Many people have lofty goals for a future that includes a healthy retirement full of rewarding opportunities and experiences.

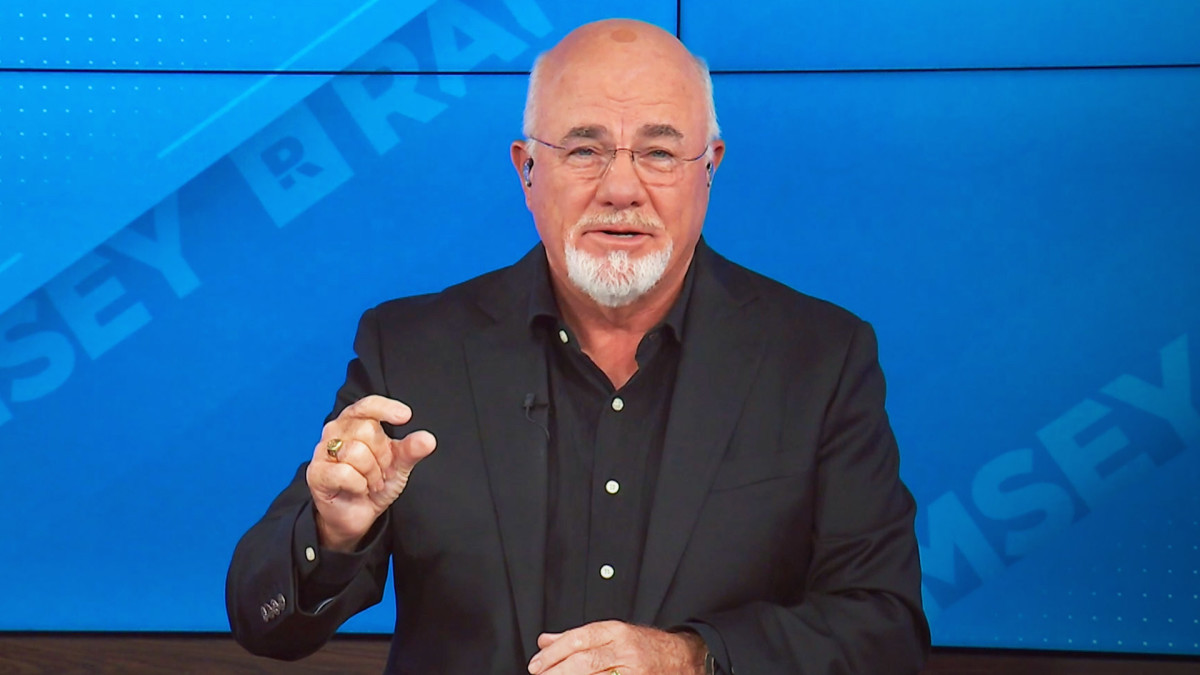

Personal finance personality Dave Ramsey asserts that the dream is attainable, provided a few simple tasks are taken care of along the way.

Related: Another company files for bankruptcy and Dave Ramsey has words

Ramsey writes about seeing people thriving in a meaningful retirement and wondering what they did to achieve it.

And he insists that it doesn't have to be anything extraordinary. But the steps people need to take involve some consistent behavior.

Ramsey wrote that several straightforward undertakings repeated regularly can add up to a successful retirement.

The people that accomplish this lifelong goal are very likely to have put money in their retirement accounts every month for years. They also probably made saving a priority and did not spend money unnecessarily.

Ramsey has created a list of financial characteristics shared by those who are enjoying their retirements to the fullest.

A successful retirement involves smart budgeting

First, Ramsey suggested that one common trait among happy retirees is that during their careers they understood that their incomes were their largest tools for building wealth.

They also were able to stay away from debt — especially credit card debt.

Doing these things while creating and sticking to a monthly budget also greatly enhanced their retirement success.

"Retirement-savvy people know how much they spend on groceries, eating out and new clothes," Ramsey wrote on Ramsey Solutions. "And if they run out of coffee money before payday, they drive past the coffee shop to avoid busting the budget — even if it's just a couple of bucks we're talking about here. Why? Because every dollar adds up. They know that small, everyday choices make the biggest difference in the long run."

Ramsey also suggested people use one mathematical formula to aid in their savings plans: investing 15% of their household income in retirement.

