to Ramsey Solutions. He then turned his failure into a multi-million dollar company.

The next tweet adds another piece of simple advice that seems to come from experience.

In the following tweet, Ramsey advances this thinking into a suggestion for people who find themselves looking beyond their means, thinking happiness lies elsewhere.

He advises not forgetting to enjoy the journey on the road to success.

Along these lines, Ramsey believes that finding satisfaction with work, in addition to one's personal life, may be a matter of choosing the appropriate career that provides rewarding experiences.

In addition to these suggestions for living a fruitful life, personally and financially, Ramsey also offers some thoughts about how to think of success and failure regarding wins and losses in the stock market.

Ramsey says people can react in unnecessarily negative ways to short-term financial losses. He attributes this to a human tendency to be more dramatic than warranted when facing some challenging circumstances.

In fact, Ramsey goes as far as to call this impulse a "drama queen" inclination.

"Studies have shown us it takes $3 of gain in an investment to emotionally offset $1 of loss," he recently told someone asking for some advice. "Our brains record negative things at a much greater rate than they do positive things, and it takes a lot of emotion to recover from that."

"Your investments may be down a little," Ramsey continued. "If you’ve got $1 million in there, it may be worth $900,000 right now. Next year, it’s liable to bounce up to $1.1 million. In other words, your entire retirement savings is not 'eroding away.'"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.