Ramsey found that people who invest 15% of their income in tax-advantaged retirement accounts frequently reach the million-dollar mark in less than 20 years.

"And by investing that amount, they're able to make real progress toward a solid retirement while still working toward other important financial goals — like saving for their kids' college and paying off their mortgage early," Ramsey wrote.

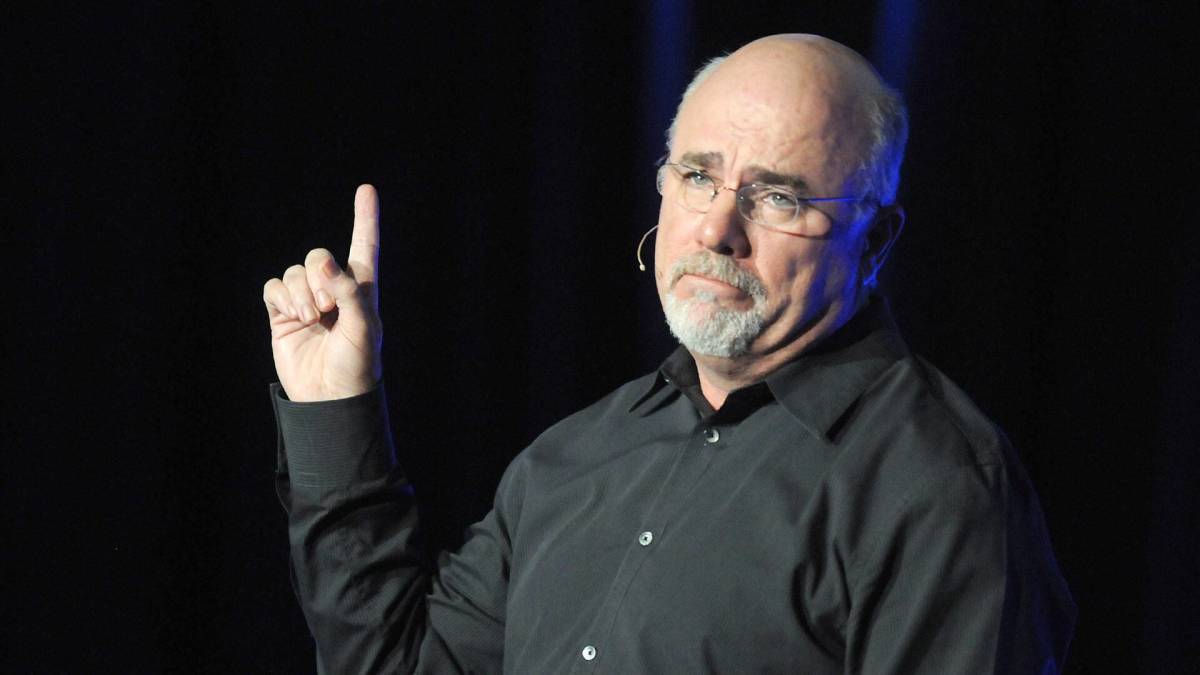

Getty Images

How a long-term investing vision can help

It's important to think of investing for retirement as a marathon, not a sprint, Ramsey wrote.

Successful retirees didn't jump from one investment to another because of fluctuations in the performance of the stock market.

"They know mutual funds with a solid history of growth are a great investment choice to stick with for the long haul. So, stay focused on the future and keep the long game in mind," Ramsey wrote.

It's also important that people remember to live below their means.

"You won't find retirement-savvy people spending more money than they make," Ramsey wrote. "According to The National Study of Millionaires, 94% of millionaires live on less than they make. They buy modest houses and pay cash for vehicles and vacations. This leaves enough money to stash away for retirement."

Ramsey also reminds people planning for retirement to keep their hands off their 401(k) plans. Borrowing from it can seem like a good idea in the short term for unexpected expenses. But taxes and penalties associated with such a move make it unwise.

Ramsey also advises avoiding get-rich-quick investments, being flexible when it's necessary to update plans and working together with a spouse if they have one.

It's also a good idea to meet regularly with an investment professional, Ramsey wrote.

"Having someone in your corner to help you choose the right mutual funds makes a huge difference," he wrote. "Saving for retirement is way too important to do on your own, folks."

Related: Veteran fund manager picks favorite stocks for 2024